A Unique Buying Opportunity For Invitation Homes

Invitation Homes Incorporated (NYSE: INVH) - Strong Buy Recommendation

The 25-day quiet period on underwriter analyses that began with the February 1, 2017 IPO of Invitation Homes will come to an end on February 27, allowing the firm's IPO underwriters to publish reports and recommendations for the first time on February 28.

Invitation Homes Incorporated fits the bill in terms of all these characteristics. The company performed well in its IPO, with the deal oversubscribed and pricing above the mid-point range. It is backed by a strong underwriting team and is growing revenue. Additionally, its model of renting single-family homes matches well with recent housing trends. We view the upcoming quiet period expiration as a buying opportunity for event-driven traders and expect positive reports from underwriters to boost stock price.

Business Overview: Real Estate Investment Trust with Portfolio of Single Family Homes

Invitation Homes raised $1.54 billion in its IPO, placing it among the largest United States home rental companies. INVH acquires, owns, renovates, and manages single-family homes for rent in the following cities: Miami, Florida; Jacksonville, Orlando, Florida; Seattle, Washington; Las Vegas, Nevada; Charlotte, North Carolina; Minneapolis, Minnesota; Chicago, Illinois; Atlanta, Georgia; Phoenix, Arizona; and Los Angeles, Orange County, Sacramento, and Ventura County, California. It buys and sells vacant, leased, or occupied homes, including post-foreclosure, short sale, and non-distressed assets. The company also offers customer, professional management and maintenance, and management and resident support services.

The company's initial public offering is the largest REIT to IPO since 2014, when Paramount Group (NYSE: PGRE) raised $2.29 billion. Invitation Homes was launched in 2012 and has approximately 48,000 homes in its portfolio. Close to 15 percent of these are located in South Florida, while 12.4 percent are located in Southern California.

Financial Overview: Solid Growth Trajectory

As we described in our IPO preview, business for Invitation Homes began in 2012 with a Phoenix home purchase worth $100,000. From there, Blackstone engaged in a multi-year homebuying surge throughout 14 metropolitan regions. At its peak, the company spent over $150 million per week on foreclosed homes. Currently, Invitation Homes manages an estimated 50,000 residences.

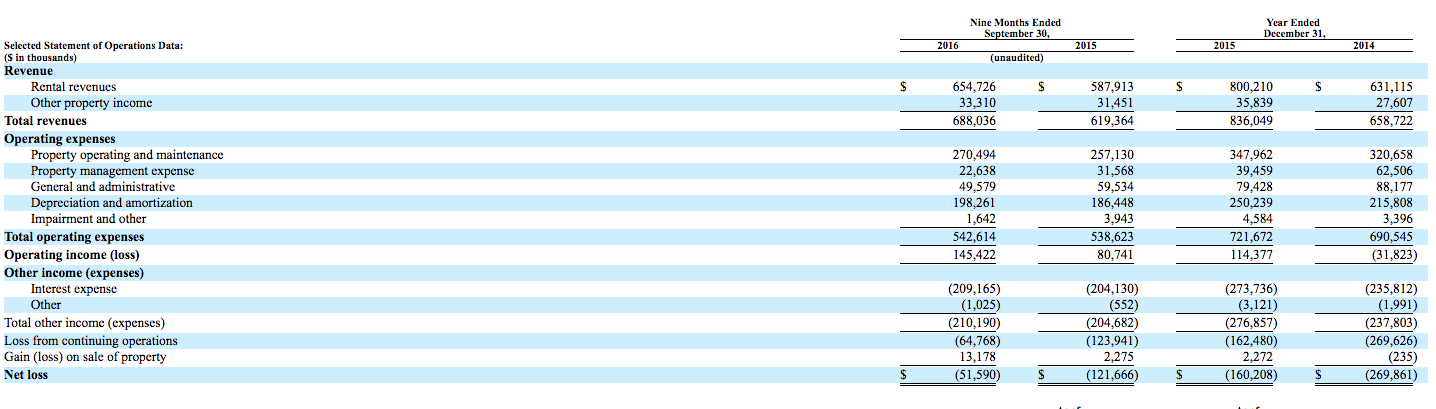

From its SEC filings: for the nine months ended September 30, 2016, the company booked rental revenues of $654,726,000, up 11% from $587,913,000 in 2015. Losses of ($52M) for the same time period in 2016 were down from ($122M) in 2015.

(Click on image to enlarge)

(Source)

Competitors: Altisource Residential Corporation, Colony Starwood Homes, American Homes 4 Rent, and Others

Invitation Homes faces direct competition from American Homes 4 Rent (NYSE: AMH) and Colony Starwood (NYSE: SFR), both REITs that invest in single-family homes. Other competition comes from REITs, individual investors, small private investment partnerships, and larger investors. Other REITs that compete against INVH include Altisource Residential Corporation (NYSE: RESI) and Silver Bay Realty Trust (NYSE: SBY).

At present, a P/S of 7.1 places INVH on par with peers and just below the industry average of 8.8.

Management Team With Strong Track Records

INVH's IPO was an important success for Jonathan Gray, now worth approximately $1.8 billion, and in queue to assume the role of Blackstone's chief executive after co-founder Stephen Schwarzman steps down. Although Mr. Gray was in the running to serve as President-elect Donald Trump's Treasury secretary, he has so far elected to remain with Blackstone.

President and CEO John Bartling has served in his position since November 2014. His previous experience includes positions at Ares Management, AllBridge Investments, Walden Residential, Lexford Residential Trust, and Credit Suisse First Boston.

Solid Market Debut

INVH was priced at $20, slightly above the mid-point of its expected price range of $18 to $21 and was then pushed up a day, signaling strong preparation. INVH has returned 5.7% so far from its IPO and now trades at $21.47 (market close 2.21.2017).

(Click on image to enlarge)

(Source)

Conclusion: Unique Buying Opportunity

Given Invitation Homes' strong IPO and solid growth trajectory, we see reasons for its vast team of underwriters to release detailed positive reports beginning with the conclusion of the quiet period. These underwriters include: Credit Suisse Securities, J.P. Morgan Securities, Blackstone Advisory Partners, BofA Merrill Lynch, BTIG LLC, Evercore Group, FBR Capital Markets, Goldman Sachs, JMP Securities, Keefe Bruyette and Woods, Morgan Stanley, Raymond James and Associates, RBC Capital Group, Siebert Cisneros Shank and Company, Wells Fargo Securities, and Zelman Partners.

2016 was a strong year for publicly traded REITs, while prices for homes have increased to all-time highs. Combined, these indicate a good possibility that rental housing demand will remain strong and healthy.

We see a buying opportunity for INVH ahead of its IPO quiet period expiration.

Investors might consider purchasing shares for both the event and the longer-term hold.

Disclosure: I am/we are long INVH.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not ...

more