TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Aben Resources Ltd. (ABN:TSX.V; ABNAF:OTC.MKTS) looks like a very attractive speculative gold investment here for three big reasons—one is that, as we will see, it is at the support of a long-term trendline that goes back years, two is that its drill programs in the northern wastes are highly weather dependent and the summer drilling season is just cranking up, and three is that gold and silver are now about ready to start major bull markets.

We'll start by taking a look at the long-term 10-year chart, on which we see that, after a horrendous bear market from 2011 through 2015 that resulted in it becoming almost worthless, a low Pan base formed which Aben has made a couple of unsuccessful attempts to break out of. The second attempt was on tremendous volume, which means that investors thought that the company was "on to something." Well, they didn't find anything significant last year so the stock dropped right back into its base pattern, losing all the gains made on the spike, and as we can see it is thus still historically very cheap, which is the main takeaway from this chart.

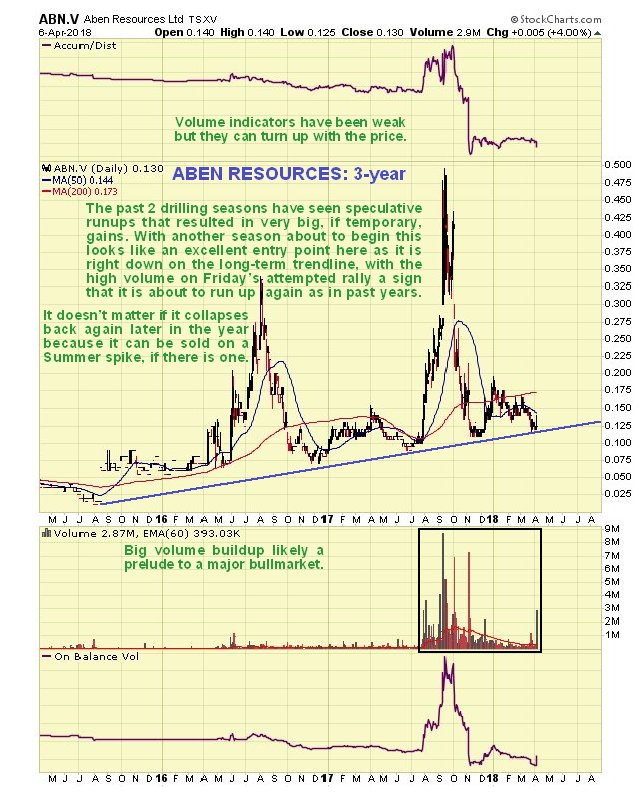

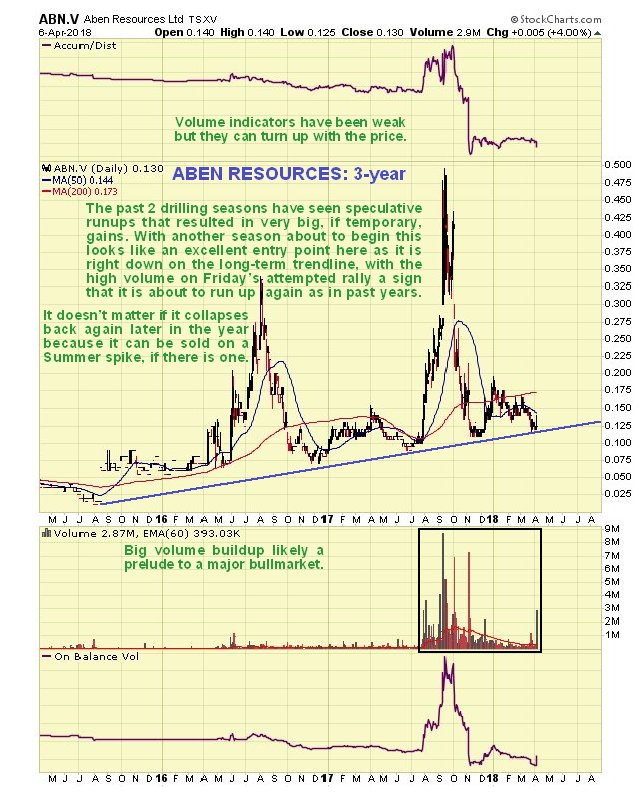

The 3-year chart is most interesting as it enables us to see in more detail the "drilling season spikes" of the past two years, which is where investors get all excited as the drills start turning because they might find something, and then get fed up and go away when they don't. From this we can make the simple deduction that it doesn’t matter whether they find anything or not, the key to trading this stock is to ditch it for a whacking great profit on the next summer spike before any results are published, or at least half and the rest if results are not favorable. This chart also shows us that the stock is at an optimum entry point before the next summer run up, because it is right down on the long-term trendline, and very cheap. Volume indicators are unimpressive but these can turn up with the price.

Lastly, we look at recent action in detail on the 6-month chart. On this chart we see that it attempted to rally away from that long-term trendline just last Friday. Going on price alone the move looks insignificant—it lost two-thirds of its intraday gain to close up a miserly half a cent, at least on the Canadian traded stock, but the story here is not price action but volume action, especially as volume precedes price. This rally attempt was on the highest volume for five months, which means it drained off considerable nearby overhanging supply, and also indicates that savvy speculators are piling in ahead of the expected summer rally. We should therefore do likewise. We can also see on this chart that Aben is still substantially oversold relative to its 200-day moving average and its MACD indicator shows big upside potential.

Lastly, more senior mining professionals know from their own experience that when summer comes around, the thoughts of younger men, particularly those out in the field, may turn to other matters, perhaps resulting in distraction from the task at hand. However, there are simple ways to mitigate this. For example, if the song "In the Summertime" comes on the radio, the men can be encouraged to substitute the line "you've got drilling on your mind" for "you've got women on your mind" if they sing along.

Conclusion: Aben is believed to have an active drill season coming up, and speculative interest is expected to mount as it progresses, resulting in potentially big gains from the current low price. Great entry point here at the long-term trendline. Tactics are to take profits, or partial profits, before any drill results are announced—partial because you never know, they might find something, and there's actually a good chance of it considering they are drilling in British Columbia's Golden Triangle as well as Saskatchewan and the Yukon. Aben trades in light but acceptable volumes on the OTC market. There are 63 million shares in issue.

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my ...

more

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Aben Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Aben Resources.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Aben Resources, a company mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stockmarket analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

less

How did you like this article? Let us know so we can better customize your reading experience.