5 Stocks To Watch This Week: COH, DIS, YELP, FOSL, SHAK

Tuesday, August 9

![]()

![]()

![]()

Wednesday, August 10

![]()

Coach (COH)

Consumer Discretionary - Textiles, Apparel & Luxury Goods| Reports August 9, before the open.

The Estimize consensus is looking for earnings of 41 cents per share on $1.155 billion in revenue, 1 cent higher than Wall Street on the bottom line and right in line on the top. Compared to a year earlier, earnings are expected to increase by 33% with revenue increasing 15%. Revisions activity since Coach’s last report show that EPS estimates have increased 8%, while sales estimates have remained flat.

What to Watch: Fellow purse designer, Kate Spade, kicked off earnings season for luxury brands on quite a sour note last week. After missing bottom-line expectations, the stock plunged over 20%. Unfortunately, a weak quarter from KATE might not bode well for Coach and other luxury brands reporting this week.

Coach has only recently dug itself out of the hole. In the past 12 months shares are up 27% as comparable store sales begin to gain traction. North American comparables have steadily improved after comps declined by double digits every quarter last year.

The new Disney collection along with an emphasize on lower price merchandise and ecommerce growth have helped drive sales. The problem with discounting is that it takes a toll on gross margins. Coach outlets currently account for 65% of total revenue, so it might be difficult to avoid collapsing margins.

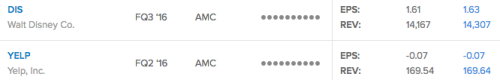

Disney (DIS)

Consumer Discretionary - Media | Reports August 9, after the close.

The Estimize consensus is calling for earnings per share of 1.63 on $14.31 billion in revenue. Earnings per share and revenue estimates have increased by 6% and 2%, respectively, since Disney’s last report in May. Profits are now expected to grow 12% YoY and sales by 9%.

What to Watch: Three segment typically stick out when Disney reports earnings; media networks, theme parks and studios. Media revenue has been in a steady decline since ESPN troubles began. Last quarter ad sales at the sports network fell 13% because of fewer college football playoff games. The company has made strides in alleviating the downturn by partnering with distributors. Noted distributors like Sling TV are seeing encouraging upward momentum after adding ESPN to its portfolio.

Investors often forget that studios and theme parks have performed remarkably well in recent quarters. The company’s film unit took off due to the blockbuster hit Star Wars: The Force Awakens and they haven’t looked back since. Last quarter the company saw sales from studio entertainment rise 22% thanks to Zootopia, Captain America and The Jungle Book. This quarter should be largely driven by the success of Finding Dory. Disney’s movie pipeline is incredibly deep so it won’t be surprising if revenue continues to grow from here.

The recent success of its movies have carried over to theme parks. Disney World is in the process of opening a Star Wars themed attraction and will continue to do so with other popular movies. This segment reported a 4% gain last quarter and should continue to be a huge earner moving forward. Disney recently opened new theme parks in Asia. Disney Shanghai has already attracted millions of visitors since opening less than a month ago.

Yelp (YELP)

Internet Technology - Internet Software & Services | Reports August 9, after the close.

Both the Estimize community and Wall Street is calling for Yelp’s earnings per share to come in at -$0.07 on revenues of $170 million. The crowd has drawn down their bottom-line estimates by 82% since the last report, while sales expectations have remained unchanged. Compared to a year earlier, profits are expected to fall 236%, while sales are pegged to increase by 27%.

What to Watch: While Yelp is the foremost trusted reviewing platform, this has yet to be reflected in earnings results. The company continually turns a loss in its efforts to stimulate revenue and drive user growth. Its efforts have somewhat paid off this year. Last quarter Yelp reported better than expected revenue thanks to 40% growth in its local services. The stock is also starting to show some signs of new life. Shares are up 15% year to date and 10% in the past 12 months.

Yelp’s surge in the last few months is coming to a screeching halt. Citigroup recently downgraded the stock from buy to neutral citing over-exuberant stock movement, modest ad revenue guidance and pressured margins. It’s been reported that user mobile and transaction sales slowed in the first quarter. Yelp also took liberties when it assumed a significant increase in margins in the second half of 2016.

Unfortunately, this isn’t Yelp’s only concern. Facebook (FB) has recently embarked on the local review space. Facebook’s review system eliminates internet anonymity typically associated with a Yelp rating. This poses a threat to web traffic and at the end of the day, ad revenue. Morgan Stanley estimates that roughly 50% of Yelp’s current ad-buyers will not purchase ad units in the next 12-months.

Fossil (FOSL)

Consumer Discretionary - Textiles, Apparel & Luxury Goods | Reports August 9, after the close.

The Estimize consensus is looking for earnings per share of $0.09 on $675 million in revenue, in-line with Wall Street on the bottom line and $3 million above on the top. Compared to a year earlier this reflects a 90% decrease in earnings and -9% growth in sales. Earnings estimates have increased 158% since the last quarterly report, with sales estimates unchanged.

What to watch: Fossil not only manufactures watches unders its own brand but also high fashion brands like Michael Kors and Kate Spade. Watch sales have been muted for some time now as demand across its multi brand portfolio continue to wane. Earnings have naturally followed this downward trend, delivering negative earnings and revenue growth for 3 consecutive quarters.

Lately, Fossil is seeing discouraging trends throughout its core business. Soft watch sales have driven weak comps in North America and sluggish performance in international markets. Currency headwinds and economic challenges haven’t helped in key Asian and European markets. The performance in those regions are greatly decelerating and aren’t expected to deliver much growth. This is largely the result of waning demand and unfavorable foreign exchange rates.

With its legacy business showing no signs of picking up, Fossil is looking to wearable technology to pick up the slack. The acquisition of Misfit provides Fossil with a platform to bring smartwatches and innovative technology to its customers. Wearable technology is one of the fastest growing markets and should help offset the trouble in its core business. However, it also adds a new layer of competition against the likes of Apple (AAPL) and Samsung, who both offer smartwatches.

Shake Shack (SHAK)

Consumer Discretionary - Hotels, Restaurants & Leisure | Reports August 10, after the close.

The Estimize consensus calls for EPS of $0.14, 1 cent higher than Wall Street’s consensus. Revenue expectations are slightly higher than the sell-side, with the Estimize community expecting $63.3 million, as compared to $63.2 million. Earnings expectations have trended upward by 5% since last quarter, while revenue estimates are up 1%. This puts YoY growth expectations at 53% for EPS and 30% for sales.

What to Watch:

Shake Shack’s cult following and successful expansion has finally encouraged a turnaround in the stock which is now up nearly 5% YTD. This quarter, earnings are expected to come in strong once again, but slower than previous quarters. It could also be the first time earnings growth fails to hit triple digits, with last quarter just barely eking into that territory with 100% profit growth, but this quarter expecting almost half of that at 53%.

Arguably the more important metric for this company is same shack sales, which increased 9.9% in Q1 2016, and 13.3% in 2015. The outlook for 2016 isn’t as impressive, but has been revised upward. At the beginning of the year the company was guiding for same shack sales between 2.5 and 3.0%, but after robust Q1 results they increased that outlook to 4 - 5%.

One drag on Q2 results will be increased labor costs. Competition from fast-food names could also have their impact as value-focused consumers have taken a liking to McDonald’s (MCD) and Wendy’s (WEN) this year. Still, Shake Shack has a very loyal customer base which has only increased in recent years. The company continues to attract new customers with frequent menu updates. Shake Shack also continues with it’s aggressive expansion plan, with 16 domestic stores set to open this year, and 7 licensed Shacks scheduled to open in the U.K. Middle East and Japan.

(Photo Credit: .imelda)

Disclosure: None.

Thanks for sharing