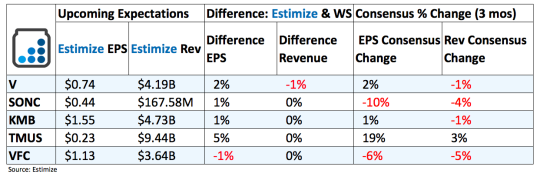

5 Stocks To Watch That Report Earnings On Monday (October 24, 2016)

(Click on image to enlarge)

Visa (V): The credit card industry is going through an expansive overhaul given the rise of new technologies. Merchants are now more than ever moving away from legacy contracts towards mobile payments. Some of this includes the emergence of payments app like Square and Venmo but also the increasing adoption of Samsung and Apple pay. Visa’s stake in Square and recent partnership with PayPal should help them remain relevant as technology becomes a bigger part of the payments space.

Meanwhile, Visa’s first quarter partnered with Costco is proving to be favorable. Costco recently said that about 85% of the 11.4 million co-branded American Express cards have been changed to Visa card and activated. An additional 1.1 million members have applied for the new card since the transition.

There still remains a handful of near term headwinds impacting the credit space and Visa. Volatile exchange rates, Brexit uncertainty and weaker spending habits could all dent Monday’s results.

Sonic Corp (SONC): Earlier this month, Sonic released weak preliminary results for the fourth quarter. The drive-in chain reported adjusted earnings per share of 43 cents to 45 cents, versus the Estimize consensus forecast of 44 cents. They also released same store sales projections of a 2% decline. Shares have since slid over 5% ahead of the actual report. Sonic has been unable to gather steam like many of its peers in the fast food industry. The third quarter saw earnings per share, net income and margins drastically decline on slower consumer trends. McDonald’s better than expected report earlier today may set a new tone for the fast food industry this earnings season, but based on preliminary results that may not have an impact on Sonic

V.F. Corporation (VFC): Shares have dropped nearly 15% this year on consecutive weaker than expected quarters that resulted in negative growth. Performance has been hampered lately from the ongoing fluctuations in the currency market and a slowdown in consumer spending. The company’s sales outlook was trimmed recently after it suspended operations of its contemporary brand and the bankruptcy in the sporting goods space. Analysts at Estimize are optimistic that its well established brands like the North Face and Timberland can make significant gains and offset previous losses. Current estimates are forecasting a 7% increase on the bottom line and 1% on the top, marking the first quarter in over a year that growth was positive.

Kimberly Clark Corporation (KMB): Despite a better than expected second quarter, the stock is down 10% over the past 3 months. The consumer staples company has struggled to jumpstart growth given ongoing currency headwinds and increasing competition. New cost controls and restructuring have slightly eased these pains, but not enough to appease investors. Regular buybacks and moves to reduce expenses will be ongoing until earnings and revenue growth are sustainable

T-Mobile (TMUS): T-Mobile burst on to the scene a few years ago and disrupted the wireless industry to benefit the consumer. Lower prices and comparable service have put a strain on traditional power players, Verizon and AT&T, and have pushed them to explore new revenue streams. Verizon is exploring its options in the media space with acquisitions of AOL and Yahoo, while AT&T is having its hand at the cable industry. T-Mobile, on the other hand, is sticking to building out its wireless technology and attracting new customers. This has been largely successful as evidenced by the past few quarterly reports. The past 2 quarters recorded double digit gains on the top line with analysts projecting a 21% gain for the upcoming quarter.

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more

thank for sharing