5 Stocks To Watch After The Market Closes Today - Monday, November 7

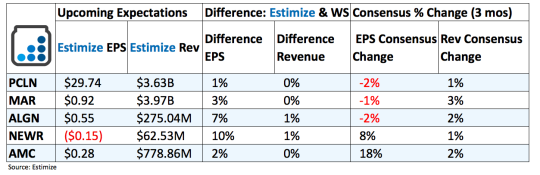

Priceline (PCLN): The travel industry was handed a gift this earnings season starting with strong reports from the airlines and continuing through Expedia (EXPE) and Las Vegas Sands Corp. (LVS) results in the past week. Priceline along with the hotel chains are next on deck and expectations are edging higher on this encouraging news. The online travel booking market is a two horse race between Expedia and Priceline that is coming down to who can make the most acquisitions and consolidate the market. Priceline currently has the upper hand overseas with a number of partnerships including a lucrative investment in Ctrip while Expedia dominates North American markets. A recent deal with Booking.com will help the former expand in domestic markets. As always, near term threats to travel trends such as terrorist attacks and currency headwinds along with the rising presence of Airbnb could hamper results.

Marriott International (MAR): Marriott is likely to benefit for the very same reasons as Priceline. Increasing travel demand along with continued expansion are expected to boost the quarter’s results. Its recent acquisition of Starwood Resorts makes Marriott the largest hotel operator in the world and provides a huge new layer of revenue. Revisions activity has been muted despite all these positive initiatives. Fortunately estimates are calling for a 20% increase on the bottom line and 11% on the bottom, reflecting a significant improvements from previous quarters. Marriott is also susceptible to many of the near term headwinds threatening Priceline and the rest of the travel industry.

Align Technology (ALGN): Align is emerging as a popular alternative to traditional orthodontic treatment used with teens. The recently launched Invisalign G7 is expected to better facilitate tooth movement in young patients. Tying technology with dental care has propelled earnings potential in recent quarters. Align recently introduced a new treatment software that will provide a more realistic 3D visual mode to compare treatment plans. The technology is not only more cost effective but will minimize margins of error. Expectations are edging higher on these new initiatives with analysts now calling for a 60% increase in earnings and 32% in sales.

New Relic (NEWR): As has been the case with most new IPOs, New Relic has had its struggles in recent quarters. Decelerating revenue and consistent losses have led to nearly 20%decline in share prices in the past 12 months. The stock has largely recovered those losses in the past 6 months and is only down 4% since its IPO. Expectations for the quarter to be reported are largely consistent with the recent trends. Analysts are calling for a 9% increase on the bottom line and 46% on the top, reflecting a stark slow down from prior reports. As the company continues to expand and release new products that harness the power of cloud computing, earnings growth and share prices will likely follow. We are still too early though in the maturation process to know where the long term outlook is heading.

AMC Entertainment (AMC): The entertainment side of the company has its investment in theaters in the U.S. and internationally. Its active investments in improving theaters with better quality seats, improved food and overall renovations are expected to help drive traffic. Furthermore, AMC and Dolby recently signed a strategic partnership that would bring Dolby Cinema sounds to 100 AMC locations by the end of 2017. After the initial 100 projects are completed the two companies are likely to extend the relationship to additional AMC locations around the United States. Nonetheless AMC still faces a number of imminent threats included macroeconomic uncertainty and volatile consumer spending.

Disclosure: None.