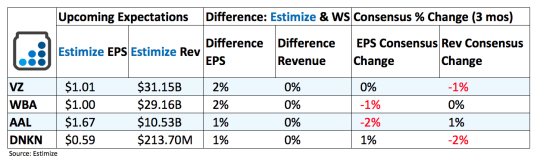

4 Stocks To Watch Before The Market Opens Tomorrow (October 20, 2016)

(Click on image to enlarge)

Verizon Communications (VZ): Verizon is no longer just a communications company as its namesake would suggest. The company has been diversifying its portfolio to include fiber optic television, broad based media and even a developer of new technologies, particularly 5G networks. The telecom giant made a few headlines during the quarter including the $4.8 billion acquisition of Yahoo and the prolonged labor strike that took place over the summer. There have been some pitfalls to both stories that Verizon is working through. The labor strike and subsequent deal could have a bearing on earnings this quarter while Yahoo’s massive data breach might threaten the deal all together. These news driven events won’t have a long term material impact like some of its recent partnerships and the development of 5G technology. Recent partnerships with Disney and Qualcomm will help build out its Fios and IoT brands, respectively. If Verizon can launch mainstream 5G networks before AT&T or T-Mobile then there is no limit to near term growth.

Walgreens Boots Alliance (WBA): Walgreens has had its troubles in recent quarters, despite being one of the largest pharmacy chain in the country. Revenue has consistently fallen below expectations while also accelerating on a year over year basis. Walgreens is still in the process of seeking regulatory approval for its Rite Aid takeover in late 2015. The merger would form the largest drug chain in the country and has led regulators to rethink the merits of the deal. Meanwhile, Walgreens is implementing new technologies and forming partnerships to strengthen its market position. A deal with Prime Therapeutics will help expand its retail pharmacy business thereby boosting top line growth.

American Airlines Group (AAL): Disappointing earnings from Delta and United earlier this season sets an unfavorable tone for American Airlines. Both airlines recorded mid single digit declines in unit revenue which reflects weaker travel trends. American Airlines is fortunately in a better position than its peers. Its efforts to return to profitability and growth have begun to pay off. The airline recently raised its key PRASM guidance to a 2-3% decline, a much bigger improvement from the 6.1% decline last quarter. This is largely due to its presence in regions with favorable consumer trends. That said, discount retailers like Southwest and Spirit Airlines will put a dent on revenue this quarter. As ticket prices continue to come down in the industry we will also seen margins begin to edge down.

Dunkin’ Brands (DNKN): Dunkin Donuts has performed well recently despite Starbucks dominant position in the coffee market. New initiatives such as more drive through locations, menu innovation, comprehensive mobile app and a loyalty program have help engage and attract customers. Furthermore, licensing deals with Keurig and J.M. Smucker to sell Dunkin’ branded K cups will continue to boost top line growth. The company may have missed its revenue target in the second quarter but analysts are confident that a rebound is in store tomorrow. Shares are up 18% year to date but historically remain flat through the print.

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more

thanks for sharing