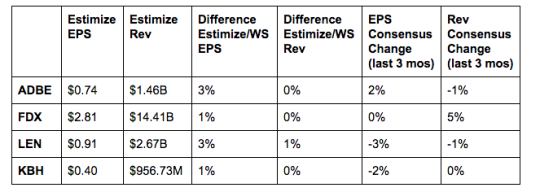

4 Companies To Watch That Report Earnings Tomorrow

Adobe Systems (ADBE): Adobe has delivered steadily improving earnings and revenue for over 2 years and counting. That consists of continually beating on both the top and bottom line during this streak. Yet over this time, growth has decelerated causing share prices to remain relatively flat year to date. A large portion of its recent gains are driven by innovation in the Creative Cloud and Marketing Cloud business. The two segments continue to gain traction and see increasing adoption rates. Investor’s will be carefully watching the company’s annualized recurring revenue. If this begins to slow down it indicates that users are letting their subscriptions expire or the company isn’t doing a good job of upselling its existing user base. Based on current estimates, this quarter is expected to prolong the marked slowdown.

FedEx (FDX): The recent flood of online retailers have benefitted courier services including FedEx. FedEx has successfully expanded both revenue and earnings as a result. Higher margin Express Services has been a standout performer during this time, followed by Ground and Freight. FedEx Express currently accounts for about 40% of operating income and continues to be the fastest growing form of delivery. Ground has been almost as successful, thriving on the growing adoption of ecommerce platforms. The company’s acquisition of TNT Express, essentially FedEx Europe, is expected to provide strong synergies in the near future.

Lennar Corporation (LEN): Whether it’s Housing Starts or Existing Home Sales, the housing recovery continues to remain steady. In light of the recent bounceback, home improvement stores such as Home Depot have delivered strong earnings. This bodes well for Miami based homebuilder, Lennar. Stronger demand along with higher selling prices is expected to translate to strong volume trends and ample support to both the top and bottom line. That said, rising land costs could take their toll on gross margins. This has been a problem for several quarters and nothing would suggest that it has improved.

KB Home (KBH ): KB Homes is in a similar position to Lennar. The ongoing housing recovery has helped earnings in recent quarters. Additionally, a newly implemented buyback program in 2016 has boosted share prices by 25% year to date. KBH is expected to deliver another strong report driven by those two factors and strong order growth. Just ahead of its scheduled report, Buckingham research upgraded the stock to a buy from neutral. Historically this is a stock that remains flat following an earnings report.

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more