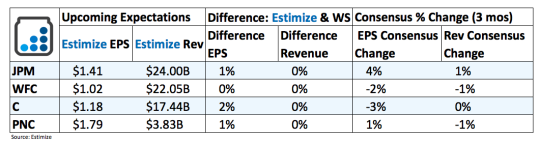

4 Companies To Watch That Report Earnings Tomorrow (October 14, 2016)

(Click on image to enlarge)

JPMorgan Chase (JPM): JPMorgan, along with the companies listed below, kick off bank earnings season tomorrow morning. The world’s largest bank is coming off a better than expected second quarter that printed a massive beat on both the top and bottom line. This was primarily driven by stronger trading activity and a bounceback in the energy market. Most of what made the quarter so impressive are expected to carry into tomorrow’s report. This includes steady improvements in the energy sector, ongoing momentum in its mortgage business, and minor advances in market activity. However, the bank should see pressure from its advisory business, net interest income, and its commercial and industrial loan sectors, which appear to be running out of steam. An all but certain rate hike in December will be what investors were looking for to boost earnings and pop the stock.

Wells Fargo (WFC): Wells Fargo situation is slightly different than the rest of the banks this quarter. The bank was recently caught in a major scandal that resulted in a $185 million fine and more recently the resignation of its Chairman and CEO, John Stumpf. More importantly, the termination of the fake accounts program will cause a near-term hit to earnings. This fraud was artificially boosting earnings and is what drove the bank to prominence following the financial crisis. Fortunately, Wells Fargo is the largest mortgage provider in the country and could lean on the sector for some support. Any insight into whether its other banking services has been impacted would be a huge blow that the stock wouldn’t be able to sustain.

Citigroup (C): After worse than expected results during the second half of 2015 and the first quarter of 2016, last quarter’s 11 cent beat on the bottom-line was a welcomed surprise. A lot of the weakness in the past couple of years have come as the bank’s traditional engines of trading revenue, fixed income, and currencies, have slumped due to high regulatory costs. After years of cost cutting, Citigroup decided to expand its business in the equity market. Trading revenues were strong in Q2 after a rough start to the year. Like many of the other big banks, uncertainty around Brexit and the global economy looms. The almost certain promise of a rate hike in December should mean a return to healthy interest revenues in the new year.

PNC Financial Services (PNC ): PNC’s results have been largely mixed lately. Second quarter earnings topped expectations by a wide margin but revenue fell well below its target. The prior quarter was just the opposite as this up and down trends as continued for nearly 2 years. Tomorrow’s reports appear to head in the same direction with revenue forecasted up 1% and earnings down 6%. PNC has fallen victim to the trends in the banking sector. Strong trading activity and a less concerning energy sector should help prop up results but without a rate hike until December, investor’s shouldn’t have their hopes too high.

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more

thanks for sharing