3 Stocks To Watch Before The Market Opens

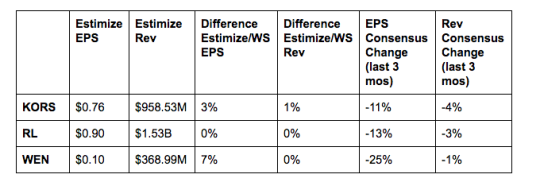

KORS: After weak earnings from Kate Spade and Coach, it appears likely that Michael Kors surging stock could hit a roadblock tomorrow. Shares of the luxury brand have risen 25% this year on consecutive beats and strong comparables. Both KATE and COH cited higher discounting and promotions for its poor quarterly results. Similar sentiment is likely to be echoed in KORs report tomorrow. The retail sector has been choppy lately and with a large exposure to volatile international markets both earnings and revenue could see its first downturn in over a year. Michael Kors continues to invest heavily in new store openings, expanding outlets and building its omni channel capabilities to remain competitive in the long term.

RL: Similar to KORS, recent reports from luxury brands doesn’t not bode well for Ralph Lauren. However, unlike KORS, Ralph Lauren stock has been beaten down lately. In the past 12 months shares have dropped over 20%. Despite a couple beats in the past few quarters, comparables continue to turn negative. Last quarter featured a 38% decline on the bottom line and 1% on the top. The company’s key problems include too many brands in retail stores, over reliance on department stores, large inventory hangover and high operating expenses. The company’s new CEO has actively addressed these issues and has implemented a new strategy but it certainly isn’t a quick fix.

WEN: Wendy’s is a part of a group of fast food names that has bounced back in recent months. The stock is up 9% year to date thanks to cost saving initiatives and improving bottom line growth. Revenue, on the other hand, is expected to continue to decline for the foreseeable future. Wendy’s recently transitioned its company owned restaurants to franchise based models. Furthermore, a rise in beef prices since the beginning of the year, and other food costs is expected to put pressure on margins. Fortunately, international expansion, promotional campaigns and frequent menu innovations should offset some of the downturn.

Disclosure: None.