3 Stocks That Regularly Increase Dividends 20% Every Year

What would you think of a stock paying a yield of 3% to 4% with strong visibility that the company will grow the dividend rate every quarter and increase dividends by 20% or more per year? That type of income stock gets me very interested. The raw math shows that if the dividend is growing by 20%, the share price must go up by the same percentage to keep the yield at the same level. Add the share price growth and dividend yield and you are generating a 25% or so total return. That’s a double in three years. Stocks with returns like this will help you easily beat the market each and every year.

What would you think of a stock paying a yield of 3% to 4% with strong visibility that the company will grow the dividend rate every quarter and increase dividends by 20% or more per year? That type of income stock gets me very interested. The raw math shows that if the dividend is growing by 20%, the share price must go up by the same percentage to keep the yield at the same level. Add the share price growth and dividend yield and you are generating a 25% or so total return. That’s a double in three years. Stocks with returns like this will help you easily beat the market each and every year.

The investments that I am referring to are a small group of stocks not many investors are familiar with. These are the publicly traded MLP general partner, GP in industry jargon companies. A master limited partnership has a general partner that operates and manages the business. The GP can be another large energy company, such as Phillips 66 (NYSE: PSX) operating as the general partner of Phillips 66 Partners LP (NYSE: PSXP). Sometimes the GP is owned by a private firm that is using the MLP to get publicly traded exposure to its business. What we are looking for here are the GP companies that list on the exchanges and generate the bulk of their revenues from distributions from the MLP they manage as this is the secret to their dividends regularly growing at such high rates.

The MLP distributions as the sole or primary revenue stream model works for a pure play GP company because the partnership agreement gives the general partner incentive distribution rights (IDRs). The IDRs are earned and grow as the distributions paid to the limited partner unit holders (that’s us retail MLP investors) are increased. The IDRs have a tiered payout structure, so as the LP distributions hit preset quarterly amounts, the IDR percentages are increased. The IDR math is too complicated to cover in an article of this length, but the bottom line is that IDR payments to the general partner can grow at two to three times the rate of growth in the LP unit distributions. This means that if the general partner works to grow the LP distributions by say 8% per year, the cash received by the general partner could be growing at a 20%+ annual rate.

The list of pure-play or close to pure-play, publicly traded GP companies is short. I track just seven GP companies in my MLP database. Here are three that offer significant investment potential:

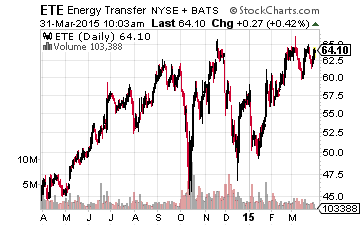

Energy Transfer Equity, L.P. (NYSE: ETE) is an MLP that operates as the general partner of four other MLPs: Energy Transfer Partners, L.P. (NYSE: ETP), Regency Energy Partners L.P. (NYSE: RGP), Sunoco Logistics Partners L.P. (NYSE: SXL), and Sunoco LP (NYSE: SUN). ETE currently yields 2.85% and analysts are forecasting 23% annual distribution growth from the GP company.

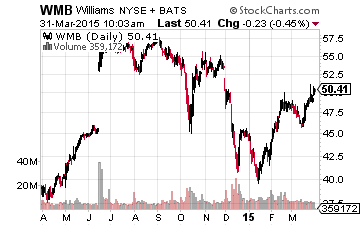

Williams Companies Inc (NYSE: WMB) owns midstream energy assets and is the general partner for Williams Partners L.P. (NYSE: WPZ). Last year Williams Companies acquired 100% of the general partner interests in Access Midstream Partners and merged the two midstream MLPs into a single partnership. WMB currently yields 4.6% and is forecast to grow its dividends by an average of 21% per year.

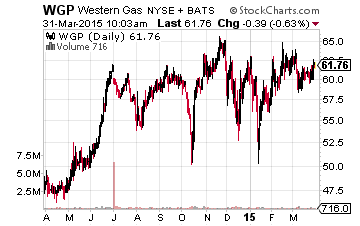

Western Gas Equity Partners LP (NYSE: WGP) is the general partner of Western Gas Partners, LP (NYSE: WES). WES has been a strong distribution growth story on its own, increasing distributions by more than 15% per year. This growth has allowed WGP to grow its distribution rate by more than 30% per year. Wall Street analysts are looking for lower growth going forward – 11% and 23%, respectively – but I think they may be underestimating the Western Gas midstream energy growth machine. WGP currently yields 2.0%.

These MLP GP companies are dependent on the distribution growth rates of the MLPs they manage. Share prices have dropped with the energy commodity prices, providing more attractive investment opportunities than have been available for several years.

REITs that raise their dividends, like the ones above, have been an integral part of the income strategy with my newsletter, more

Some really great ideas here, thanks for tipping me off to them!