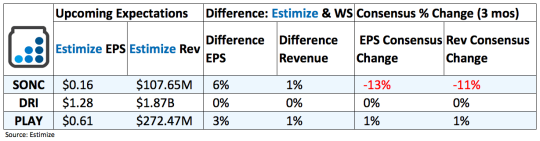

3 Restaurant Stocks To Watch That Report Earnings Tomorrow - Tuesday, March 28

(Click on image to enlarge)

Sonic Corp (SONC): Shares of Sonic tumbled 17 percent in the past 3 months after fiscal first quarter revenue missed analyst’s target expectations. The company reported an 11% decline on the top line from a year earlier, marking a second consecutive quarter of negative growth. Key same store sales metrics posted a 2 percent decline across franchise and company owned drive ins. Management was quick to point fingers at the sluggish consumer landscape for its recent struggles. In an effort refuel sales the company continues to reinvent itself through new menu items and store openings. In the first fiscal quarter Sonic opened fourteen new franchise drive ins with 56 locations undergoing refranchising.

Darden Restaurants (DRI): Shares of Darden maintained a steady rise in the past 6 months despite some inconsistency in recent quarterly reports. Revenue missed the Estimize consensus for three consecutive quarters while earnings largely met expectations. Same store sales, on the other hand, continue to exhibit strength with Olive Garden, Eddie V’s and Bahama Breeze all posting 2.6 percent gains in the fourth quarter. Seasons 52 remains the lone brand in the Darden family to post negative comparable sales as it fell by 0.3 percent. Like many other full service restaurants, Darden aims at improving operations through menu innovation, better customer experience and remodeling many of its locations to integrate technology initiatives. That said, a number of near term headwinds put pressure on overall performance including soft consumer spending and higher labor costs.

Dave & Buster’s Entertainment (PLAY): Dave & Buster’s is one of the hottest stocks since going public in December 2014. In that time shares have increased 252 percent with the support of robust quarterly results. Unlike other newly traded companies, revenue growth hasn’t shown any signs of slowing down. Management’s commitment to opening new stores helped lift sales over this time with the most recent quarter posting a 20 percent increase from a year earlier. The fiscal third quarter also featured a 5.9 percent increase in comparable store sales and two new stores. Dave & Buster’s proclivity to deliver exceptional quarterly results boosted the stock up an average of 5 percent immediately through the print.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.

Thanks for these gems Leigh. $PLAY's balance sheet is looking very robust along with their current prospects. I'll have to keep an eye on this one for the time being.

I wonder what the secret to $PLAY's success is...