2 Biotech Stocks Under $10 To Scoop Up Now

Investing in companies that are on the forefront of the biotech revolution is one of the best ways to secure a double or even triple digit return on your investments. These companies are changing the face of medicine, and Bret Jensen, an expert biotech investor, knows which are leading the way. With multiple home runs already this year, you would be wise to invest alongside him.

There is just something about an equity selling for under $10.00 a share that appeals to certain investors. Maybe it is the potential thrill of seeing a stock purchased at $8.00 a share soar to $25.00 a share in short order or just the fact that one can buy many more shares of a stock selling for $6.00 a share than one selling for $75.00 a share.

I like stocks under $10 simply because the vast majority come from the small cap arena which has been a focus area of my investing for over two decades and where most of my outsized gains have originated. It is this success and passion that led me to establish the Small Cap Gems portfolio last summer. I particularly like plumbing the small cap biotech and biopharma arenas to find these potential multi-baggers.

Some of the stocks that I originally profiled when they traded in the single digits over the last few months here at Investors Alley now comfortably trade in the mid-teens. These include ZIOPHARMA Oncology (NASDAQ: ZIOP) and Halozyme Therapeutics (NASDAQ: HALO). Hoping to find the same success here are two stocks selling for less than $10 a share that easily could be trading much higher in the foreseeable future.

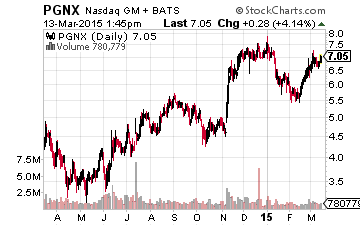

Let’s start with Progenics Pharmaceuticals (NASDAQ: PGNX) which goes for some $7.00 a share. The stock is up some 50% since last time I profiled it in late October. That is a great return compared to the overall market. However, it pales in comparison to the over 300% returns achieved by the other small biotech play profiled in that article, ZIOPHARMA.

Let’s start with Progenics Pharmaceuticals (NASDAQ: PGNX) which goes for some $7.00 a share. The stock is up some 50% since last time I profiled it in late October. That is a great return compared to the overall market. However, it pales in comparison to the over 300% returns achieved by the other small biotech play profiled in that article, ZIOPHARMA.

I believe Progenics has further upside and would not be surprised if the company has its stock see the $10.00 level by the end of the year, representing a 42% return. The key driver of the stock’s recent outperformance is that a compound called Relistor to treat opioid-induced constipation was approved by the FDA in 2014. Relistor was developed with partner Salix Pharmaceuticals (NASDAQ: SLXP).

Approval triggered a $40 million milestone payment to Progenics and the company could receive up to another $200 million in various milestones if the drug develops into a successful product. It also would receive 15% to 19% of overall sales in royalties. The drug itself could be worth more than the approximate $500 million market capitalization of the company. This does not take into account the big slug of net cash Progenics has on its balance sheet.

The company also has a stable of imaging and therapeutic agents it is developing to better detect and treat various forms of cancer and its associated effects which the market is placing little to no value on at the current time. Brean Capital recently reiterated its “Buy” rating and $11.00 a share price target on PGNX and I think that level is achievable over the next 12-18 months.

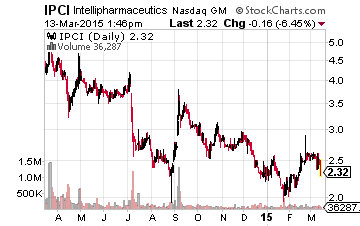

IntelliPharmaCeutics International Inc. (NASDAQ: IPCI) recently popped up on my radar due to a couple of positive analyst mentions. IntelliPharmaceutics is an emerging biopharmaceutical company based in Canada. The shares currently go for just under $2.50. Within the last month or so Brean Capital reiterated its “Buy” rating and $8.00 a share price target. Maxim Group did the same albeit with a $7.00 a share price target. Both of these came from highly ranked analysts within the biotech and biopharma space.

IntelliPharmaCeutics International Inc. (NASDAQ: IPCI) recently popped up on my radar due to a couple of positive analyst mentions. IntelliPharmaceutics is an emerging biopharmaceutical company based in Canada. The shares currently go for just under $2.50. Within the last month or so Brean Capital reiterated its “Buy” rating and $8.00 a share price target. Maxim Group did the same albeit with a $7.00 a share price target. Both of these came from highly ranked analysts within the biotech and biopharma space.

The company is engaged in the research, development, and commercialization of controlled-release and targeted pharmaceutical products. The company’s proprietary Hypermatrix™ allows for the intelligent and efficient design of drugs through the precise control of a number of key variables.

The FDA recently approved the company’s generic version of the marketed drug Focalin XR® which has three-quarters of a billion dollars in annual sales. The drug will be distributed by IntelliPharmaCeutics partner Par Pharmaceutical Inc. The company has a half dozen other reformulated generic versions of drugs before the FDA through its Abbreviated New Drug Application filing process and the company is willing to take on a partner like Par Pharmaceutical for distribution.

In late summer, the company announced an enhancement to its Rexista abuse-deterrent technology. The new platform is called Podras (Paradoxical OverDose Reistance Activating Platform). The new platform potentially restricts the amount of active drug released in the body if more pills are consumed than prescribed while preserving the normal release of the drug if the amount consumed is as expected. Rexista technology prevents drug tampering while Podras addresses all forms of prescription drug misuse/abuse.

The most promising product being developed using this new technology combination is a generic oxycodone candidate. It’s an abuse-resistant version of this widely used drug with $2.3 billion in annual sales just in the United States. Given the company’s pipeline, myriad shots on goal, analyst support and minuscule $55 million market capitalization the stock is worth a small speculative position.

Although the small cap biotech and biopharma areas are inherently volatile spaces, I find both of these plays attractive from a risk/reward perspective at current levels.