Settle Down Dollar Bulls And Deflationists; It's Just A Bounce So Far

We have expected the stock market to resume correcting as USD bounces with the Gold-Silver ratio, but we need to understand what is the trend and what is the reaction. So far, the pro-USD view is a reaction, not a trend.

The 2 Horsemen (Gold-Silver Ratio and USD) are riding… hard.

But the Gold-Silver ratio has not definitively reversed its 2016 downtrend. If it does, everybody out of the pool.

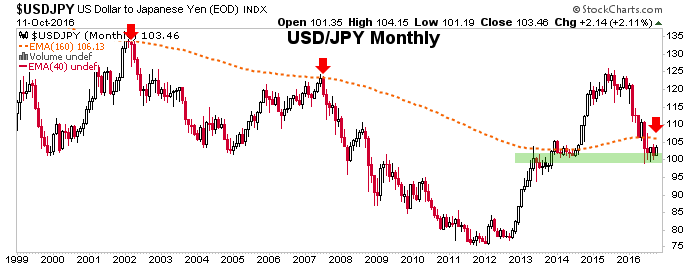

USDJPY is bouncing, but in a downtrend by weekly chart.

We have used an alternate monthly chart in NFTRH to show a support level at which this bounce could manifest. Well?

Flipping it over to JPYUSD with gold and silver (daily chart) we see all 3 Amigos are in line as they should be. But that if Yen-USD is only suffering a bounce reaction from Uncle Buck, gold and silver will be just fine. And so too likely, will be the inflationary scenario.

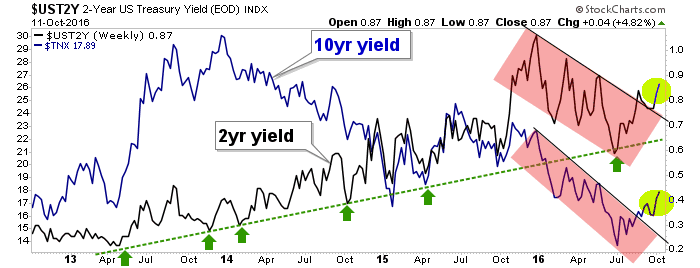

2 Yr and 10 Yr yields have each broken out to the upside, getting casino patrons far and wide concerned about a big dollar bull, since USD benefits from rising yields.

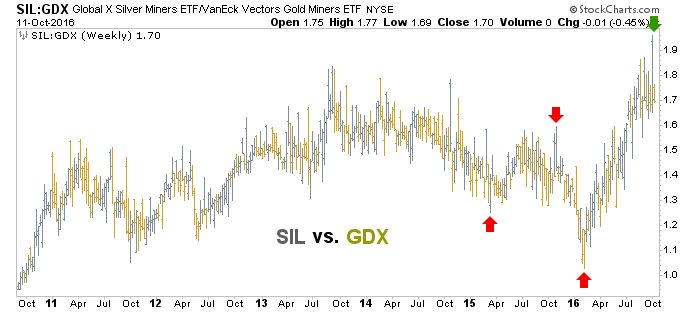

Despite the wipe out in precious metals, silver stocks are still in a 2016 uptrend vs. gold stocks (SIL vs. GDX). What’s up with that?

Well, what’s up with it is that the Silver-Gold ratio has not broken down from its 2016 uptrend and commodities have held firm thus far.

As we await a signal in the CRB vs. SPX.

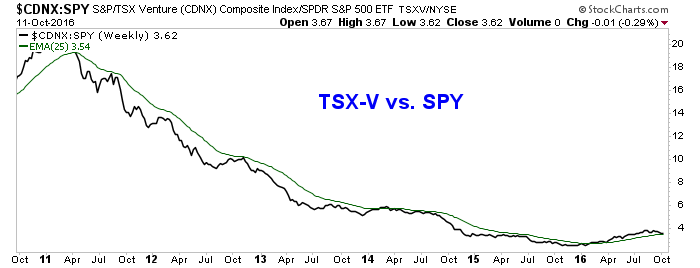

And we wait to see if these two speculation/inflation indicators will test out successfully.

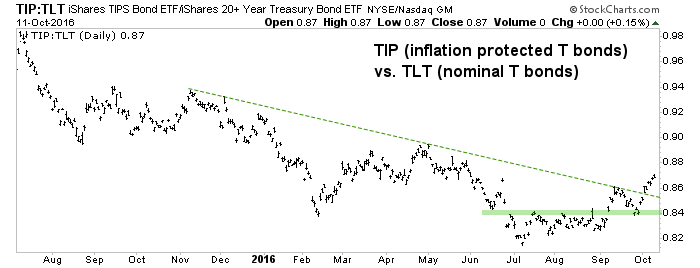

As we noted on Monday, over in bond land the indications are at least open to an inflationary phase. Because the yield curve is a candidate to bounce (while nominal yields shown above rise), inflation expectations are bouncing and Junk Bonds are telling everybody to get in the pool. So what if the water is just sitting stagnant, not being filtered and there is no chlorine in use? GET IN!

Anything can happen because these are financial markets operating in a policy-driven Wonderland. But the above items indicate that taking the deflationary bait in a long-term manner as stock markets correct and fear begins to amp up may not be the correct way to be out a few months from now.

Disclosure: Subscribe to more