Richmond Fed Warns On Rising Commercial Real Estate Lending

The 2008 financial crisis is most closely associated in the public mind with subprime lending on private homes, but commercial real estate (CRE) lending also played a role. As a new economic brief from the Federal Reserve Bank of Richmond notes, from 2008 to 2012, banks with high concentrations of CRE lending were three times as likely to fail as all banks in the United States.

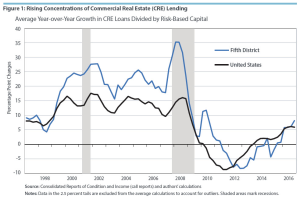

Now, the Richmond Fed warns, CRE loans, measured as a percentage of banks’ risk-based capital, are rising again, as the following chart taken from the brief shows. The situation deserves close monitoring, even though the rate of increase is not yet as rapid as it was in the run-up to the 2008 crisis.

CRE loans fall into three main categories—construction and land development loans, commercial mortgages, and loans to finance multifamily housing. These loans tend to be relatively risky, since they have a relatively long average term and are sensitive to changes in market conditions between the time they are originated and the time they mature. CRE loans tend to be concentrated in smaller community and regional banks, which often have special expertise in local real estate markets. At the end of 2016, these banks held about half of all CRE loans even though they account for only a quarter of all bank assets, according to the Richmond Fed.

The risk that CRE loans pose also depends on a bank’s source of funding. The risk increases when such loans are financed with noncore funding, for example, certificates of deposit in excess of the limits of FDIC insurance, brokered deposits, and other borrowing. These sources of funding tend to evaporate when a crisis strikes, unlike traditional retail deposits. The combination of a high ratio of CRE loans to capital and dependence on noncore funding makes a bank vulnerable to failure.

The Richmond Fed’s cautionary brief concludes that while banks are not as exposed to CRE lending risks as they were before the Great Recession,

“The CRE sector remains a potential source of problems due to its unique risk factors. Banks with high CRE concentrations, particularly those that also have rapid CRE loan growth and heavy noncore funding reliance, bear careful watching.”