Why This REIT Is A Step Above Its Competitors

During the three weeks or so of each quarterly earnings season, I either listen to or read the transcripts of 100+ earnings conference calls. The calls can be invaluable to learn about management team goals, plans, and how well those plans are working out. My top “don’t miss” call each quarter comes from a high-yield finance REIT with a CEO that is not afraid to speak his mind. This quarter he had a lot to say about why his company is a step above its competitors.

He always covers a variety of topics and speaks bluntly on each matter. I have gone ahead and collected some of my favorite quotes from the call this quarter about his thoughts on the market, their business valuation, and their long-term growth prospects. Not only are his quotes entertaining, but they show that this company has great growth potential in the long-term that the market does not fully see.

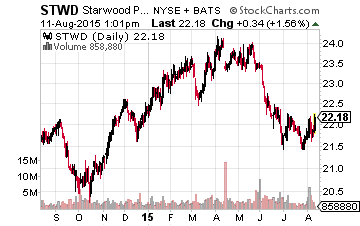

Starwood CEO Barry Sternlicht is very open about sharing his thoughts and beliefs on a wide range of topics. This is a big contrast to the majority of CEOs, who stay close to the Wall Street version of politically correct when discussing their companies or answering questions. Sternlicht’s comments in the 2015 second quarter conference call did not disappoint and the stock should not disappoint investors as a long-term income investment.

“Our Yield is a Joke”

Starwood Property Trust (NYSE:STWD) currently yields 8.8%. and Sternlich has trouble with the high yield in comparison to STWD’s peers for a couple of reasons. He notes that the company’s commercial mortgage book is at just 61% loan-to-value. There is tremendous equity protection of loan principal values. Starwood also carries a very low debt ratio to produce the cash flow and yield investors earn. Starwood debt level represents 1.2 times leverage on capital and the business generates a 14% return on capital. The other major commercial mortgage REIT, Blackstone Mortgage Trust Inc (NYSE:BXMT) is half the size of Starwood and yields 7.2%.

Starwood does not get the credit it deserves for the emphasis that the management team puts on making sure the company will grow in the long term. Blackstone made a big, splashy deal in the second quarter which pumped up the share price, but the results of that deal will bleed off in just a few years. In contrast, Starwood just made a purchase in Ireland that will produce a double-digit cash return for the next 20 years, but that type of acquisition doesn’t make the financial headlines. Here’s another quote: “Really excited about the pipeline both on the team and the origination side, we are not looking for mass, we are looking for quality and finally we are very picky.”

“We’d really like the Feds to increase interest rates”

The Starwood commercial lending business would see a significant growth in profits if and when interest rates start to increase. The company’s loan portfolio is primarily floating rate and the commercial mortgage servicing business purchased last year would see fees increase with higher interest rates. Yet, just the fear of higher rates has the market selling finance REITs without discriminating the good from the bad. Sternlicht noted that market selling of STWD based on higher rates is something investors need to understand, but that the company will do very well in a higher rate environment. He put it this way: “Our stock will fall, but we’ll make more money.” More money in the long run will mean larger dividends for investors.

Starwood Property Trust is the kind of high-yield stock I really like as recommendations to my Dividend Hunter subscribers. This is a company that is committed to the long-term growth of profits and cash flow, which will lead to higher dividends. CEO Sternlicht likes to point out that the market is too short-term focused and doesn’t try to understand how a company like Starwood is different from the pack. Finally, he dropped a couple of hints that the company is working on some deals that will be very good for investors, but stated that we need to wait until next quarter to get more details. I can’t wait to listen to that call.

There are great opportunities in the tax-advantage master limited partnership –MLP– sector. MLPs develop, own and operate a large portion of ...

more

interesting pick I recently bought NLY..cheers