Mortgage Delinquencies At Multi-Decade Lows

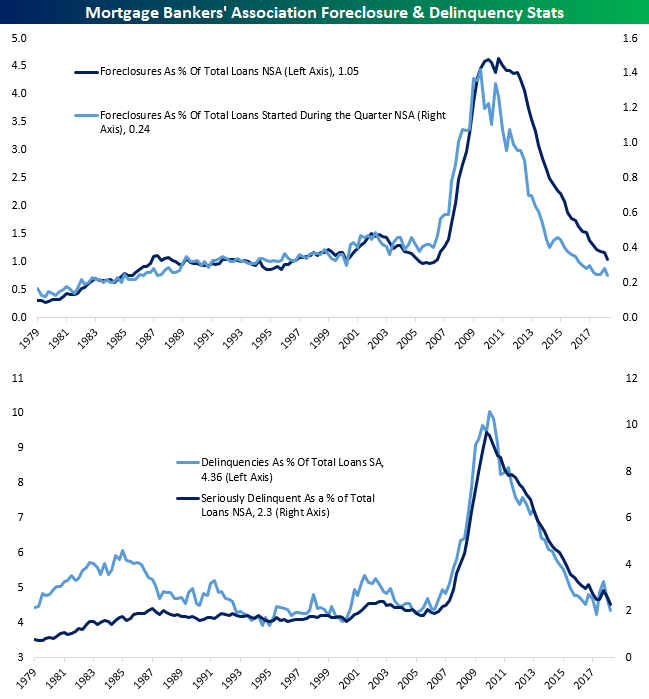

Earlier this week, we noted that the New York Fed’s quarterly household debt data showed a collapse in the share of consumers facing collections for bad debts. On Thursday, quarterly data from the Mortgage Bankers’ Association relating to mortgage bankruptcy and delinquency showed similar results. In the charts below we show the share of all loans facing foreclosure, share of loans with new foreclosure proceedings started, delinquent loans, and seriously delinquent loans all as a share of total mortgage loans.

As shown, these indicators of mortgage credit performance are in free-fall and making new lows on a consistent basis. The foreclosure stats are the most impressive. New foreclosures as a share of all loans are the lowest since 1986 per the MBA data, while foreclosures as a share of all loans are the lowest since 2006. Delinquency data isn’t quite as positive but also shows impressive levels of timely payment. By all indications, consumers are in very good financial shape, buoyed by the job market, strong home prices, and higher post-crisis borrower standards.