Kimco Realty: Retail Worries Are Overblown, The 5% Dividend Yield Is Safe

The rumored “death of the shopping mall” is not only wreaking havoc among retail stocks, but it is also dragging down REITs that own retail properties. Take, for example, Kimco Realty (KIM). Shares of Kimco have declined 25% so far in 2017. The stock is sitting at lows not seen in the past five years.

The biggest reason for the decline is that investors are concerned about the ripple-effects of the decline of brick-and-mortar retailers eventually spreading to the REITs that own the real estate. However, Kimco’s fundamentals have held up so far this year. The prolonged decline in the share price has pushed up Kimco’s dividend yield to 5.7% Kimco is one of 295 stocks with a 5%+ dividend yield.

You can see the full list of established 5%+ yielding stocks by clicking here.

This article will discuss why investors should not assume Kimco will suffer alongside the retail industry. If anything, its huge share price decline presents a compelling buying opportunity for income investors.

Business Overview

Kimco is one of the largest REITs focusing on shopping centers. At the end of the first quarter, it owned 517 U.S. shopping centers, spread across 34 U.S. states and Puerto Rico. Kimco’s properties are concentrated in high-density markets with high incomes. These are predominantly areas where store traffic is still strong.

Source: Q1 Earnings Presentation, page 20

Kimco’s top 10 core markets comprise approximately 80% of its annual base rent. This is a very difficult time for retailers, which means REITs that predominantly own retail space could be in big trouble. Indeed, if brick-and-mortar retail is truly dead, mounting store closures and bankruptcies will inevitably impact retail industry REITs like Kimco.

A quick scan of Kimco’s tenants is admittedly terrifying: Sears Holdings (SHLD), Kmart, and J.C. Penney (JCP) to name a few. Fortunately, Kimco has only been minimally affected, because many of the stores being closed are company-owned.

Of 965 store closures announced in 2016, Kimco is affected by 15 closures. Occupancy rates remain strong, at 95.3% in the first quarter. And, rent per square foot increased by 3.8% last quarter. The headline risk is very scary for Kimco, as retailers face a constant deluge of negative news coverage. The good news is, Kimco’s fundamentals are not deteriorating. Quite the opposite—Kimco’s funds from operation (or FFO, which measures a REIT’s cash flow while excluding non-cash charges like depreciation) rose at a 5% compound annual rate from 2010-2016. Kimco’s dividend has grown at an 8% compound annual rate during this time. Going forward, Kimco is likely to continue growing FFO and dividends.

Growth Prospects

Going forward, Kimco is steering investment toward industries that are insulated from Internet retail competition, such as health and wellness, food and restaurants, and entertainment. Longer-term, Kimco expects operating income for its U.S. properties to grow at a 5% rate from 2015 through 2020, eventually reaching $1.2 billion.

Source: Q1 Earnings Presentation, page 18

Positive momentum is building so far in 2017. With 497 new leases signed, leasing activity last quarter was the highest in 10 years. Kimco continues to acquire properties, as part of its broader growth strategy. Management anticipates $300 million-$400 million of property acquisitions in 2017. Occupancy is expected to rise to 95.8%-96.2% this year, along with 2%-3% operating income growth for properties owned at least one year. For all these reasons, Kimco maintains a very promising forecast for 2017. At the midpoint of management’s guidance, FFO-per-share is expected to increase 15%, from reported FFO of $1.32 per share in 2016. This growth will be achieved through a variety of catalysts. For example, Kimco expects operating income to increase through a combination of organic growth, rent increases, property redevelopments, and acquisitions. And, Kimco believes it can generate growth from accelerating investment in its portfolio of “small shops”, meaning properties with less than 10,000 square feet.

Source: Q1 Earnings Presentation, page 19

The company believes these smaller properties will offer stronger growth potential moving forward. Occupancy is rising rapidly, from 82% in 2012 to over 90% projected by 2020. In addition, small shops tend to have significantly higher rents. For example, Kimco’s small-shop rents have averaged $26.42 per square foot so far this year, which was well above its company-wide rent per square foot average, of $15.23 in the first quarter. Overall, Kimco expects to have another good year in 2017. Thanks to its strong fundamentals, Kimco’s current dividend is sustainable. Not only that, but Kimco will likely have an opportunity to raise the dividend in 2017.

Dividend Analysis

Because of its plunging share price, Kimco’s current dividend yield has reached 5.7%, which is very attractive in a low interest rate environment. However, a high yield alone is not enough to buy a stock. Sustainability of the dividend payout is equally important.

Kimco’s dividend appears sustainable, as the company generates more than enough cash flow to cover its dividend payout. Its current dividend of $1.08 per share represents a payout ratio of 72% based on 2016 adjusted FFO-per-share.

Another important consideration for dividend sustainability, is balance sheet strength. Companies with high levels of debt are at greater risk of cutting dividends, when business conditions deteriorate.

Being over-leveraged is a particular risk for REITs, which typically rely heavily on debt financing to invest in property redevelopments and acquire new properties. This is especially true if interest rates are to rise moving forward. Kimco appears to have a manageable level of debt.

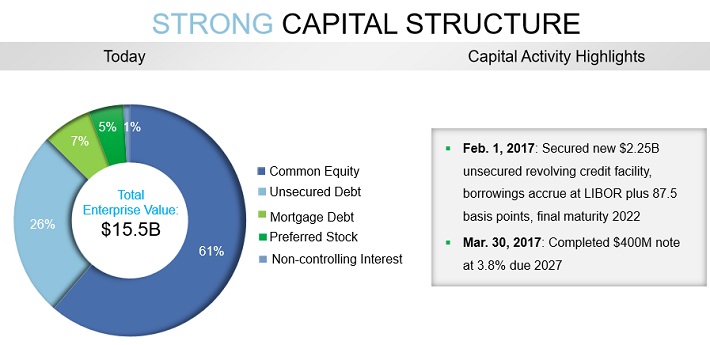

Source: Q1 Earnings Presentation, page 28

Kimco does not overly utilize debt. Unsecured and mortgage debt makes up approximately one-third of the company’s capital structure. Its net-debt-to-EBITDA is near 6.0, which is on the high side for a REIT. However, the company has a fixed charge coverage ratio of 3.4, and an investment grade credit rating of BBB+ from Standard & Poor’s. The company plans to use excess cash flow to improve its balance sheet. By 2020, the company believes it can earn a credit rating of A- from S&P.

Final Thoughts

Investors are bailing out of retail stocks, given the rise of e-commerce. REITs that focus on shopping centers, such as Kimco, are suffering from guilt by association. However, Kimco seems to be in a good position. Its portfolio has not deteriorated much at all; in fact, the company’s lease activity continues to expand, and rents are increasing as well. Kimco stock trades for a price-to-FFO ratio of 12 based on 2016 results. This is a proxy for the price-to-earnings ratio, and indicates Kimco is potentially undervalued. And, the company generates more than enough cash flow to maintain its dividend, with the potential for future dividend growth. As a result, Kimco and its 5.7% dividend yield are attractive for dividend investors.

- In a world of low interest rates and record-high stock markets, a 5% yield is hard to find. To see another 5% dividend yield hailing from the financial sector, click here.

- A stock that combines a high yield with dividend growth is the best of all. For a 5% dividend yielding stock that has raised its dividend for 38 quarters in a row, click here.

- However, not all 5%+ dividend yields are good investments right now. To see why this 7% yielding dividend stock may cut its dividend payout, click here.

more