Government Properties Income Trust: Risky But Speculative Buys

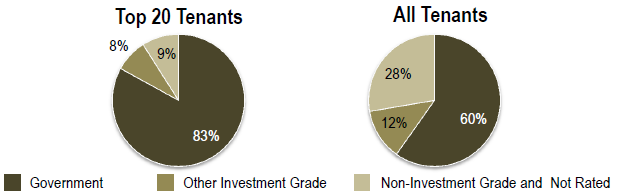

Government Properties Income Trust (GOV) is a high yielding real estate investment trust or REIT. The business model is simple. The company leases offices to federal, state and other government institutions (where it derives about two-third of income) and private enterprises (where the remaining one-third of rental income comes in).

GOV’s total portfolio, factoring in known acquisitions includes 18 million square-feet across 170 buildings, with 54.3% of the portfolio located in the Metropolitan Washington DC market. The portfolio has a blended occupancy of 94.1% with a weighted average lease maturity of 4.9 years. It is a well-established business with high-quality tenants.

Source: Company presentation

The question is, can you consider buying here? We believe that you should use caution in the name as the company is losing money and funds from operations are barely covering the dividend. However, we think shares are at levels that could be promising for a speculative buy.

Q4 review-dividend barely covered

The company is losing money. Net loss available for common shareholders on a GAAP basis, was $18.3 million, or $0.18 per diluted share, for the quarter ended December 31, 2017, compared to net income available for common shareholders of $12.1 million, or $0.17 per diluted share, for the quarter ended December 31, 2016.

Net loss available for common shareholders for the quarter ended December 31, 2017 includes a $9.3 million, or $0.09 per diluted share, loss on impairment of real estate. The weighted average number of diluted common shares outstanding was 99.0 million for the quarter ended December 31, 2017 and 71.1 million for the quarter ended December 31, 2016. While this hurts, we should look to the funds from operations to check dividend coverage.

Normalized funds from operations, or Normalized FFO, available for common shareholders for the quarter ended December 31, 2017 were $49.2 million, or $0.50 per diluted share, compared to Normalized FFO available for common shareholders for the quarter ended December 31, 2016 of $41.5 million, or $0.58 per diluted share. This decline is a big risk factor. The biggest issue? The dividend of $0.43 is getting dangerously close to not being covered by funds from operations. This is true for the annual results as well.

For the year 2017

Net income available for common shareholders determined in accordance with GAAP was $11.8 million, or $0.14 per diluted share, for the year ended December 31, 2017, compared to net income available for common shareholders of $57.8 million, or $0.81 per diluted share, for the year ended December 31, 2016.

Net income available for common shareholders for the year ended December 31, 2017 includes a $9.5 million, or $0.11 per diluted share, loss on impairment of real estate. The weighted average number of diluted common shares outstanding was 84.7 million for the year ended December 31, 2017 and 71.1 million for the year ended December 31, 2016.

Normalized FFO available for common shareholders for the year ended December 31, 2017 were $171.1 million, or $2.02 per diluted share, compared to Normalized FFO available for common shareholders for the year ended December 31, 2016 of $167.9 million, or $2.36 per diluted share.

The dividend of $1.72 was covered, but the coverage ratio is tightening. A large part of this drop was due to moves being made, namely a large acquisition, as well as some dispositions.

Making market moves

On October 2, 2017, GOV completed an acquisition of First Potomac Realty Trust (FPO). This pickup brought in 35 office properties (72 buildings) with approximately 6.0 million rentable square feet that were 93.3% occupied as of the date of acquisition and two properties (three buildings) with approximately 443,900 rentable square feet that were 100.0% occupied as of the date of acquisition.

There were some notable sales as well. In October 2017, GOV sold a vacant office property (one building) located in Albuquerque, NM with 29,045 rentable square feet for $2.0 million, excluding closing costs.

In January 2018, GOV entered an agreement to sell an office property (one building) located in Minneapolis, MN with 193,594 rentable square feet for $20.0 million, excluding closing costs.

In February 2018, GOV entered an agreement to sell an office property (one building) located in Safford, AZ with 36,139 rentable square feet for $8.3 million, excluding closing costs. This sale is expected to occur in the second quarter of 2018. This month the company also agreed to sell an office property (one building) located in Sacramento, CA with 110,500 rentable square feet for $10.8 million, excluding closing costs. This sale is expected to occur in the second quarter of 2018.

Our thoughts

Government Properties Income Trust completed significant leasing volume in the fourth quarter of 2017, entering new and renewal leases for over 520,000 square feet with a 3.3% average roll up in rent.

The acquisition of First Potomac Realty Trust weighed during the quarter, dragging down funds from operations for the year. The good news is that the integration is complete and initial property level operating results are strong according to management.

The 10% dividend yield is certainly attractive here. That said, there are risks. Government consolidation of physical space to save taxpayer money could impact lease renewals going forward. The company is priced competitively to other REITs, but the dividend coverage ratio is a bit concerning. Still, there is wiggle room. That said, 2018 will be a definitive year, because the First Potomac Realty purchase was controversial, with many shareholders opposed. The proof will be in the fiscal results. Going forward, we think shares are a speculative buy at present levels.

Quad 7 Capital has been a leading contributor with various financial outlets since early 2012. If you like the material and want to see more, scroll to the top of the article and hit ...

more