Buy This Lodging REIT For Yield + Gains!

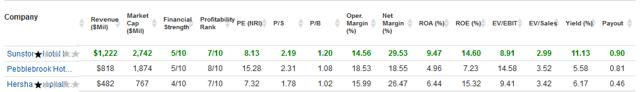

I have owned a number of lodging REITs in past years. Our most recent, however, was Hersha Hospitality (HT) which we sold at a nice profit back in late 2014. (FYI, with its round trip back near what we paid this past year, Hersha is starting to look good again...) But of the three most undervalued lodging REITs I see right now – Pebblebrook Hotel Trust (PEB), Hersha and Sunstone Hotel Investors (SHO) – Sunstone would be my first choice with the others as further diversification later.

I travel a great deal for my business as well as for pleasure and in support of a non-profit on whose board I serve. This puts me in lots of different hotels, where I always inquire which companies actually own and, if different, which manage the property. In most cases Marriott, Hilton, Hyatt et al provide some combination of employee training, marketing and branding, logistics and supply, restaurant management, etc., but they do not own the land and buildings they occupy.

Often, the owners, typically REITs, large real estate development companies, or consortiums of successful individuals, will also hire a property management company to oversee day-to-day operations. No matter the business model, most quality properties then affiliate themselves with a nationally-known hotelier like Hyatt, Hilton or Marriott in order to gain national exposure, provide loyalty programs, and train employees to the standard guests have come to expect from these names.

Hyatt Regency Newport Beach – Far From the Madding Crowd

One of my favorite hotels, to which I return whenever I am in Southern California, is the Newport Beach Hyatt. This is an older hotel in a sylvan setting, spread across 26 acres with buildings no higher than three stories. The sense of being in the country, while really an easy walk to Balboa Island or a slightly longer one to Fashion Island, is enhanced by the views of Back Bay, beautiful landscaping and the contiguous golf course. The service is always superb and the onsite dining excellent. They are a typical Sunstone acquisition. The staff is attentive without being intrusive and leadership is innovative and guest-focused.

Other Sunstone properties include those branded by Marriott, Hilton, Renaissance, Fairmont as well as other Hyatts. Specifically, this includes Marriott hotels in Portland, Park City, Wailea (Maui,) Houston, New Orleans (the J.W.,) Tyson’s Corner (Virginia, suburban D.C.,) Boston and Philadelphia. Renaissance-branded hotels occupy Sunstone property and facilities are in Westchester N.Y., D.C., Baltimore, Orlando, Long Beach and Los Angeles. Other Sunstone properties include Hilton-branded hotels in San Diego, La Jolla, Houston, Chicago, and New Orleans as well as the Fairmont in Newport Beach and Hyatts in Chicago and San Francisco.

(click to enlarge)

One common theme you’ll notice about Sunstone’s locations, whether urban or resort setting: these properties are all located in cities with significant business travel or destination vacation attractions or both. With properties like these, all Sunstone has to do is keep them well-maintained and occasionally remodeled. If ever there were “build it, they will come” destinations, “these be them!”

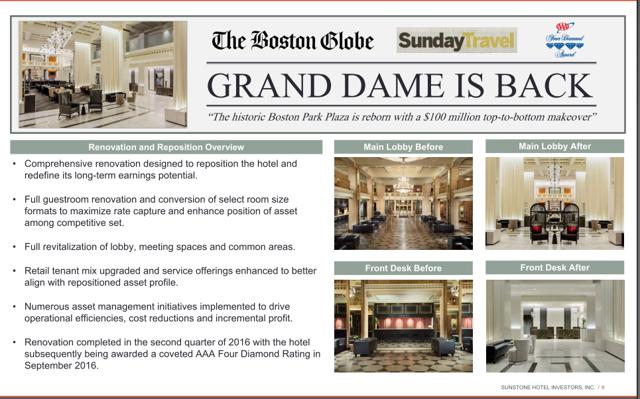

With these great locations and hotels, how is Sunstone executing? Pretty darn well. They are actively acquiring properties whose previous owners have been too parsimonious. Many of these are “faded glory” properties that were premier hotels in premier locations but have been overtaken by neighboring properties.

(click to enlarge)

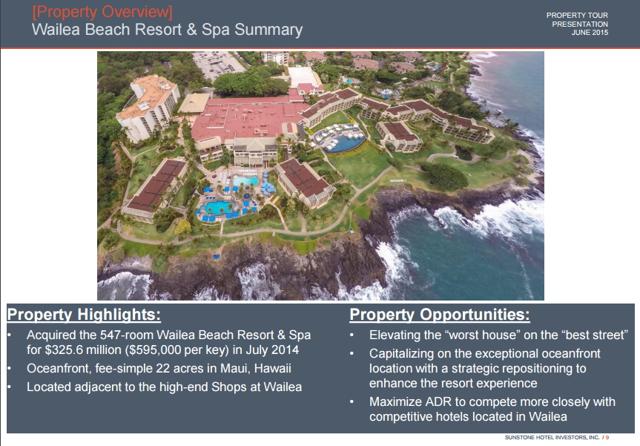

The lodging industry is fiercely competitive. Deep-pocketed neighbors with newer properties can easily steal guests away if you don’t keep your own properties fresh and new. For example, the Marriott-branded Wailea, Maui Beach Resort & Spa sits directly between the Andaz (a Hyatt brand) on one side and the Grand Wailea, Four Seasons and Fairmont on the other. By purchasing from owners who wanted to milk their cash cow without spending the money to keep it competitive in such a crowd, Sunstone is able to add significant value.

Revenue per available room ( RevPAR) is a performance metric used in the hotel industry. It is computed by multiplying a hotel's average daily room rate by its occupancy rate. In the case of this Wailea property, the RevPAR for its immediate competitors is $442. For Sunstone’s new acquisition, still being upgraded, it is less than $240. As SHO completes its remodel, SHO will benefit twice: I believe the rooms themselves will see an increase in revenue and occupancy will also rise.

(click to enlarge)

SHO’s equity/assets ratio, at 67%, is among the highest in the hotel industry. Nat margins are just under 30%. Return on equity is 14% and return on assets is 9.5%. Revenue growth has stalled with all the upgrading of various properties, but I consider this to be a temporary event. If SHO’s revenues declined because they were content to own declining properties I’d be concerned. But as I see it revenues declined because the company made an investment in its future — buying properties that provide less revenue today but will yield more revenue as all upgrades are completed. Their debt is well covered by cash flow so they are still quite profitable.

(click to enlarge)

As for stock valuation, Sunstone sells for 8.25 times TTM earnings. (Of course, for REITs, PEs are not an important metric; adjusted FFO, funds from operations, are a better one. I think AFFO for SHO will come in at 11 or so this year.)

Price/book is 1.2 and price/sales indicates good value at 2.2. Quarterly yield is just 1.5% however REITs must pay out 90% of earnings and, like many REITs, SHO pays a substantial “catch-up” distribution at year-end as well. This has typically taken it to the 7.5% to as high as 11% yield level for the year.

(click to enlarge)

The Hyatt Regency San Francisco (For those of us who lived there when it opened, this will always be the "Hyatt Embarcadero"!)

We are now buying Sunstone.

Disclaimer: I do not know your personal financial situation, so this is not "personalized" investment advice. I encourage you to do your own due ...

more