Big-Dividend REITs: Ranking The Best And Worst

It’s been a choppy year so far for big-dividend Real Estate Investment Trusts (REITs). This has created some attractive buying opportunities as the market moved from January/February distress, to a near-infatuation with yield in the months that followed, a Brexit-induced flight to quality, a new real estate sector, and perhaps another leg lower following the upcoming November 1-2 Federal Reserve meeting. For your consideration, we’ve provided a ranking of the best and worst performing big-dividend REITs year-to-date, and we’ve also provided five general recommendations on how to “play” the current state of the REIT sector. Further, we cover several specific REIT opportunities in this article, and provide our Top 10 Big-Dividend REITs worth considering here.

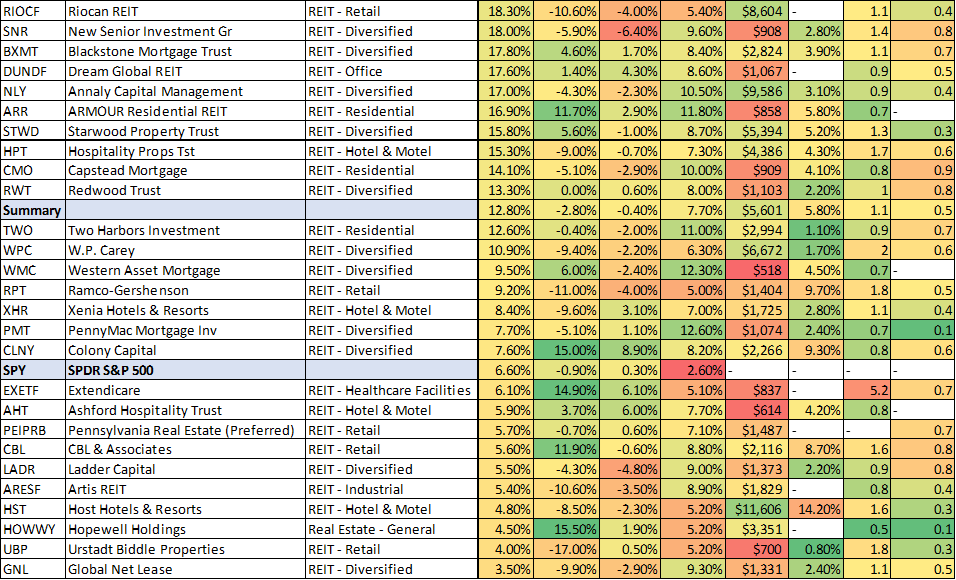

For starters, the following table ranks the year-to-date total returns (dividends plus price appreciation) of the 75 REITs that passed our screen (we required at least a 5% dividend yield and $500 million in market capitalization). The table also provides several additional metrics that we believe are worth considering.

Several things stand out to us about the data in this table:

1. If you’re a contrarian, don’t just buy the worst performers

We believe there is a general tendency for individual security performance to sometimes revert towards the mean. This means what performed the best in the past, likely won’t perform the best in the future, and vice-versa. For example, with regards to the worst year-to-date performer in our table, Corrections Corp (CXW), we wouldn’t buy it. This is a company that runs for-profit prisons. It’s been in the crosshairs of pension funds, activists, and legislators for years. And following the Department of Justice decision in August to reduce its reliance on private prisons, the stock tanked. Big time. It’s down about 60% since August 1st. Even though Corrections Corp may soon experience a dead cat bounce, we’re still not buying this 15.4% yielding REIT. We’re also not buying Geo Group (the fourth worst performer in our table, and also a for-profit prison) despite its 10.7% dividend yield. These are big-dividend REITs we just can’t get behind because of the social and legislative risks.

Chatham Lodging Trust (CLDT): Worth noting, we do like the 6th worst performer on the list, Chatham Lodging Trust. Chatham is a hotel REIT with a big 7.1% dividend yield (paid monthly), and significant price appreciation potential. The market has dramatically overreacted to slowing growth among hotel REITS, and Chatham in particular offers an attractive investment opportunity for long-term income-focused investors because of its attractive locations, attractive valuation, and potential for more dividend increases. We liked Chatham when we first wrote about it several months ago, and we like it even more now. You can read our previous report on Chatham here: This Big-Dividend Hotel REIT has Big Upside.

2. Don’t Chase After the Best Performers Either

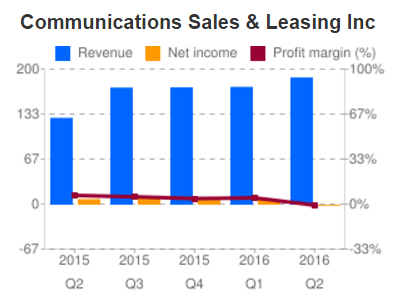

Many investors make the mistake of investing in whatever has performed the best recently. However, as value investors, it’s hard for us to get excited about Communications Sales (CSAL), the best-performing REIT in our table, which is up 74.1% year-to-date. Despite CSAL’s big 7.6% dividend, it has an enormous amount of debt, very little net income, and an extremely short track record since being spun off from Windstream Holdings.

Stag Industrial (STAG): However, we do like the 7th best performer in our table, Stag Industrial. Specifically, Stag’s shares have fallen 12% since August 1st, and its dividend yield (paid monthly) has risen to 6.3% (annually). And despite Stag’s unique risk exposures (i.e. secondary/tertiary industrial properties that institutional investors usually avoid), we like it because of its diversified approach, reasonable valuation, continued growth opportunities, and big monthly dividend. (Note: our recent full write-up on Stag can be accessed using the link at the beginning of this article titled Top 10 Big Dividend REITs worth considering).

3. A Bigger Yield Isn’t Always Better

Just because something offers a big yield doesn’t mean it’s a better investment than something with a lower yield. For example, Annaly Capital (NLY) offers a big dividend yield (10.5%) but we’re not attracted to it. We believe Annaly is basically a one-trick-pony at the mercy of the capital markets. And even though it may have the financial wherewithal to maintain its big dividend for more than the next few quarters, its asset value and share price are in peril, and so is the company’s long-term dividend sustainability. Plus the recent Hatteras acquisition is an ominous reminder of the atrocious yield curve and Annaly’s shrinking balance sheet (You can read our full Annaly report here).

4. Consider the Short-Interest

The “Short % of Float” column in our table shows the percentage of the company's publicly traded shares that have been shorted. This can be a valuable metric to consider because it can provide insight into market sentiment and it can help explain price movements. For example, many of the Hotel REITs in the table have a relatively high amount of short-interest, which adds color to this sub-industry’s recent poor performance (a lot of investors are betting against hotel REITs, which can certainly impact the price).

Omega Healthcare (OHI): As another example, Omega Healthcare is an income investor favorite because of its big dividend (7.2%) and low valuation, but its short interest should also be considered. Certainly Omega’s focus on skilled nursing facilities contributes to its relatively low valuation (the threat of legislative reform to Medicare could significantly reduce Omega’s profitability), but the high 16.7% short-interest should also be taken into consideration. Specifically, the short-interest is likely a contributor to (and symptom of) the stock’s recent underperformance, and the market’s somewhat negative sentiment towards Omega.

5. Be Opportunistic: Especially Around the Fed

You are likely pleased if you were able to take advantage of the depressed REIT prices in January and February of this year (i.e. you may have bought big yields at low prices). However, we may be about to get some additional buying opportunities as we approach the upcoming Federal Reserve meeting on November 1st and 2nd. Specifically, if the Fed raises rates or makes a “hawkish” announcement then we could see another selloff in REITs (i.e. a buying opportunity). More specifically, REITs may sell off because they’re highly levered and higher rates means more expensive debt and less profitability. Additionally, higher interest rates (or the threat thereof) could cause investors to look towards other interest-paying options to capture the yield they seek, and therefore cause REITs to selloff (which would create a buying opportunity, in our view).

Conclusion:

Despite this year’s market choppiness, many high-quality REITs have continued to pay big safe dividends. Opportunistic long-term investors were able to add shares during the market pullbacks, and these same investors will likely get more buying opportunities in the future, such as the upcoming Federal Reserve announcement (i.e. a hawkish Fed could cause REITs to selloff and create an attractive buying opportunity). Remember also to not chase returns or dividend yields without first understanding the fundamentals. In particular, we are avoiding Corrections Corp, Geo Group, Communications Sales, and Annaly Capital. We like Chatham Lodging, Stag Industrial and Omega Healthcare.

Disclosure: None.