A 10% Yield That’s Getting Safer

We’ve written about Chimera Investment Corp. (NYSE: CIM) twice since my Safety Net column debuted in 2013.

Both times, the stock received an F for dividend safety.

Four years ago, when I first wrote about it, the company wasn’t making enough money to afford its dividend. To make matters worse, it was behind on its SEC filings, causing a serious lack of confidence.

In 2015, Research Analyst Kristin Orman also slapped an F rating on the company.

Though its SEC filings were then up to date, it still didn’t generate enough net interest income (NII) to afford its dividend. It also was penalized for several dividend cuts over the previous five years.

SafetyNet Pro reacts to dividend cuts like a teacher reacts to the “my dog ate my homework” excuse. Not well.

A dividend cut causes an automatic reduction in the safety rating. After all, if a company has taken the drastic step to lower its payout to shareholders, it’s likely to do so again.

In Chimera’s case, we saw six dividend cuts between 2008 and 2012.

You can see from the chart that, after Chimera stopped lowering its dividend, it stabilized for three years and then began raising it. Though, it did cut its payout once more (last June) before lifting it again.

This track record is significant. It gives us insight into management’s beliefs about the dividend and its importance.

Even if the dividend is considered sacred, there may be no choice but to slash the payout if the company isn’t generating enough cash to pay it.

That’s where things are looking up for Chimera.

Last year, it generated $586.2 million in NII. NII is the measure of cash flow for a mortgage REIT. It’s the difference between what the company earns from lending money (or investing in mortgages) and what it pays in interest expense for borrowing money to lend out or purchase investments.

Chimera’s 2016 total was down from the prior year but still well above the $454 million it paid in dividends.

This year, NII is forecast to inch higher to $592 million. So the company has plenty of room to pay and even raise its dividend again.

The company’s track record is not good. But if it can grow NII this year, it will go a long way in making shareholders feel more secure that their dividend is safe.

It’s on the right path. Another year of solid performance could lead to another upgrade.

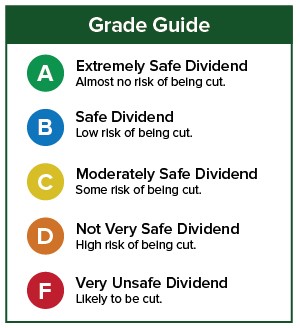

Dividend Safety Rating: D

Disclaimer: Nothing published by Wealthy Retirement should be considered ...

more