RXi Pharmaceuticals: Keeping A Large Focus On Shareholder Value Creation In 2016

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

RXi pharmaceuticals (RXII) is a biotechnology company focused on developing unmet medical needs using RNAi therapeutics. RNAi stands for RNA interference which is a new science that was co-founded by Dr. Craig Mello and Dr. Andrew Fire. They both received the Nobel Prize for discovering RNAi, a mechanism of action where genes can be silenced from expressing a protein. Dr. Mello currently serves on the scientific advisory board for RXi Pharmaceuticals. With many catalysts coming in 2016 it should prove to be a good year for the company. This means that in 2016 and beyond, RXi shares are poised to trade higher on positive catalysts stemming from the company's pipeline.

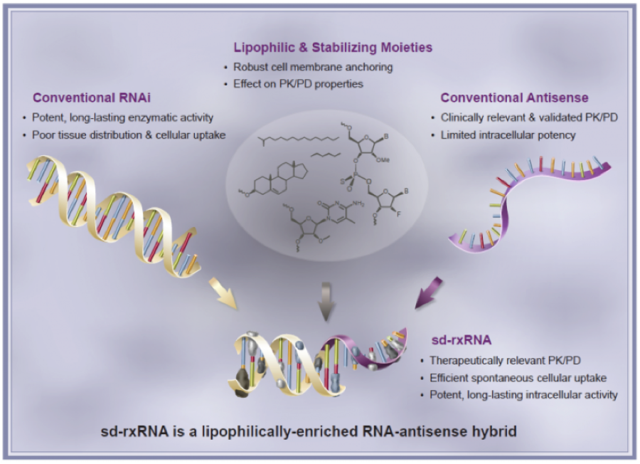

Sd-rxRNA Technology Platform Over Competitors

The biggest problem with RNAi failing to take off is that early companies were plagued with the problem of failed delivery attempts. Initially, companies tried to deliver small interfering RNA --- siRNA -- without any type of delivery vehicle. The problem was that there wasn't any sufficient delivery vehicle for RNAi to make it to the cell that it needed to silence. As the years have gone by,many RNAi biotechs have formulated delivery vehicles for their respective RNAi drugs and here they are as follows:

| Company | Delivery Vehicle |

| Alnylam | GalNAc, lipid nanoparticle |

| Arrowhead Research | Dynamic PolyConjugate |

| Arbutus Biopharma | lipid nanoparticle |

| Benitec Biopharma | DNA-directed RNAi |

| Dicerna | DsiRNA-EX-Conjugates, Encore Lipid Nanoparticles |

All these biotechs and many others have one thing in common, they have some form of a delivery vehicle needed to deliver their RNAi drugs to effectively knockdown the genes of the targeted diseases. RXi on the other hand is unique and it doesn't use a delivery vehicle at all. The name of its technological platform is sd-rxRNA or self delivering RNAi molecules.

Source: RXi Pharmaceuticals

Having the ability to send their RNAi drugs without a delivery vehicle isn't RXi's only advantage over other technologies in the same RNAi space.

There Are Two Other Advantages:

- Being both RNAi and RNA

- Being soluble enough to turn into a cream or liquid form

Having the sd-rxRNA technology platform being both RNAi and RNA means that it has a clear advantage because it takes the best parts of both sciences. This means that the disadvantages of RNAi and RNA are left out, forming a potent sd-rxRNA technology that is sufficiently strong in cellular uptake. Being soluble means being able to take the current nucleic RNAi form and change it to a cream/liquid form. This will help with RXi's pipeline products like ones for corneal scarring, and cosmeceuticals which will be described in more detail below. The key here is that the technology can be changed on a molecular level depending on the targeted indication.

Hypertrophic Scars

Scars that are small are noticeable but not in the same league as other scars known as hypertrophic scars. Hypertrophic scars are an excess of scar tissue that develop at the site of an injury to the skin or surgery performed. These types of scars affect all ethnic origins, however, they are more prevalent in people that are darker in skin such as: African Americans, Hispanics, or Asians.

The graphic above is just a glimpse of a small hypertrophic scar, because they most certainly can grow bigger depending upon the patient and incident in question.

The company incorporated its sd-rxRNA technology to allow delivery to any targeted choice without a delivery vehicle. RXi management chose scars as the first target for a couple of reasons that seem to make a lot of sense in the grand scheme of things:

- Local delivery access

- Multiple opportunities because of same clinical target

- Reduced investor risk

- CTGF scarring target already validated by another biopharma company

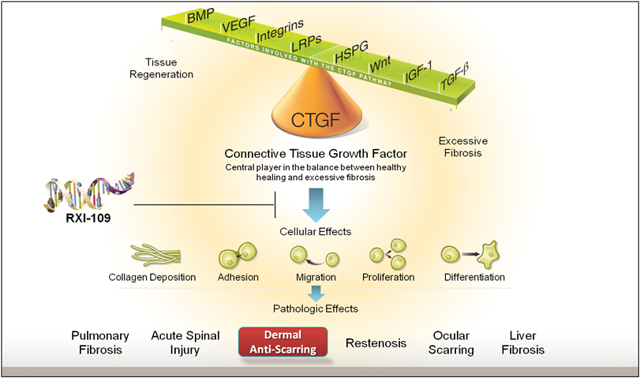

Looking at RNAi science, it is quite new, and RXi chose to go after scarring because of Connective Tissue Growth Factor -- CTGF. Being able to deliver RNAi molecules systemically into the liver and other organs requires additional clinical work. Even with this additional clinical work, there is no guarantee that the siRNA -- small interfering RNA molecule -- will always reach its intended target.

Thus, the reason why RXi chose the skin first is because the RNAi drug can be injected into the skin as a local access point. This improves the chances of clinical outcome, compared on attempting to target systemic organs. This is where reduced investor risk comes into play, because RXi management is playing it safe by targeting the outside skin first. The company is working on eventually targeting systemic targets, such as the liver, but it wants to make sure it gets local delivery right before it branches out to systemic targets.

Being able to target CTGF means opening the doors to other great opportunities. Targeting the skin means being able to go after other tissues such as: in the eye, the lung, the liver, and other targets. As can be seen in the graphic above the company can develop RXI-109 against big markets such as Pulmonary Fibrosis, Liver Fibrosis, Ocular scarring, Acute Spinal Injury, and many others. These other targets can be worth billions of dollars in market opportunity.

The final reason why RXi chose CTGF is because it was already validated previously by another biopharma company known as Excaliard Pharmaceuticals. Excaliard was an Isis Pharmaceuticals (ISIS) spinout company that had put its focus on scarring. Exaliard had achieved initial positive phase 2 findings in targeting CTGF with their RNA antisense technology. Because of the initial phase 2 scar success, Pfizer (PFE) bought Excaliard in 2011. The fact that CTGF was previously validated is another event that de-risks CTGF as a clinical target.

RXI-109 Phase 2a Results

Throughout 2015, RXi has updated investors on preliminary results on scars treated over a 3-month and 6-month time period. Both times have shown RXI-109 to be superior on control. This means that the RXI-109 phase 2 program has been validated and the share price should be trading at a higher value than its current market cap of $25 million. Below I will discuss the results and why investors should be more optimistic of clinical success in the phase 2b and phase 3 trials going forward.

In October RXi reported positive phase 2a results for its hypertrophic scar trial. This trial is known as RXI-109-1402, and it recruited 16 patients. The premise for this trial was to give patients 6 doses of RXI-109 over a 3-month period, and then evaluate efficacy compared to control. At this time, the company reported that these patients had only been given 5 doses of RXI-109 at the time of unveiling the results. Despite showing results with one less dose, the results still displayed RXI-109 as being superior to control.

There were two different scales that were used to determine if RXI-109 performed better during the trial or if the control saw better results. One of the scales used is known as the "Patient and Observer Scar Assessment Scale" -- POSAS. This POSAS scale looks at thickness, pigmentation, surface area, and other features of a scar. Investigators running the clinical trial are the ones who use this scale, and they are expert plastic surgeons that deal with scars on a daily basis. Investigators using the POSAS scale concluded that RXI-109 -treated scars performed better than the control. An example of the sheet that the investigators used can be seen here at posas.org.

The second scale used to determine if RXI-109 performed better during the trial than control is known as the Visual Analogue Scale -- VAS. This VAS scale allows investigators to rate the severity of a scar from "1" being a fine line scar, and "10" as being the worst scar possible. Once again the results were tallied and investigators determined that RXI-109 performed better than control.

There was a final panel assessment by both investigators of the trial and blinded panel members to determine if "Scar A" or Scar B" looked better. In addition there was an option of "no difference at all". The Independent blinded panel correctly identified RXI-109 -treated scars 68% of the time compared to control. The investigators correctly identified RXI-109 62% of the time compared to control. The final conclusion was that RXI-109 performed better than control. This data is important for a few reasons. It shows that RXI-109 is able to knock down the genes of CTGF, and it is able to do so in a dose-dependent manner. Secondly, the company is planning on expanding the doses up from 6 doses to 8 and 9 doses of RXI-109 in the expansion of this trial. The reason for this is to keep the scar down over the course of the entire year. This is because hypertrophic scars take approximately one year to fully grow back to their original form.

RXI-109-1402 Catalyst:

- Preliminary results for 8 and 9 doses of RXI-109 over a 6-month period in 2016; plus other possible scar readouts before 8 and 9 dose results 2016

Reduced Investor Risk With Samcyprone

Samcyprone is a topical immunomodulator gel that RXi obtained from a private pharmaceutical company known as Hapten Pharmceuticals. The mechanism of action for Samcyprone is that it is a gel that inhibits a T-cell responses against targeted diseases. I believe RXi obtained Samcyprone for three possible reasons:

- Reduce investor risk with another phase 2 asset in pipeline

- The company specializes in Dermatology so it is a good fit

- Samcyprone has already shown superior efficacy in three different indications.

The three indications Samcyprone has shown to be successful in can be seen in the table below:

| Target | Efficacy Observed |

| Warts | 80% to 85% response rates |

| Alopecia Aerata | 67% to 78% response rates |

| Cutaneous Metastases of Melanoma |

40% complete clearance, 38% partial clearance |

All three indications of Samcyprone treatment have been indicated in peer-reviewed medical journals. The company has chosen one specific target from the three indications to take to the next step of development. This past Monday, RXi announced the initiation of a phase 2 trial using Samcyprone to target warts.

RXI-SCP-1502

The trial that RXi will be conducting for Warts will be known as RXI-SCP-1502. The trial is recruiting patients who had their warts for at least four weeks. The phase 2 trial will have an initial part where patients will be given samcyprone on the skin.This is to determine whether or not the skin reacts negatively to Samcyprone treatment. If all goes well then the patient will receive treatment on their wart lesion, and then followed for a total of ten weeks. In order to determine clearance of the warts the investigators in the trial will use two measurements:

- Investigator's Global Assessment Score -- IGAS

- Wart Measurements

Since the treatment of the recruited patients is only 10 weeks the company can possibly report on preliminary results in 2016.

Samcyprone Catalyst:

- Preliminary results for Samcyprone treating patients with warts over a 10-week period to be released in 2nd half 2016

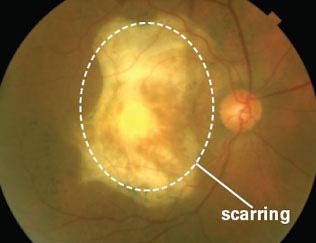

RXI-109 Advanced For Retinal Scarring As Well

RXi has recently chosen to advance its ophthalmology pipeline by advancing RXI-109 for retinal scarring. The trial, known as RXI-109-1501, will recruit patients with advanced neovascular or wet age-related macular degeneration. The trial will be a phase 1/2 trial that will use multi-doses of RXI-109 to treat these patients. Drugs like Eylea from Regeneron Pharmaceuticals (NASDAQ:REGN) and Lucentis from Roche (OTCQX:RHHBY) treat the age-related macular degeneration portion of the disease, but they do nothing for the scarring that occurs. The graphic below gives a glimpse of the scarring that can occur within the eyes of a macular degeneration patient:

RXi believes that by adding treatment with RXI-109 they can reduce the scarring of the eyes associated with the disease. This in turn could potentially improve vision. Dr. Peter Campachiaro, who is on the scientific advisory board for RXi, will be the main investigator for this trial. He has authored over 300 peer-reviewed clinical trials. In addition, his research team was largely responsible for demonstrating the importance of VEGF as a clinical target against wet age-related macular degeneration. This trial will be run at the John Hopkins Wilmer Eye Institute, which is ranked 3rd in the nation for Ophthalmology trials. Since this is a phase 1/2 trial, the duration of the trial will be very short. Treatment will only be for 4 months, which means that 2016 will bring final phase 1/2 results as a potential catalyst for RXi shares.

RXI-109-1501 Retinal Scarring Catalyst:

- Final Phase 1/2 results for RXI-109-1501 for retinal scarring treatment for a four month treatment period -- 2016

Cosmeceuticals Provide An Advantage Over Other Biotechs

RXi recently stated that it will advance two cosmeceutical products within its pipeline. These clinical products are RXI-231 which targets Tyrosinase and RXI-185 which targets Collagenase.

- RXI-231 -- target is set as a skin lightening agent -- shown to be one hundred times more potent than Kojic acid -- current skin lightening agent

- RXI-185 -- target is set as breaking down collagen -- is seen as a skin improvement molecule -- improving skin appearance

Both RXI-231 and RXI-185 provide two advantages over other biotechs:

- Faster development path

- Less expensive to complete

Cosmecueticals make no claim of a therapeutic benefit. They just have to be able to perform a specific dermatological function. Because they offer no therapeutic claim they can bypass the need for FDA approval. For example, looking at the development path between cosmeceuticals and therapeutics you can see why RXi chose the cosmeceutical path for these compounds.

Therapeutic Path >>> in vitro testing >>> in vivo testing >>> pre-clinical trials >>> Phase 1 trial >>> Phase 2 trial >>> phase 3 trial >>> New Drug Application >>> FDA approval

Cosmeceutical Path >>> in vitro testing >>> Human testing >>>marketed product

As you can see, the cosmeceutical path is quicker and less expensive for a biotechnology company to take. You will also notice that the cosmeceutical path doesn't have animal testing. That's because in the United States it is not legal for a company to perform cosmeceutical testing on animals. RXi choosing to start off in the cosmeceutical space is a good idea in that it could potentially start generating revenue at an earlier stage than would normally be possible. Both RXI-231 and RXI-185 are also indicated for therapeutic products but RXi is leaving that portion of testing to be completed by potential partners.

Right now RXi has already done its in vitro testing for its cosmeceutical product. It is in the process of creating the proper delivery system, possibly a cream/gel, that it will use to improve a person's skin appearance. It is estimated that the global cosmeceutical market could reach $61 billion by 2020. Even if RXi gets its cosmeceuticals to market and only captures 10% of the total market that is still a nice $10 billion market opportunity. This is just a target on the low end which gives a picture of the possibilities with these cosmeceutical compounds.

Partnerships On The Fly

As mentioned in the beginning, RXi's sd-rxRNA technology platform is adaptive depending on the intended target. As seen on slide 27 from the "Dawson's James Securities Growth Stock Conference" presentation slides RXi is open for business development with other pharmaceutical companies. But that is because RXi's technology has another distinction that makes it an ideal partner: It only takes four months to bring a product from the discovery stage to the IP stage when a target is known. For instance, both RXI-231 and RXI-185 took only four months to bring from a discovery product to a clinical product with an IP filing.

Financials

According to the 10-Q SEC filing RXi has cash and cash equivalents of $12 million as of September 30, 2015. The company expects that it will have enough cash to take itself all the way to Q1 of 2017. This means that RXi will have to establish a partnership in 2016 to avoid further dilutive efforts to sustain its clinical pipeline.

Risks

As with many small-cap biotechnology stocks there are a lot of risks associated with them:

- RXI-109 has yielded good results in phase 2 skin scarring but there is no guarantee that phase 3 will yield similar results

- Even upon RXI-109 being successful in phase 3 skin scarring it will have to prove to the FDA that it is efficacious enough for approval

- RXI-109 has proven to be successful in the skin, but may not yield similar efficacy in the eye for retinal scarring

- Samcyprone has shown positive preliminary efficacy in a small phase 2 study but there is no guarantee that it will show positive results in the phase 2 trial in warts

- Samcyprone may not be successful in all clinical targets currently selected

- The cosmeceutical products RXI-185 and RXI-231 may not make it to market without a proper delivery platform or positive clinical efficacy

- Even if the cosmeceuticals make it to market they will be up against many other skin enhancement products as competitors

- If RXI-109 fails to find a partner for upfront clinical milestone payments it will have to dilute shareholders to obtain further funds

- Small-cap biotechnology stocks such as RXi Pharmaceuticals are low in market cap and can easily be manipulated; therefore investors should expect wild price swings while trading RXi

- Cosmeceuticals' time to market will depend on delivery technology created and possible marketing partnership which may or many not happen in the allotted time frame

Valuation

RXi Pharmaceuticals currently trades with a market cap of $25 million. A lot of biotechnology companies with a similar pipeline trade with a market cap of $250 million to $500 million. With the potential positive catalysts coming up, RXi has the ability to gain up to $4 per share on the low end and $8 per share on the high end. The market has clearly gotten RXi all wrong, because the company has already bent over backwards to create shareholder value. It has already shown in preliminary phase 2 results that RXI-109 reduces hypertrophic scar formation. Samcyprone has also shown to work in three different indications: alopecia areata, warts, and melanoma. After all these positive developments to date RXi should not be trading with a market cap of only $25 million. This is why I believe investors have the ability to invest in a company such as RXi on the ground floor. It has a fully patented self-delivering RNAi tech platform, huge pipeline, and enormous market opportunities with its clinical targets. In addition the majority of its targets, such as skin scarring and eye scarring, are an unmet medical need. This means that there are currently no FDA approved drugs for scarring of the skin nor for scarring of the eye. If RXi receives FDA approval for both scar products, it will have no competition to go against it.

Conclusion

As the CEO mentions in the most recent press release of the Samcyprone phase 2 trial initiation:

"The company continues to deliver the building blocks to increase shareholder value as promised. We look forward to providing clinical data from all of our ongoing clinical trials over the course of 2016"

As can been seen in the above quote RXi is expected to have multiple data readouts throughout all of 2016. This provides multiple catalysts opportunities for investors looking to buy shares of a company like RXi with a good risk/reward scenario. The current share price is $0.40 per share which means the downside to 0 is limited and the upside potential is unlimited if all catalysts play out well. When the CEO Geert Cauwenbergh makes mention of building blocks in the quote above, he is talking about the value creation tool he created to improve shareholder value. Most building blocks have been achieved this past year, and now there are two fronts that are left. One is to out-license the sd-rxRNA tech to a small pharmaceutical company or create a large deal with a big regional pharmaceutical company for upfront money. If all the catalysts are positive, then the share price of RXi Pharmaceuticals should appreciate in value thereafter. The time it will take for share price appreciation to occur could happen between the first catalyst and possibly over the next twelve month period. If RXi can form a partnership with a large pharmaceutical partner then it can appreciate in share price at a quicker pace. It will also avoid having to dilute to fund its clinical pipeline.

Disclosure: Long RXi Pharmaceuticals (RXII)

$RXII has proved very disappointing, but I haven't completely given up on this stock yet.

"The current share price is $0.40 per share which means the downside to 0 is limited"

Apparently, losing 100% of your investment qualifies as a limited loss in the eyes of the author.

More risk factors:

1) RXI will be delisted from NASDAQ in May if the share price fails to get to $1.

One possible solution would be to do a reverse split.

RXI has previously done a 1-for-30 reverse split with devastating consequences for shareholders

2) If RXI is such a good investment, why has there been no insider buying since April 2015?

And the CEO is the ONLY insider making any purchases of note in the past.