American Icon Sears Run Into Ground

Sears Holdings Corporation (SHLD), the parent of Kmart and Sears, Roebuck and Co., used to be the leading home appliance retailer in North America anda retail sales leader in tools, lawn and garden, home electronics, and automotive repair and maintenance.

It's been a long-time coming, but what so many predicted has finally come to pass. Sears Holdings has declared bankruptcy, unable to make a big payment on its debt. This story is sad for students of American history and consumerism, as Sears Roebuck was an icon of the nation, so long an important part of culture and life.

As we have detailed many times over the past few years, Sears provides a cautionary tale about what can happen when a CEO more driven by ideology than sense gets free rein to implement ideas that may sound good after the reading of an Ayn Rand novel, but are, in fact, disastrous when trying to run a massive retail concern.

Eddie Lampert spent years demanding that divisions within the company compete for bonuses and resources in a sort of Darwinian experiment gone horribly wrong. It took a while, but after seven years of losses and hundreds of store closings, the firm finally collapsed under the weight of Lampert's horrible leadership.

Of course, the follies of Lampert were bad, but outside events didn't help the giant retailer either. Wal-Mart dethroned Sears decades ago as the largest retail concern in the US. More recently, Amazon.com chipped away at the once storied retailer even more. A merger with K-Mart didn't help stop the bleeding either.

Now, the sad story shows that more than 200,000 jobs are lost, shareholder losses exceed $30 billion, and the numerous employees who have already retired will most likely lose their pensions.

It stands as a cautionary tale about hedge funds and their supposed genius when it comes to running businesses in which they acquire a stake--and of course, Lampert seemed to have a knack for skimming off the cream of the crop when it came time to liquidate the company's assets.

While Lampert currently claims that Sears will be back, we aren't going to hold our breath.

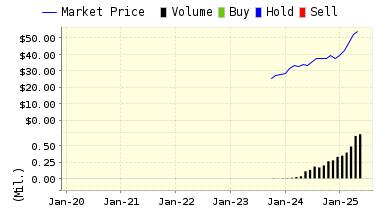

As you can see above, many data fields are no longer available due to the bankruptcy filing.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

0.41 | 0.00% |

|

3-Month |

0.41 | 0.00% |

|

6-Month |

0.41 | 0.00% |

|

1-Year |

0.41 | 0.00% |

|

2-Year |

0.41 | 0.00% |

|

3-Year |

0.41 | 0.00% |

Disclosure: None.

Sad news indeed. But it does prove that there is no institution so successful that it can't be destroyed by poor management. Very true but quite sad here.

I think it was the pension plans that killed #Sears. Newer companies like #Amazon don't have to contend with that at all. It cost Sears billions that it could have used to generate revenue. I think that more than anything else is what sealed $SHLD's fate.