After Arresting Hundreds Of Stock Traders, China Cracks Down On "Malicious" Metals Sellers Next

Five months ago, in the aftermath of its biggest market crash since 2008, China unleashed an unprecedented series of measures to stem the selling tide, none more mindblowing than its threat (which was promptly executed) to arrest "malicious short sellers" or even worse. It did just that as the following stories recount:

- China "Punishes" Hundreds For "Maliciously" Manipulating The Market

- China Arrests Three High Frequency Traders For "Destabilizing The Market And Profiting From Volatility"

- Chinese Authorities Arrest 'King Of IPOs' & 'Hedge Fund Brother No. 1'

- Partner Of "China's Carl Icahn" Executed By Local Police After Attempting Escape Following Insider Trading Charges

- "We Arrested Some Folks" - How China "Fixed" Its Stock Market

- Chinese Hedge Fund Manager Denies She Was Arrested, Was Merely "Meditating"

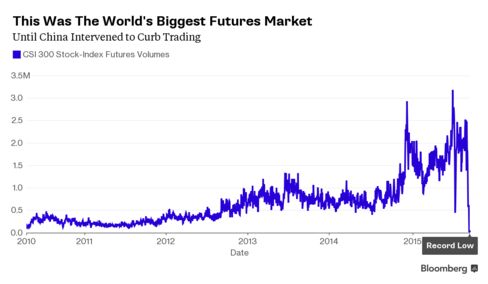

The result of all these ridiculous interventions was two-fold: China effectively killed the market, as can be seen by the following chart of volume on China's futures market, until recently the world's biggest which overnight evaporated after China made it practically impossible to trade anything...

... and as a result of the PBOC being the last standing player, the Chinese "stock market" would now trade precisely as its central planners demanded it to. Too bad nobody else will participate.

But now that China has gotten its stock "market" under control, it was time to focus on a market that is far more important to China's economy - that of commodities. After all, while several dozen million may have gotten very rich and then very poor over the summer, the implications of the Chinese stock bubble and subsequent burst were mostly contained. However, when it comes to plunging commodity prices, these have a far greater impact on both China, where fixed investment is about 50% of GDP, and as a result impact everyone, as well as the world.

And as we reported yesterday, China will soon commence "fixing" the commodity market (which has seen its worst collapse since 2008 in the past year) by engaging in what will be the first bailout of its domestic metals producers since 2009:

The state-controlled metals industry body, China Nonferrous Metals Industry Association, proposed on Monday that the government scoop up aluminum, nickel and minor metals including cobalt and indium, an official at the association and two industry sources with direct knowledge of the matter said. The request was made to the state planner, the National Development and Reform Commission (NDRC).

... while the proposal does not include copper, it is likely to revive memories of 2009, when the State Reserve Bureau (SRB) in Beijing swooped in to buy more than 700,000 tonnes of copper on the domestic and international markets. Prices were languishing at around $3,000 per tonne at the time, and the buying spree reversed the falls and ultimately helped to propel prices to record highs above $10,000 per tonne in February, 2011.

The news spread like wildfire overnight, and sent copper, aluminum, zinc, and the rest of the metals complex surging. However, the price spike will hardly last long as: "any policy support from the government and smelters subsidies to smelters or joint production cuts, will be short-lived forces and won’t change the bigger picture of a market glut. Prices may be impacted temporarily," said Qi Ding, Beijing-based analyst at Essence Securities.

So as a plan B, the same metals industry group that is reeling and understands it is one foot in the grave unless commodity prices pick up and which earlier this week demanded a government bailout, or "QEmmodity" soaking up all excess production, has doubled down and according to Bloomberg the China Nonferrous Metals Industry Association has submitted a request to Chinese regulators to probe "malicious" short-selling in domestic metal contracts amid recent price declines.

What is even more insane, is that China will do just that, in the process breaking what little is left of a domestic commodity market next.

Regulators have begun to collect some records of trading activity following a request from the China Nonferrous Metals Industry Association, according to the people, who asked not to be identified because they aren’t authorized to speak publicly on the matter. Nobody answered calls to the industry association’s general office.

Remember: it is always the "malicious" sellers who are the cause of all the world's problems, never the "malicious" buyers, especially when said buyers are the central banks themselves.

Irony aside, if indeed China does buckle under the demands of its commodity producers and unleashes what is effectively a "commodity QE" while at the same time arresting anyone who sells or shorts commodities, there is no telling what will happen to the prices of commodities which may - if only over the near term - soar to unprecedented levels, unleashing even greater excess production and capacity, which would entail that instead of merely arresting "malicious" sellers one year from now, China's politburo will have to summarily execute, on prime time TV, each and every one of them.

One thing is certain: since a market in which the government is about to set prices at whim, and where sellers will be "put away" no longer has any price discovery and is anything but a "market", China's commodity prices are about to see an unprecedented disconnect from the supply/demand constraints of reality, and even more pent up humor when this latest forced attempt to reflate a bubble finally blows up.

Copyright ©2009-2015 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time you engage ...

more