No Hashtag Needed: Twitter’s Issues Worsen

Twitter (TWTR: $36/share) went public in late 2013 touting excellent customer growth, equally impressive revenue growth, and the potential to be the “next big thing.” More recently, Twitter shares have come under pressure in the face of concerns about the company’s ability to make money. We think investors are just seeing the tip of the iceberg of the problems with Twitter. The stock has much farther to fall and earns a place in the Danger Zone this week.

Twitter derives nearly 90% of its revenues from advertisements. Twitter sells ads that promote individual tweets, accounts, or even trends that allow advertisers to increase awareness of their brand, product, or service. The company’s profits depend on maximizing monetization of users and growing its user base. The company is struggling and lags peers in both areas.

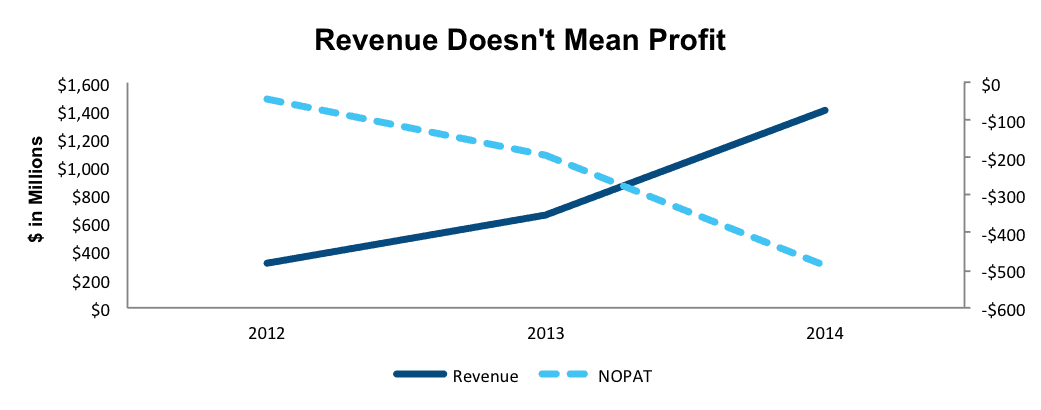

Some Growth…Yes, But Not In Profits

Twitter is similar to other Internet stocks about whom we’ve written recently: Salesforce.com (CRM), Workday (WDAY), and Box (BOX). The similarities are not positive, however. First, Twitter has failed to record any profit (accounting or other) since its IPO. Second, Twitter touts large revenue growth (upwards of 100% annually), but converts none of it to profits.

Since 2012, revenue has grown from $317 million to $1.4 billion in 2014. However, net operating profit after-tax (NOPAT) has moved in the opposite direction. Since 2012, NOPAT has fallen from -$45 million to -$490 million in 2014. This trend has continued into 2015, as NOPAT has declined even further to -$500 million on a trailing 12-month (TTM) basis.

Figure 1 shows the inverse relationship between Twitter’s revenue and profit.

Figure 1: The Opposite of Growth For Profits

Sources: New Constructs, LLC and company filings.

The biggest reason for the company’s declining profits is costs are rising as fast as revenues. In 1Q15, when revenues grew 74% year over year (YoY), cost of revenues grew 68% while sales and marketing costs grew 73%. One of the largest drivers of these increases has been stock based compensation. Stock based compensation was 6% of total expenses in 2012, 50% in 2013, and 30% in 2014. While stock based compensation was a lower percentage of expenses in 2014, it still accounted for nearly 1/3 of the company’s expenses.

As could be expected, with negative profits, Twitter has also never achieved a positive return on invested capital (ROIC). In 2012, Twitter earned a -5% ROIC, which has since fallen to -10% in 2014 and on a TTM basis.

Operating pretax margins (NOPBT) have only declined since IPO as well, from -14% in 2012 to -32% on a TTM basis.

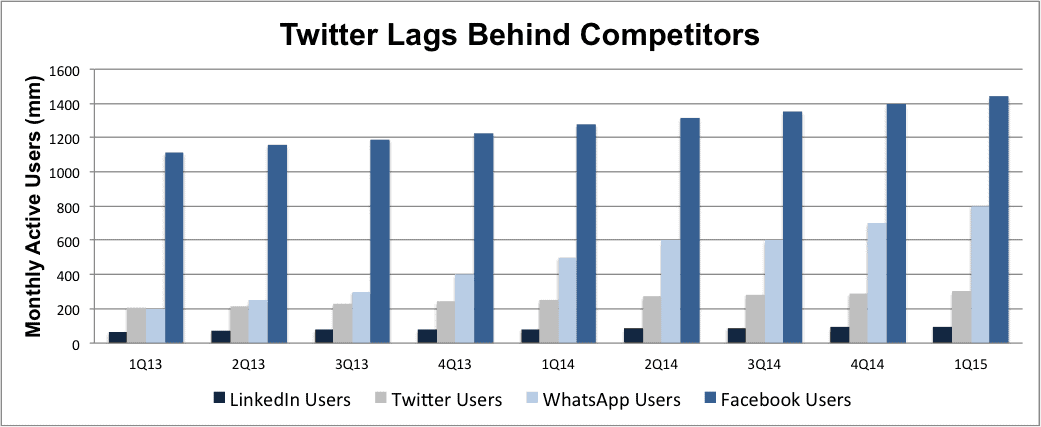

Highly Competitive Landscape Undermines Ability To Grow Users

While Twitter’s service for its users has few direct rivals, the company faces stiff competition for advertising dollars. Most notable are Facebook (FB), Google (GOOGL), and LinkedIn (LNKD). Companies wishing to buy advertising have many alternatives besides just Twitter.

Twitter’s management touts its user growth as a driving factor of its ability to succeed. However, with only 302 million monthly average users (MAU) at the end of 1Q15, Twitter ranks below Facebook and even messaging company WhatsApp. It does not appear that Twitter’s user base will catch up with its competitors anytime soon either as the rate of user growth has been declining since 2Q12. Management has already stated that new user additions have been disappointing to begin 2Q15.

Figure 2 shows how Twitter’s monthly active user base stacks up to competitors.

Figure 2: User Growth Lags

Sources: New Constructs, LLC and company filings.

As you can see, since 1Q13, Facebook has added over 300 million users and WhatsApp has added around 600 million users. In contrast, Twitter has grown its user base by only 100 million over this timeframe, surpassing only LinkedIn, another company struggling to monetize its user base.

Business Model Flaw: What Is Good For Users Is Not Good For Investors

Twitter’s business model has a large, overlooked flaw. The best interests of the users (i.e. quick, easy access to the content of their choosing) are not aligned with the best interests of advertisers (i.e. getting more attention of users not necessarily looking for them). This conflict makes me wonder how successful Twitter’s business can be. If Twitter shows more ads, it risks putting off users and seeing user growth falter. If Twitter does not give advertisers more access to its users, its profits will continue to struggle.

There are other inherent problems as well. Advertising clients can now choose to pay only for clicks on ads or actual sign-ups instead of just impressions. This change contributed to the company lowering its expected 2015 revenue.

Bull Case?

Much of the bull case behind Twitter is built around the belief that it will begin to monetize not only its existing user base but also the services it has acquired, including Vine and Periscope. These two video sharing apps are different from one another in functionality but are both believed to bring additional revenue streams to Twitter. This strategy may be possible, but revenue has never been an issue with Twitter: it is profits that have been elusive. Twitter management has given no reason to believe in their ability to monetize these new avenues either. Twitter had no plans to monetize Vine when asked in October 2014. Even worse, since acquiring Vine in 2012, monthly average user percentage growth has significantly declined from 10% per quarter to 5% in 1Q15.

Stupid Money (Buyout) Risk

Twitter operates in the most fast-paced area of the Tech sector and acquisitions are always a possibility. However, Twitter has always been on the purchasing side of acquisitions, buying other startups and small technology firms. We believe the chances of Twitter being acquired are low. First, with its large market cap of $24 billion, very few companies can afford it. Second, the company’s business model challenges and utter lack of profits suggest that waiting for the price to drop or the business model to prove itself worthy of the current valuation are more likely strategies for any potential suitors in the short to medium term.

Adjustments to Twitter’s Income Statement

While Twitter’s net income showed a narrowing loss in 2014, our NOPAT calculation shows that Twitter’s operating loss actually grew. The company depressed 2013 earnings by burying $406 million of unusual charges in its earnings, which, in turn, set up a (false) positive comparison for 2014 earnings. These unusual charges came from stock based compensation expenses related to Pre-2013 restricted stock units vesting upon IPO.

Without these unusual charges in 2013, the company’s losses would have increased, instead of decreasing, in 2014.

Valuation is Outrageous

Simply put, Twitter is grossly overvalued. To justify its current price of $37/share, the company must raise its pretax (NOPBT) margin from -32% to +5% (similar to LinkedIn and Yelp) and grow revenue at 29% per year for the next 17 years. In this scenario, Twitter would then be generating over $106 billion in revenue, more than Google, Facebook, and LinkedIn combined.

To put the current valuation into even more understandable terms, it helps to look at the current revenue per user. Twitter currently generates $1.29 per monthly active user.

Even if Twitter were to achieve the $106 billion in revenue as implied by the above DCF scenario, the company would require 82 billion monthly active users at $1.29 per user. Assuming Twitter were able to significantly increase its average revenue per user to $20 (despite Facebook earning just $8.30/user in the U.S. and Canada in 1Q15), the company would still need 5.3 billion users to generate the revenue required in the DCF scenario above.

Much like our analysis on Netflix showed, there simply aren’t enough people on Earth to support the growth expectation embedded into Twitter’s stock price. If we give Twitter credit for 10% NOPBT margins (above LNKD and YELP, but below FB), and 20% revenue growth for the next decade, the stock is only worth $14/share today –– a 62% downside from current levels.

The Ride Stops Here

The biggest potential catalyst for Twitter is another earnings miss. After 1Q15, the stock dropped over 20% on fears that the company is not monetizing its user base and that its user base is not growing nearly as fast as expected. After concerns about lowered guidance, investors fled in large numbers. Anything less than expected results could drop Twitter’s stock even further. With that said, there are times when the market simply ignores profits (i.e. Netflix, Salesforce, etc.) and Twitter may trade on nothing but momentum for the foreseeable future.

Short Interest

Short interest stands at 22.8 million shares, or just over 4% of shares outstanding.

Heavy Insider Selling, Not Much Buying

In the past 12 months, insiders have bought 3.8 million shares and sold 22 million shares, for a net of 18 million shares sold. This represents ~3% of shares outstanding.

Executive Compensation Not Based On Profits

Executives were paid $113 million in 2014, 99% of which was in the form of equity. Twitter’s compensation committee believes that keeping cash salaries and cash performance bonuses low is a good way to conserve cash. In addition, the compensation committee believes awarding equity rewards tied to the stock price motivates the executive team to focus on growing the business by aligning with the interests of shareholders. These stock awards are not given based on any specific formula but rather by a process under the discretion of the compensation committee that involves examining the expected stock price and projecting a value similar to competitors’ compensation.

Dangerous Funds That Hold TWTR

The following ETFs and mutual funds allocate significantly to TWTR and earn our Dangerous or Very Dangerous ratings.

- Berkshire Focus Fund (BFOCX) — 7.0% allocation to TWTR and Very Dangerous rating

- Transamerica Growth Opportunities (ITSAX) — 4.9% allocation to TWTR and Very Dangerous rating

- Morgan Stanley Institutional Fund Trust: Mid Cap Growth Portfolio (MMCGX) — 4.8% allocation to TWTR and Dangerous rating

Click here to download a PDF of this report.

Photo Credit: mkhmarketing (Flickr)

Disclosure: New Constructs staff receive no compensation to write about any specific stock, sector, or theme.

Nice post. I think the problem with Twitter is that everyone is talking, but few are listening. And it's very hard to have a decent conversation when limited to 140 characters.

Great article. I've been saying Twitter is overrated for years.

StockTwits' Howard Lindzon just shared some interesting charts about Twitter...

Searches for "Twitter" on Google, over time: twitter.com/.../1

Vs. StockTwits:

https://www.google.com/trends/explore#q=stocktwits

I saw that chart and originally wrote it off as Twitter's improved brand recognition. But after reading Mr. Trainer's article I'm not so sure. Perhaps Twitter is simply a fad to be replaced by something better. Akin to how Facebook completely supplanted MySpace.

This article was a huge "eye-opener" for me. Thank you.