It's A Numbers Game: Take Colgate Over Procter And Kimberly Clark

Securities Analysis by Graham and Dodd remains one of my all-time favorite investment books. While I have long given up on the “find a stock trading below book value and wait for the market to catch-up” strategy, I remain a fan of the book’s central idea that an investor can ascertain a great deal of information by tearing apart the company’s financials. “It’s a numbers game” columns are devoted to primarily using financial statements as a way to discern between competing companies.

According to dividend.com, the list of dividend aristocrats (stocks that have raised their dividend at least 25 consecutive years) includes the following three consumer product companies: Kimberly Clark (KMB), Procter & Gamble (PG), and Colgate Palmolive (CL). This column assumes that an individual investor can only buy one of them and wants to determine which one is the best buy.

Ultimately, this is about growth and efficiency: which company is growing the fastest (or, more precisely, shrinking the least) while also having higher average margins. We also want to know about interest payments as they relate to operating income. In an rising interest rate environment, we want the lowest ratio because that company will be least impacted when they refund their debt. Finally, there's the all-important payout ratio, dividend yield and price performance.

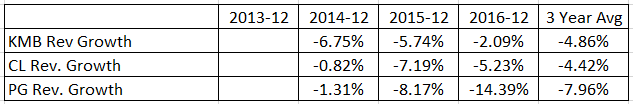

Let's start with revenue growth (data from Morningstar.com; author's calculations):

First, note that all of them are losing revenue. This is largely the result of the "Amazon (NASDAQ: AMZN) effect" that is hitting all companies in the retail sector right now. However, Colgate Palmolive is losing the least.

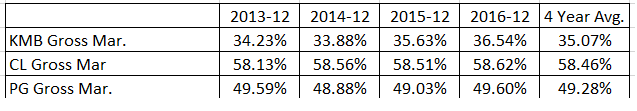

Next up are the gross margins:

There is no comparison here; Colgate has -- by far -- the best gross margin by slightly over 9%.

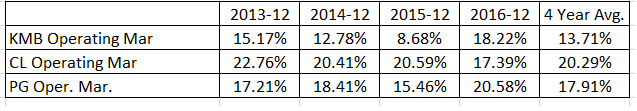

Next, let's turn to the operating margin:

Colgate beats the competition, but by a smaller margin: 2.38%.

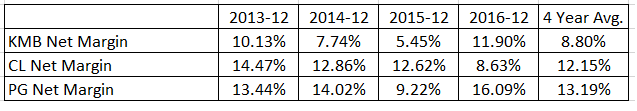

Finally, there's the net margin:

P&G has a slightly better average net margin.

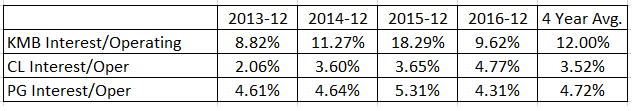

Which company is least susceptible to rising interest rates?

That would be Colgate, which has the lowest 4-year average.

Next up is information from the cash flow statement. Here, what we really want to know is who has the lowest payout ratio because lower payout means the company has more room to increase their dividends. I'm going to use the data from the Finviz.com website which has the following payout ratios:

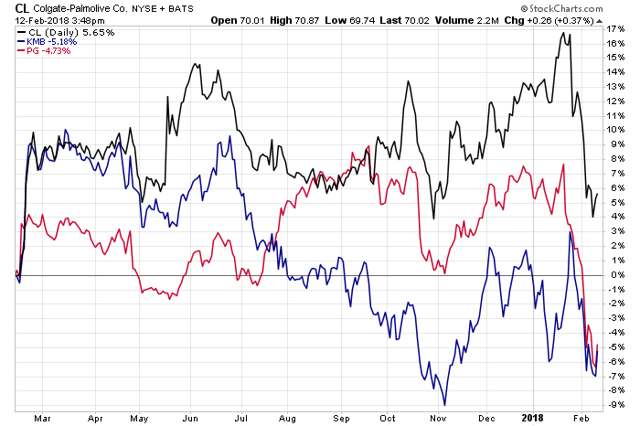

Despite having the lower payout, CL also has the lowest yield, which is 2.29%. In contrast, PG's is 3.45% and KMB's is 3.59%. However, Colgate stock has performed better over the last year:

What you would have lost in dividend income, you would have made up for in capital gain.

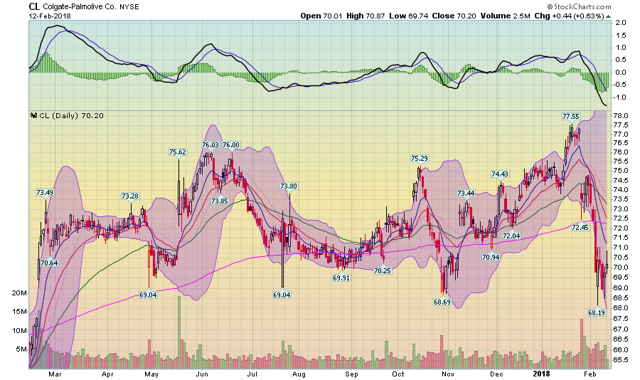

Finally, Colgate's chart is attractive from a technical perspective:

After last week's sell-off, the stock is near a 52-week low. It looks like it wants to form a bottom at current levels.

I profiled KMB earlier this year and wrote a favorable review. There, I argued that the recent cost-cutting initiative would bear fruit. But, if you're limiting your dividend aristocrat risk by only investing in one consumer product stock, make it Colgate. They have better margins, a lower dividend-payout rate and better 1-year stock performance.

Disclosure: I am long PG, CL, KMB.

This post is not an offer to buy or sell this security. It is also not specific investment advice for a recommendation for any specific person. ...

more