Wednesday, August 9, 2017 6:43 AM EDT

The Japanese Yen and the Swiss Franc outperformed as sentiment soured across financial markets in Asian trade, boosting standby anti-risk assets. Investors seemed to be spooked by the threat of military action on the Korean peninsula following fiery comments US President Donald Trump.

Commodity bloc currencies are typically sensitive to swings in market mood and proved to be so against, with the Australian Dollar leading the way lower having been stung by disappointing consumer confidence data. The New Zealand Dollar held up best as traders look ahead to the RBNZ rate decision.

Looking ahead, another quiet day on the economic data front looks likely to keep risk trends at the forefront. European shares have picked up on the negative lead coming out of Asia and S&P 500 futures are pointing decidedly lower, arguing for continued risk aversion when Wall Street comes online.

On balance, this points to continuation of overnight trends. However, just as yesterday’s absence of top-tier news flow opened the door for today’s headline-inspired volatility (as suspected), so too the lull today may pave the way for a swift reversal if cooler heads appear to be prevailing.

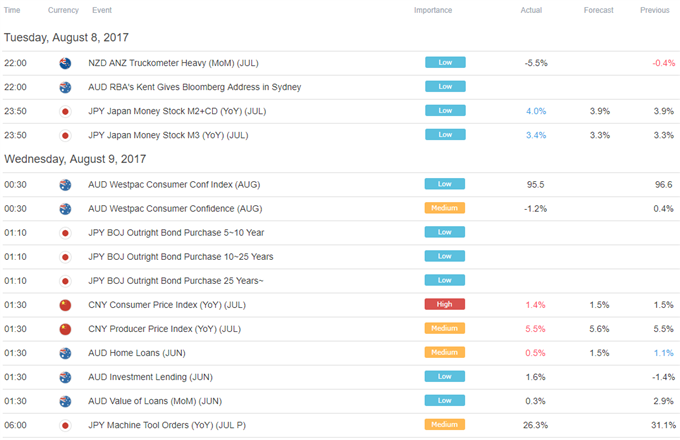

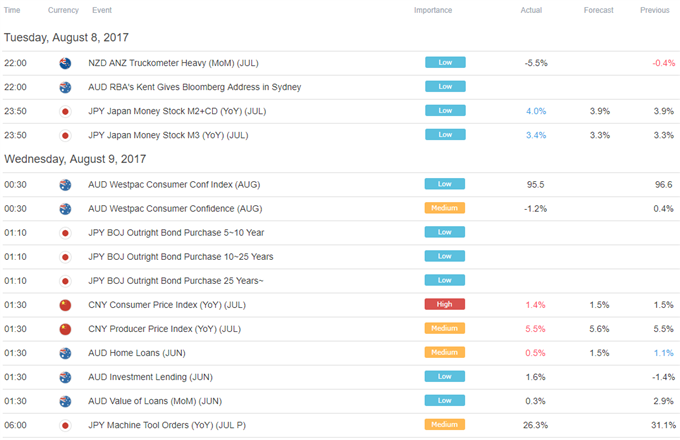

Asia Session

European Session

No data.

** All times listed in GMT. See the full DailyFX economic calendar here.

Disclaimer: DailyFX, the free news and research website of leading forex and CFD broker FXCM, delivers up-to-date analysis of the ...

more

Disclaimer: DailyFX, the free news and research website of leading forex and CFD broker FXCM, delivers up-to-date analysis of the fundamental and technical influences driving the currency and commodity markets. With nine internationally-based analysts publishing over 30 articles and producing 5 video news updates daily, DailyFX offers in-depth coverage of price action, predictions of likely market moves, and exhaustive interpretations of salient economic and political developments. DailyFX is also home to one of the most powerful economic calendars available on the web, complete with advanced sorting capabilities, detailed descriptions of upcoming events on the economic docket, and projections of how economic report data will impact the markets. Combined with the free charts and live rate updates featured on DailyFX, the DailyFX economic calendar is an invaluable resource for traders who heavily rely on the news for their trading strategies. Additionally, DailyFX serves as a portal to one the most vibrant online discussion forums in the forex trading community. Avoiding market noise and the irrelevant personal commentary that plague many forex blogs and forums, the DailyFX Forum has established a reputation as being a place where real traders go to talk about serious trading.

Any opinions, news, research, analyses, prices, or other information contained on dailyfx.com are provided as general market commentary, and does not constitute investment advice. Dailyfx will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

less

How did you like this article? Let us know so we can better customize your reading experience.