Wednesday, June 21, 2017 5:33 AM EDT

The Japanese Yen outperformed as stocks declined in Asian trade, boosting the standby anti-risk currency. The sentiment-linked Australian and New Zealand Dollars duly tracked lower. Energy names appeared to lead the selloff, which the news-wires linked to yesterday’s sharp drop in crude oil prices.

Looking ahead, a dull offering of European and US economic data may allow for risk appetite trends to remain at the forefront. Futures tracking the benchmark S&P 500 index are pointing lower, hinting that overnight trends may carry forward amid continued risk aversion.

The re-opening of the UK Parliament will be marked by the unveiling of the new government’s legislative agenda. This will be aimed to show how the now-minority Conservative government of Prime Minister Theresa May and its allies at the DUP intend to proceed with Brexit.

The two parties agree on relatively little save for the need to enforce the outcome of last year’s EU membership referendum. For its part, the DUP favors a “softer” divorce but takes a harder line on social issues. The Tories are less conciliatory on the former but more easy-going on the latter.

How these divisions will shape governance in the months ahead will help define investors’ appraisal of GBP-denominated assets. An agenda that compromises away key aspects of either group’s core philosophy may be seen as in inherently unstable, sending the British Pound lower.

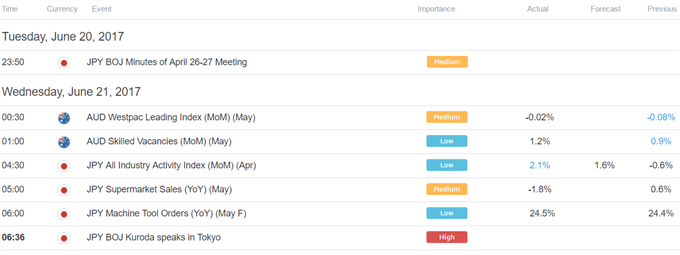

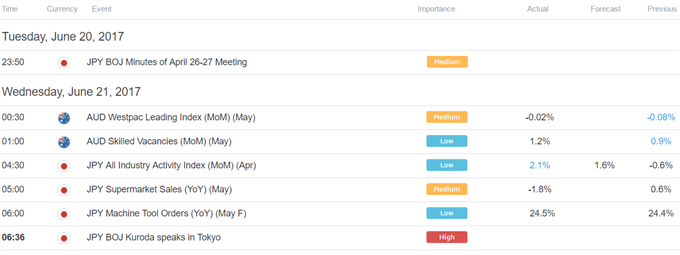

Asia Session

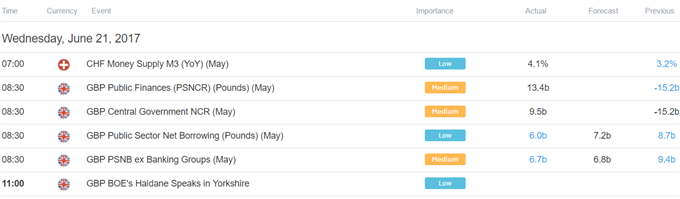

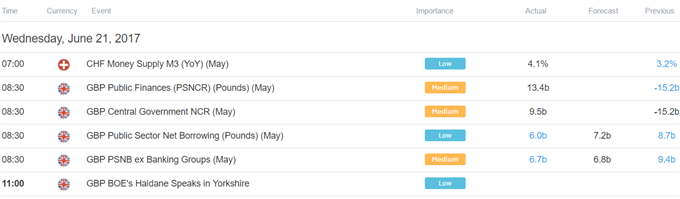

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

Disclaimer: DailyFX, the free news and research website of leading forex and CFD broker FXCM, delivers up-to-date analysis of the ...

more

Disclaimer: DailyFX, the free news and research website of leading forex and CFD broker FXCM, delivers up-to-date analysis of the fundamental and technical influences driving the currency and commodity markets. With nine internationally-based analysts publishing over 30 articles and producing 5 video news updates daily, DailyFX offers in-depth coverage of price action, predictions of likely market moves, and exhaustive interpretations of salient economic and political developments. DailyFX is also home to one of the most powerful economic calendars available on the web, complete with advanced sorting capabilities, detailed descriptions of upcoming events on the economic docket, and projections of how economic report data will impact the markets. Combined with the free charts and live rate updates featured on DailyFX, the DailyFX economic calendar is an invaluable resource for traders who heavily rely on the news for their trading strategies. Additionally, DailyFX serves as a portal to one the most vibrant online discussion forums in the forex trading community. Avoiding market noise and the irrelevant personal commentary that plague many forex blogs and forums, the DailyFX Forum has established a reputation as being a place where real traders go to talk about serious trading.

Any opinions, news, research, analyses, prices, or other information contained on dailyfx.com are provided as general market commentary, and does not constitute investment advice. Dailyfx will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

less

How did you like this article? Let us know so we can better customize your reading experience.

thanks