With Commodity Prices Falling, Can Entrepreneurship Stimulate Growth In South American Economies?

South America is one of the richest continents in commodity deposits. Commodities have been at the center of most of the member states’ economic growths over the last decade or so with exports to China and the US helping to improve the BOPs (balance of payments).

However, commodity prices have plunged over the last few years, and this has led to a widening of the gap between exports and imports thereby resulting to negative balances in BOPs. South America is one of leading suppliers of Oil, Sugar, Copper, Cereals and other metals. Among the leading exporters, Chile only comes second to Brazil and supplies 100% of Sodium nitrate as well as 85% of Copper exports from south America.

However, the whole region has been facing economic slowdown over the last few years following the decline in commodity prices. Nonetheless, per recent developments, it looks as if south America has found an alternative to augment its sensitivity to commodity prices. South America ranks within the category of emerging economies, with Brazil being a member of BRIC countries. Chile and Argentina too, are not far. Specifically, entrepreneurship in Chile has put the western coast country on the map amongst the most conducive environments for innovation.

However, with elections looming in about half of all the south American countries—including Chile—things could slow down momentarily as investors wait for the dust to settle. The entrepreneurial spirit in south America has been rising over the last few years, with notable innovative products emerging from Brazil, Chile and Argentina. Nonetheless, the overall GDP of the region fell sharply last year with a decline in commodity prices affecting exports significantly.

Brazil is South America’s largest exporter followed by Chile and Argentina. In 2015, Brazil had exports of $191.1 billion down 25.3% from 2014 while exports stood at $63.4 billion in the same year down 17.3% from 2014. Argentina, on the other hand, which caps the top three exporters from the region experienced a decline in exports of 16.9% from 2014-2015.

The trend is even worse when assessed on a four-year span from 2011. Guyana, Uruguay and Paraguay were the only countries to grow their international trade in South America between 2011 and 2015, but these contribute too little to the overall exports from the region as demonstrated in the table below.

Paraguay and Uruguay exports represent 1.8% and 1.7% of the overall exports from south America, respectively while Guyana’s exports only accounted for 0.3% in 2015.

Now, with elections taking place in the coming year, the risk of doing business in south America will rise. Investors will also be watching the commodity prices closely to see how they could affect potential investments in the region.

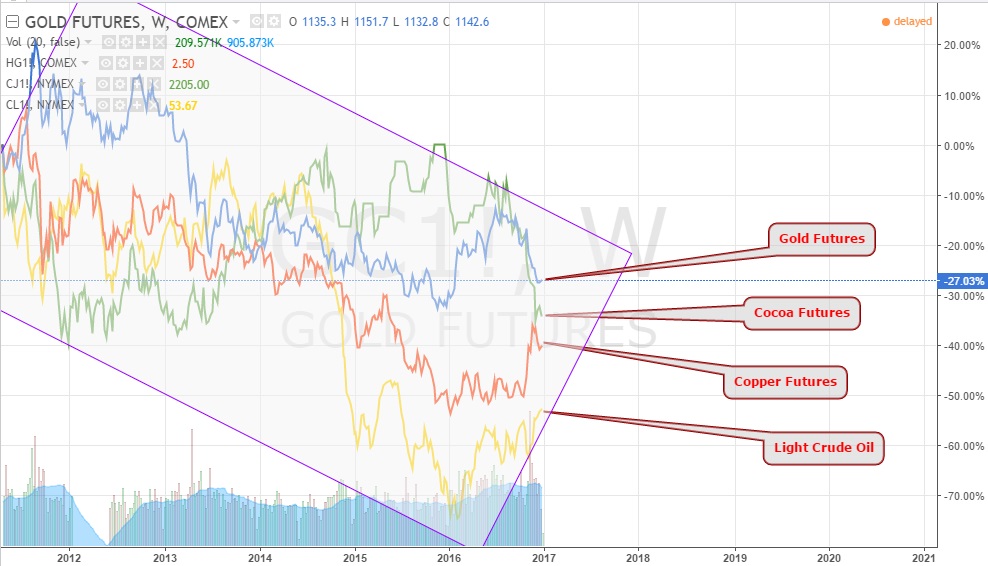

Based on the current price trends, it looks as if 2017 will be yet another unfriendly year for commodity prices. Most commodities are priced in USD terms and following the recent interest rate hike, there is a likelihood that commodity prices could fall further in the coming year.

The prices of Gold, Copper, and even the agricultural commodities like Cocoa appears to have taken a dive since the announcement of the rate hike. Light Crude oil, on the other hand, appears to be trending upwards as of late December, but given the volatility of oil prices, it wouldn’t be a surprise they came tumbling down again in early 2017.

(Click on image to enlarge)

South America as a region is classified under the emerging markets. One of the main characteristics of the emerging markets is the rise of innovation and entrepreneurship. These, per the World Bank and IMF, are key to bridging the gap between emerging economies and developed economies.

These countries are moving from the level of raw material exporters to the level of packaged products manufacturers. As such, while the commodity prices continue to fall coupled with the upcoming presidential elections in most of the countries, it looks as though South America might have found a way to leverage the overreliance on commodity exports.

Conclusion

In summary, South American economies have slowed over the last few years after the commodities boom of 2006-2011. Over the last four years, most countries in South America have experienced declines in exports, which in turn have led to lower GDPs.

However, with new opportunities in entrepreneurship and innovation opening, more jobs will be created thereby leading to increased output.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor ...

more