When It Comes To Setting Monetary Policy Europe And The United States Go Their Separate Ways

If we live in an interdependent world, one would never know this by comparing monetary policy among the developed countries. A U.S. –EU comparison of interest rates paints a picture of two continents pursuing quite divergent monetary policies.[1] The ECB continues full steam ahead with its bond buying program, while the Fed is signaling that the pace of rate hikes should pick up in 2017. What makes the European situation worthy of note is that, although inflation is picking up, the bond market continues to signal that deflationary forces are still influencing the future course of rates.

Europe has escaped, for the time being, the deflationary trap that dominated policy making for more than three years. As Chart 1 reveals, Eurozone countries have pulled out of deflation. Some of the larger nations, such as Germany and France, are now recording annualized price increases around 1.5 per cent, while Spain and Belgium are nearer the 3 per cent mark.

Chart 1

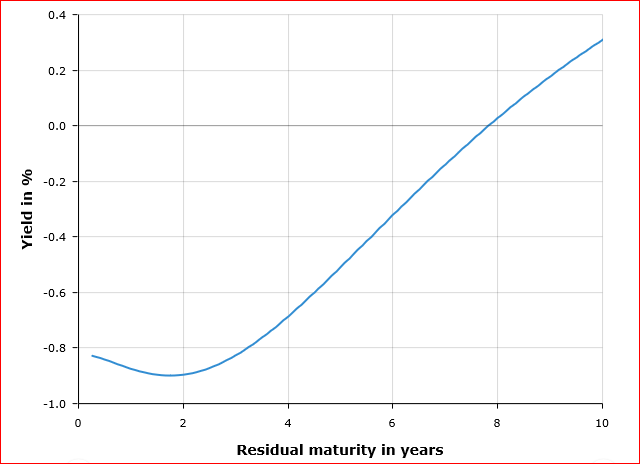

If Europe is returning to some form of `normal` inflation rates, then someone should tell European bond holders about the change in circumstances. Germany`s 2 year bond yield---the bond most sensitive to inflation--- just fell to a record low of - 0.95 per cent. Moreover, the yield curve for AAA bonds in Europe remains in negative territory well into the belly of the curve (see Chart 2). But what are more revealing are the continued negative yields in the face of a turnaround in the inflation performance. One would expect the most recent inflation results to influence bond yields over the 2- to 5 -year range.

With the presidential elections scheduled for late April in France and for September in Germany, there is considerable worry about the far-right parties gaining ground and, no doubt, some of the rush into short-term bonds reflects safe haven buying. But there is more to this than just fear of the political future. These bond holders are far from convinced that inflation has returned or that its return is sustainable over the medium term.

Chart 2 German 2 Year Bond Yield, Feb 23, 2017

The spread between the German and U.S. 2- year bond rate now exceeds 300 bps, a level not seen prior to 1999 when the Euro came into effect. With the Euro/USD exchange holding quite steady, the question remains how long can this spread be maintained? If the exchange rate risk is minimized, then one would expect money to flow out of Europe and into the United States and thus narrow the gap.

The euro area monetary policy continues to be highly accommodative, aiming to promote inflation towards the ECB’s definition of price stability. After all, it has been less than a year since the continent was mired in deflation. Much more evidence is needed to provide comfort that the worse is over in the fight against deflation. ECB officials argue that the euro area is still recovering from a double dip recession. Moreover, they believe that the Eurozone will continue to experienced prolonged years of low inflation and low growth. There is no urgency to raise rates or tighten monetary conditions. [2]

Yet, the interest rate spreads are significantly wide for the moment. Since rates do have boundaries and spreads ultimately converge, the big question concerns which set of rates will move first so as to begin narrowing. With the Fed quite committed to maintaining its interest rate policy, the burden of adjustment will mostly fall to the ECB to become less accommodative. The timing of that policy shift is very unclear at this time.

[1] For a comparison of the U.S. and Canadian policies, see Canada And The United States: Neighbors With Divergent Monetary Policies.

[2] Speech by Yves Mersch, Member of the Executive Board of the ECB, Harvard University, 12 October 2016