USD/CAD Constructive Above 1.3070 Ahead Of Canada Retail Sales

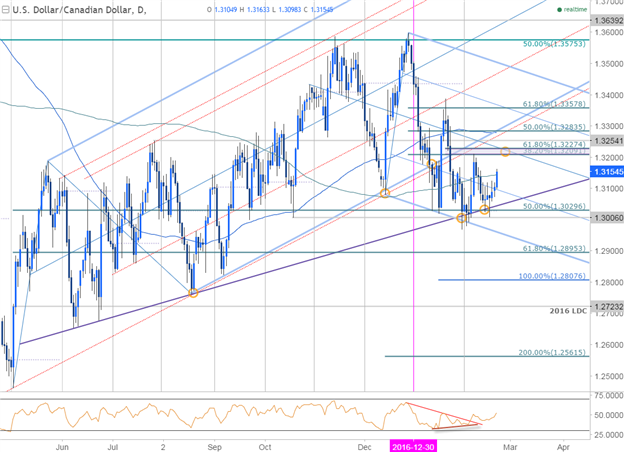

USD/CAD Daily

Technical Outlook: USD/CAD responded yet again to the June trendline support last week (5th time) with the rebound now eyeing near-term resistance targets. This trendline converges on the 2/16 reversal-day close at 1.3071 and keeps the near-term focus higher while above this confluence region. Key near-term resistance is seen just higher into the 1.32-handle.

USD/CAD 120min

Technical Outlook: A closer look at price action has the pair trading within the confines of a near-term ascending pitchfork formation with the lower parallel highlighting support at 1.3074- this region also converges on the weekly opening-range low & former trendline resistance extending off the December high and will serve as our near-term bullish invalidation level. Initial support is eyed at the weekly open at 1.3095.

Interim resistance now being tested at the 61.8% extension of the advance off the lows at 1.3160 with a breach here targeting topside objectives at 1.3209 & the 61.8% retracement at 1.3227. Watch crude here as prices test critical resistance with the rally vulnerable sub-55. From a trading standpoint, I’ll favor fading weakness while above the lower parallel targeting the median-line. Keep in mind we have Canada retail sales data on tap tomorrow morning and is likely to fuel added volatility in the CAD crosses.

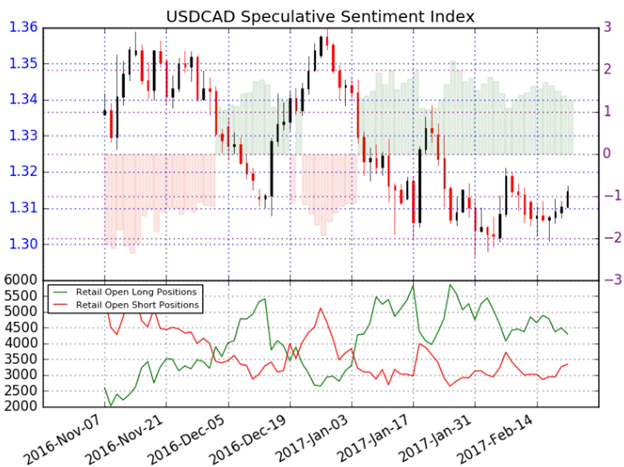

- A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net-long USDCAD- the ratio stands at +1.29 (56% of traders are long)- weak bearish reading

- Long positions are 2.5% lower than yesterday and 18.5% below levels seen last week

- Short positions are 6.8% higher than yesterday and 12.0% above levels seen last week

- Open interest is 1.3% higher than yesterday but still 3.8% below its monthly average

- While the current SSI profile continues to point lower, it’s worth noting that the recent narrowing in the ratio (increase in short exposure / decrease in long positioning) on building open interest shows the retail crowd attempting to fade this rally and further highlight the risk for a push higher. Look for this dynamic to mature in the coming days with a flip to net-short needed to suggest that a more meaningful low is in place.

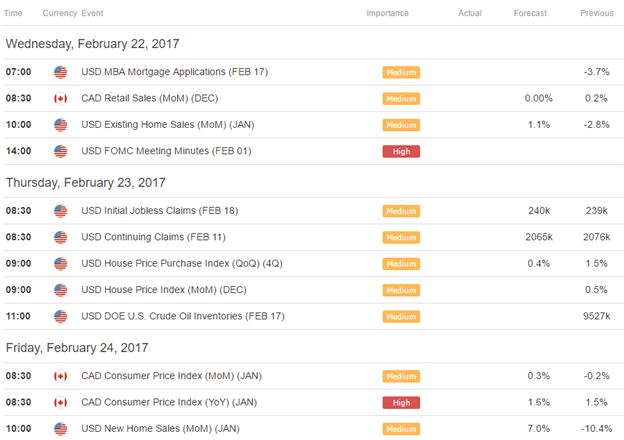

Relevant Data Releases