This Rare Metal Skyrocketed 120% Last Year

The demand for rechargeable lithium-ion batteries is going to be a driving force for miners in the years ahead.

These batteries power everything from electric vehicles to cellphones, and they need lots of lithium.

While lithium levels may currently be low, the metal is far from rare. However, there is a much rarer metal that is threatening to hold up production and drive up costs: cobalt.

Primary cobalt deposits are rare. Only 2% of cobalt is the result of direct mining. And Global Energy Metals predicts that the demand for cobalt will increase 30% from 2016 to 2020.

The Democratic Republic of Congo is home to over half of the world’s supply of cobalt … and it’s a country more notable for its human-rights violations and political instability. These issues are forcing miners and manufactures to look elsewhere for their source of cobalt.

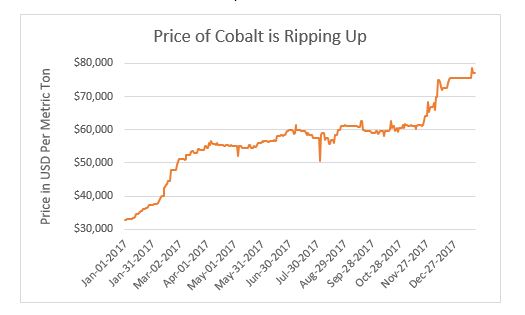

Production isn’t expected to meet the demand for the next two years. We have already seen the price of cobalt more than double in the last year. Take a look at the chart below:

The Time for Cobalt Stocks Is Now

The rocketing price of cobalt has caught the eyes of Canadian miners. The nation happens to have one of the world’s largest caches of cobalt under their feet. Junior miners are racing to get land rights and stake out cobalt deposits.

The trend in climbing cobalt prices is likely to continue. If you haven’t staked your claim in a cobalt stock yet, now is the time to do it.

Potential 10 baggers can be found throughout the natural resource sector. Just look at Magnis Resources, which shot up 1,080% after a massive graphite discovery … Pilbara Minerals, which ...

more

I was very bullish on #cobalt and #lithium over the last last year but I believe the rally in these metals is over done. With such high prices mining companies have ramped up production and on the demand side the amount of electric cars is still to few to soak up that additional production. Not to mention new advancements in technology have been aimed to reduce the amount of cobalt necessary per battery. Think we will see a sharp correction in these metals soon but I also believe there is huge long term potential.