The Problem With Democracy

Traditional Markets

The morning's shocker headlines today are coming out of the UK as...

Just look at this chart of RBS stock since the Government bought those shares in October of 2008...

At least they didn't buy the top, right?

Governments aren't like businesses. With different political parties and divides between branches, it must be very difficult to come to any sort of decisions. Of course, in the event of a crisis, it's probably a lot easier to pull the trigger.

Still, if they've been holding on to the shares for this long, it's perplexing to try and understand why they would sell now and realize this massive loss for the taxpayer? Or, why they would dump 7.7% of a bank's outstanding shares?

The UK Chancellor, Phillip Hammond, argued that public ownership was a drag on the bank. In this chart here, we can see the drag that this massive sell order had on the price of RBS. Buy the dip?

What about Banks?

Banks, on the other hand, are very good at making money and central banks are no exception.

The ECB is now printing approximately €30 billion per month in order to buy bonds and other assets as part of their Quantitative Easing program.

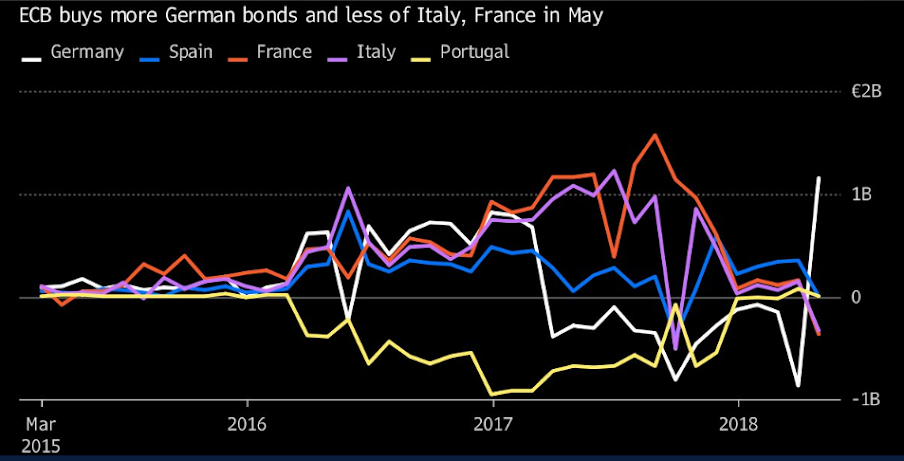

A quick analysis of the asset purchases of the European Central Bank (ECB) in May has a rather stunning revelation. Here's a graph that shows, how they are reducing their exposure to Italy and Spain and increasing their German holdings.

Of course, they say that this has nothing to do with the current political situation or the recent Italian bond market blowout....\

If you notice that there's one major country that's missing here, you might be Greek. Funnily enough, the Quantitative Easing never really covered the country that needs the most support.

Let's have an awesome day!

Just in case you ever felt like sending someone money for playing a video game, you can now do ...

more