The Euro Area Economy May Have Entered A Goldilocks Phase Of Stable Growth And Low Inflation

“After a decade of struggles, the eurozone is an island of relative stability in a turbulent sea…The eurozone owes its ostensible immunity from financial-market gyrations to major improvements in the peripheral economies’ fundamentals: growth has picked up, and unemployment, though still high, is declining rapidly.” (Daniel Gros, Project Syndicate, Feb. 13, 2017)

The 19-nation euro-zone bloc has been enjoying its strongest economic expansion in a decade and there is a growing consensus that the zone is heading into a golden period of stable growth and low inflation.

Indeed, in many respects, the economic turnaround in the euro area has been quite striking considering the problems encountered due to the global Great Recession of 2007-08 and the European financial crisis of 2011 and 2012.

At this time the eurozone seems to be locked in a rather benign credit cycle where all is quite calm. That is, both banks and governments can finance their activities at extremely low-interest rates, credit availability has improved, and there has been increases in government revenues even for the southern tier of countries which were recently under financial stress.

Indeed, more than four years into the current expansion, most indicators signal the euro-zone economic recovery is well grounded. In other words, absent an unexpected shock, we should see several more years of stable euro area economic growth.

The remainder of this comment will focus on three indicators (unemployment, GDP growth, and credit availability) which provide support for the Goldilocks thesis.

For example, the unemployment rate in the euro area was 8.7% in December of 2017, nearly a full percentage point lower than a year earlier. As the chart indicates, the unemployment rate in the euro area reached an all-time high of 12.1% in February of 2013. The lowest unemployment rate in the zone was 7.3% in November of 2007, just prior to the Global Recession.

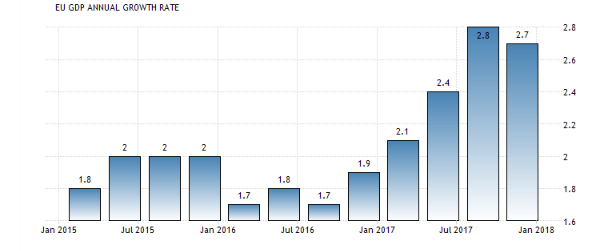

A similar positive story emerges when one reviews the recent expansion in euro area economic growth.

Eurozone GDP increased steadily last year and reached a 2.7% (y/y) pace in the fourth quarter, only slightly below 2.8% growth rate in the previous quarter.

In all 2017 GDP growth was a healthy 2.5% rate, certainly in line, if not ahead of most other advanced economies.

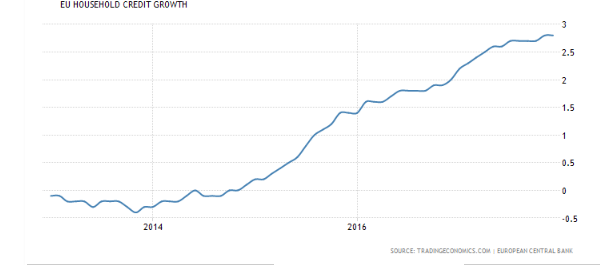

Finally, economic growth sped up and unemployment fell partly because of improved credit availability which supported investment and consumer spending in the real economy.

For example, as the following chart illustrates. loans to households in the euro area increased by 2.8% (y/y) in December 2017, which is a very rapid pace of growth and the sharpest rise in household lending since March 2009.

Also, credit to non-financial corporations rose 2.9% over the same period. Once again, this also represents a very strong rate of credit expansion.

Disclosure: None.