Sifting Through Southern Europe: Portugal’s Case

Investing in Portugal

Portugal is a small country in every aspect. Everyone knows everybody. The elites are formed from a small number of leading families that have taken over the country and digladiate themselves for political power. Just like you can see in any given episode of the “Game Of Thrones” TV series. Old rivalries are always ready to reemerge and elections are an opportunity for factions to take turns in power.

Since money is power, and those families have little, they strive to get management seats in the biggest state-owned and private companies, which they achieve through an elaborate network of influences. Obviously, this explains why there aren’t interesting companies in the PSI 20 (the Portuguese Index). Usually, the executives behind the companies are far from being remotely adequate for the mission, and their main task is to serve as power brokers.

Photo Credit: Pedro Ribeiro Simões

Politicians are part of that sensible ecosystem, which in turn prevents them from doing much more than maintain status quo. Therefore, it shouldn’t come as a surprise that Portugal is a laggard country, full of red flags indicating that corruption and power trafficking plague the economy and society. The transportation infrastructure is inadequate and uncompetitive when compared with its Spanish neighbor. Finally, the bureaucracy and taxation only seem to serve as incentives for the Portuguese to lay around on sunny beaches.

In this sense, looking at the Portuguese stock market, you’ll see it dominated by decadent banks, old state monopolies (energy, postal services and telcos), retail stocks and paper producers. That’s it. Unlike Spain, Portugal does not own any Inditex (OTCPK: IDEXY) to show for it. No mass market consumer products. And that’s a reflection of the uncompetitive structure of the Portuguese economy. It’s mostly composed of businesses that live through sucking the state coffers dry or hidden monopolies taking advantage of consumers.

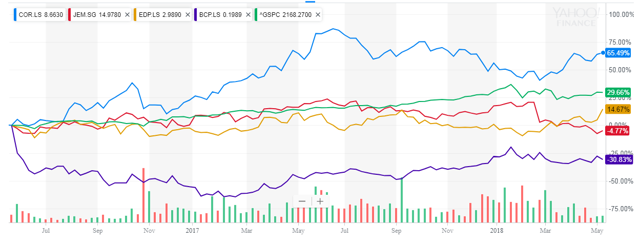

Then you have governance issues. Too many times have family-run companies been salvaged to serve what seems to be their own short-term interests. Good pieces of businesses have been sold to family members. Jeronimo Martins did this in 2016; refraining from judging the rationale behind it, I would say that selling to a family member raises a lot of doubts. Bearing all this in mind, it is not surprising that the major Portuguese companies have vastly underperformed the S&P 500 (NYSEARCA: SPY).

Graph 1 – Two-year comparison of COR, EDP, JM, BCP, S&P 500

(Click on image to enlarge)

Source: Yahoo Finance

This is not an original script; we have seen it in many countries. Unfortunately, it is a screenplay characteristic of backwater countries. Therefore, it comes with no surprise that, for years, I have avoided even considering investing in any Portuguese stock. This is a decision that has saved me more money than any other I have ever made.

If structurally Portugal is unsound, the truth is that the country is on a conjunctural recovery aided by EU spillovers – and when the tide rises, every boat is lifted. As happened in 2006-07, many foreign investors may now start looking for value in the periphery to reallocate part of their winnings in this extended bull market. Many investors might feel tempted to sift through the shambles of southern Europe in search for value.

Portugal is unsound, but the tide is rising. Now what?

I could recommend Millennium BCP (BCP.LS), the biggest private bank in Portugal, but it is plagued with all the issues that I pointed out earlier. BCP is a cross-section of the Portuguese economic issue – not good. I could recommend NOS (NOS.LS), the player kicking to the sidelines Altice’s (NYSE:ATUS) operations in Portugal, but telcos have become a tough business, mainly driven by price cuts. Finally, I could recommend paper and pulp producers whose operations have performed relatively well, but after the wildfires of the last summer I believe that future forestry policies might change the competitiveness of the whole industry.

That said, let me introduce you to something that correlates simultaneously with tourism (the poster child of Portugal’s economic renaissance), wine production, and exports: cork. Portugal is the world’s main producer of cork. This material is best known for its application to seal wine bottles. It is also used as an insulation material for homes. Cork has very interesting properties: It’s a great insulation material, copes well with high temperatures, and only starts to degrade after 200ºC. On the supply side, the oak tree takes up to 25 years to be ready to supply quality cork, meaning that supply cannot be raised too fast in the long term (as we’ll see, this might change in the future).

Corticeira Amorim (COR.LS) is the biggest player in this space. It owns most of the oak forest in Portugal and is the leading producer of both corks for bottling and construction applications.

The cork industry in Portugal

Now, let me offer some context about the cork industry. Anyone with an interest in wines must have already heard this question: What’s better, cork or screw caps? The answer has varied throughout time, and periodically some questions have arisen about the threat of synthetic screw caps.

Corticeira has put a lot of R&D effort to develop ways to control the quality of the cork and prevent contamination of wines. This has diminished the percentage of corked wines and rehabilitated the image of cork that has had some ups and downs.

Additionally, the company decided to focus on premium wines where the cork is synonymous with high quality. Corticeira is also trying to broaden cork applications to create new markets and diversify the company’s dependence on the wine market. On the same note, several types of wine corks are made from a whole piece of cork cut directly from the cork piece. This means that there is a lot of waste. Since the supply of cork is very limited, the waste is still valuable and it is used to make cork agglomerates. Corticeira is trying to broaden the applications of the agglomerates. Currently, they are used in the construction and automotive industries, but NASA and the European Space Agency are also using it to protect heat shields.

As I said, cork is very rigid in terms of supply. However, new techniques to grow the oak tree are being developed. These techniques, which are similar to what has been used on olive trees, should allow to shorten the time of the first commercial cut from 25 to eight years. If confirmed, this should be a huge improvement and might allow the company to grow its business model from a specialty wine cork to a specialty materials producer.

Corticeira state of affairs

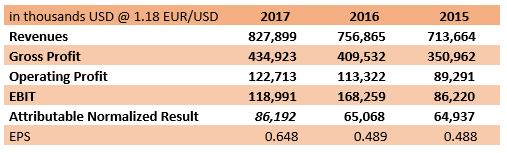

The company has an interesting financial performance. The profit has been consistent, and the revenues have been growing slowly but steadily. For the years to come, higher output of cork might be achieved, as we’ve stated, from new treatments on the cork oak tree. This should increase its productivity and reducing the time to market of the first cut. Additionally, new applications will drive new sales and increase margins.

Table 1 – COR Income statement (figures in thousands, except per share items)

Source: Corticeira Annual Report

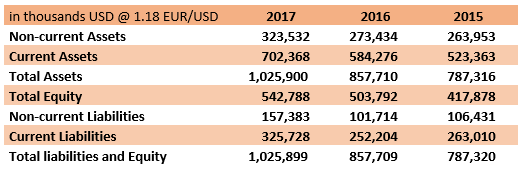

The company has a solid balance sheet. The current ratio is above 2, and the level of debt is below 25% of the assets. Given the fact that Portugal has a frail economy and sooner or later it will face another crisis, Corticeira’s balance sheet should serve as an assurance for prospective investors.

Table 2 – COR Balance Sheet

Source: Corticeira Annual Report

The financials confirm the view that Corticeira is a solid company, one of the best in Portugal.

Extra gem

Coincidentally, or not, another good company on the Portuguese stock market also has the Amorim family as its controlling shareholder. They have a 33.34% position and share the control with ENI. The company I am talking about is Galp (OTCPK: GLPEY), an oil producer. Although it is a highly conjectural play (must also consider the trajectory of oil prices), I believe proactive investors might be well served by checking it out. One additional point in favor of this stock is the newly found oil reserves in Portugal that Galp is starting to exploit.

Final thoughts

Weighing all the points exposed, I am not investing in Portuguese stocks. At this stage of the U.S. bull market, I am looking at China and getting acquainted with some of the most promising companies there. However, I know that, for instance, some funds have regional allocations quotas, and managers must look for opportunities in under covered places like southern Europe. I wrote this article for this kind of public. For all the others, I say: learn mandarin.

Disclosure:

I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.