Sensex Extend Gains; Tata Motors & Infosys Among Top Gainers

After opening the trading day in green, share markets in India continue to trade firm in the morning trade amid firm Asian markets. Barring realty sector and metal sector, sectoral indices are trading on a positive note, with stocks in the energy sector and stocks in the capital goods sector witnessing maximum buying interest.

The BSE Sensex is up by 202 points and the NSE Nifty is trading up by 50 points. Meanwhile, the BSE Mid Cap index is trading up by 0.6%, while the BSE Small Cap index is trading up by 0.5%. The rupee is trading at 65.37 to the US$.

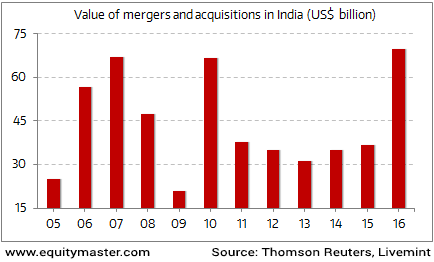

As per an article in The Hindu Business Line, India mergers and acquisitions (M&A) are expected to touch US$46.5 billon with 944 deals in 2017 boosted by Rosneft's US$13-billion takeover of Essar Oil. This is a 165% rise in value and a 70% jump in volume from 2016.

India recorded 553 deals worth US$17.5 billion last year. M&A activity is expected to continue to gather pace on the back of the Modi government's continued efforts in removing regulatory hurdles and simplifying laws to further attract foreign investment, until it reaches its cyclical peak of US$52.8 billion in 2019.

Indian M&A activity at an All Time High in 2016

Also, as per the reports Indian Initial Public Offering (IPO) is set to reach the record-breaking value of US$6.8 billion this year. Finance Minister Arun Jaitley plans to raise Rs 725 billion from disinvestment in 2017 and 2018, including Rs 150 billion from strategic asset sales, to help sustain this IPO momentum.

The Indian IPO market continues to flourish as institutional and retail investors look for productive avenues to invest in, in a market with a shrinking interest rate, low bond yields, capped gold investments and real estate investments under scrutiny.

The market euphoria is something similar to what was seen in 2007-08. When everyone around you is clamoring to get a piece of the IPO pie, it makes sitting tight difficult. And, why should you sit tight when stocks like Avenue Supermart lets you pocket a cool 100% gain from day 1 of the listing?

History suggests that these cases are few and far between. More than 70% of the IPOs listed in 2007 and 2008 are in the red, even today when the Sensex is at an all-time high.

This allows us to stay on the fence when it comes to investing in IPOs. But it doesn't make sense to completely ignore this space. For every Reliance Power - like issue, there have been issues like Maruti, TCS, and Jubilant Foodworks Ltd (with returns over 4,000%, 1,000% and 500% respectively) that have created immense wealth for shareholders. A merit-based selection primarily including valuation, business, and management quality is the logical way to go about it.

In the news from the telecom sector, Reliance Communications share price is witnessing selling pressure today. Losses were seen as the telecom operator said that it is not making any payments to lenders or bond-holders for the time being.

The above development is seen as the company is under standstill period with invocation of strategic debt restructuring scheme and working on its asset-monetisation.

The company, in a regulatory filing, said that it is in standstill period till December 2018 pursuant to strategic debt restructuring guidelines.

The company has also been in the news lately as it is going to shut down its voice call service from 1st December.

The company had last month announced its plan to shut down major parts of its wireless business. As per an article in the Economic Times, the operator has cited the competition brought in by new entrant Reliance Jio's free voice and cheap data services as one of the factors behind this development.

The company also, during the week, inked a pact with Veecon Media and Television Limited, for sale of its subsidiary Reliance BIG TV Limited (RBTV). The subsidiary deals in direct to home (DTH) services across India.

Reliance Communications had earlier this month reported that it will shut down its direct-to-home (DTH) business, operating under Reliance Digital TV, effective November 18. The company has cited expiry of DTH licence as the reason for this closure.

Disclaimer: Equitymaster Agora Research Private Limited (hereinafter referred as 'Equitymaster') is an independent equity research Company. Equitymaster is not an Investment Adviser. ...

more