Raising The Canadian Bank Rate Just Became Harder

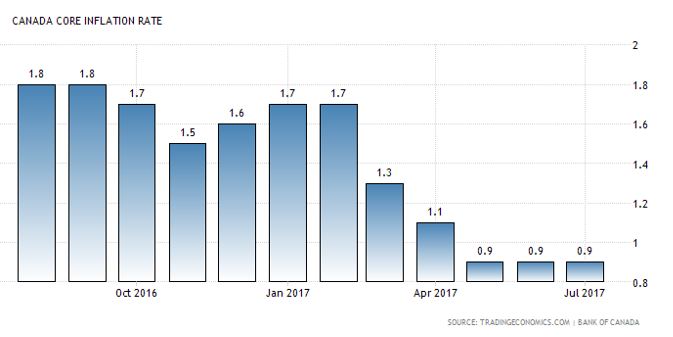

Today’s release of Canada’s CPI for July makes the case for interest rate increases more difficult. The core CPI for July was unchanged from the previous month, continuing a three - month string of no acceleration in the overall index. For nearly a year, Canada’s inflation has yet to reach the target rate of 2%.

While analysts may focus on the need to increase the bank rate in view of relatively strong growth numbers in the first half of the year, it is important to remember that the Bank of Canada has just one and only one mandate: price stability.As the Bank emphasizes,

“Canada’s inflation-targeting approach is symmetric, which means that the Bank is equally concerned about inflation rising above or falling below the 2 per cent target[1].

The concern should now be about falling below the 2 % target consistently.

Initially, the Bank of Canada lowered the bank rate twice in 2015 in response to the collapse in oil prices. The Bank used its powerful tool to buffer the effects of declining incomes and investment as it hit western Canada in particular. When announcing the increase in the bank rate in last month, Governor Poloz argued that the prior rate cuts had “done their job”. Economic growth quickened and there was no need for rates to remain this low.

However, weak inflation continues to overshadow growth when it comes to setting monetary policy. Too often, the importance of flexibility-----concern with stagnant or falling prices as well as with rising prices - is dismissed too readily by analysts. The focus is continuously on the expectation that inflation will accelerate in the medium term.

The Federal Reserve, initially, expressed its expectation that, in the “medium term “, inflation will reach the 2% target. However, it is now apparent that there is a split within the FOMC as to just how “transitory” is the slowdown in inflation. Now, speculation is building that Fed will likely pause in its quest for higher rates.

It seems that inflation in Canada is exhibiting the same slowdown. Steadily since January this year, the inflation rate has been dropping to the point where it is much closer to the lower end of the Bank’s target - 1.2% for past 12 months - than to the upper reaches of 2%. This performance really calls into question the justification for further bank rate increases this year.

[1] Bank of Canada, Monetary Policy Review, July , 2017

Disclosure: None.