Once Again The Canadian Economy Disappoints

The release of second quarter Canadian GDP numbers reveal an economy that continues to struggle with mediocre performance. Overall, annualized growth fell by 1.6% from the previous quarter. More importantly, the decline is due to the very disappointing performance in the export market; at home, business investment continues to languish. Canadian policymakers pinned much of their hopes for economic renewal on two sets of “adjustments”. First, the fall in the value of the Canadian dollar would signal that Canadian exports would now become more competitive , especially in manufacturing and other consumer products. Secondly, in the words of the Bank of Canada, the Canadian economy would be undergoing “complex adjustments” as it moves away from its over dependency on energy and other commodity exports. Granted these changes require time to take effect fully. Nevertheless, the results to date have not been encouraging, raising the question of whether Canada can pull itself up sufficiently and return to more desirable rates of growth.

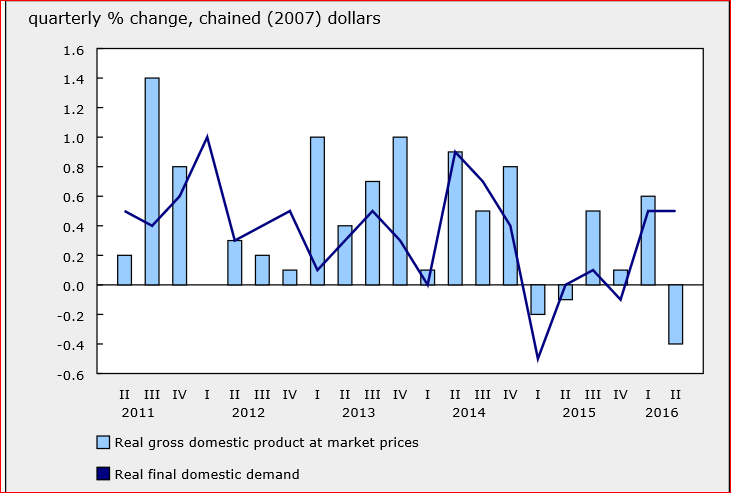

Let’s look at the performance over the past five years in Chart 1. Until the latter part of 2014, the Canadian economy registered a steady stream of positive growth. The collapse of oil prices and other exported commodities triggered a spotty performance. Overall, the economy just bounced between positive and negative growth quarters with no real conviction. The most recent quarterly drop in GDP is significant for it reveals weakness that goes beyond the energy sector. No longer can Canadians just throw their hands up and say that we are at the mercy of the international energy market. Other sectors, unrelated to the oil industry, are showing serious signs of trouble.

Chart 1 Quarterly Changes in Real GDP, 2011-2016

Source:StatsCan

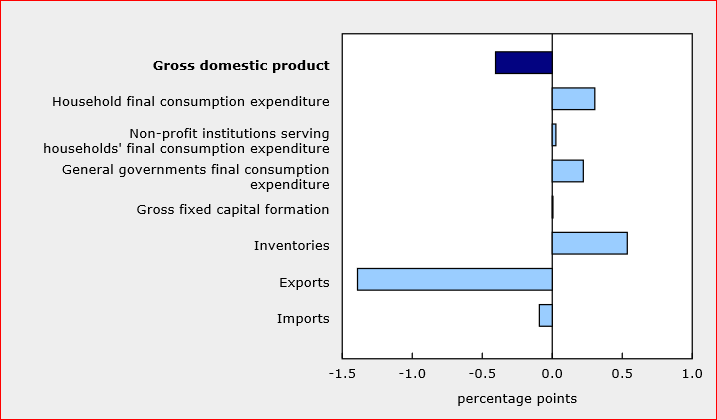

Considering major subsectors, it is clear that there are, in essence, two “distinct “ Canadian economies. (Chart 2, all growth rates are expressed at annual rates). Domestically, consumer expenditures rose modestly at 0.5 percent annually---hardly anything to cheer about. Government expenditures advanced by 1 percent, the sixth consecutive quarterly increase in public sector outlays. Those two broad segments continue to hold up, albeit at relatively low levels of growth. Externally, the picture is much less sanguine. The export sector was by far and away the biggest disappointment in recent years, and 2016 is no exception. Canada derives about a quarter of its income from exports and about 75 percent of all exports are headed to the United States. When exports fall at a rate of 4.5 percent as they did in 2016Q2, the domestic economy cannot compensate fully for that decline, resulting in a negative rate for GDP.

Chart 2 Changes in GDP by Sector, Q2/Q1

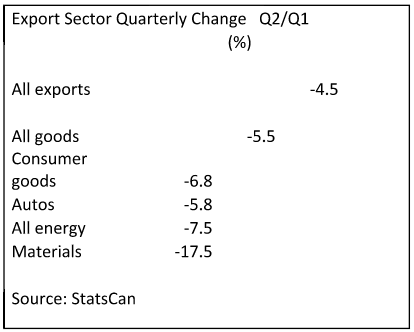

Let’s examine the export sector more closely in Table 1.

Within the export sector, as expected, energy and material exports dominated the decline in total exports. Oil prices continue to languish in the $40 range. The decline in oil export volumes is directly related to the loss of production due to the wildfires in Alberta this Spring. However, there is a serious weakness in manufactured exports, especially in automotive vehicles and parts--- the single largest manufacturer in the export sector . And, other consumer product exports recorded equally poor results. The non-energy sector was expected to benefit most from the devaluation of the Canadian dollar and would eventually lead to a more balanced export performance. The failure to generate a better export performance in the non-resource sector is the big reason the economy remains in the doldrums. Unlike past periods when the Canadian dollar was trading well below par to the U.S dollar, sales to the United States were relatively stronger than they are today. A tepid U.S. economy is a big challenge to Canadian exporters.

Table 1 Exports by subsector, 2016 Q2

What keeps the Canadian economy somewhat afloat are contributions from two large industries, each contributing about 20 percent to national income:

- F.I.R.E (financial services, insurance and real estate) and

- Public administration, health and education.

Until the export sector begins to contribute positively to national income, the burden of providing growth will continue to fall on these two sectors. The big question is whether these two sectors are sufficiently robust to generate sustained long term growth?