Nippon Dragon Resources: An Investment For Mining Innovation

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Introduction:

The mining sector is a capital intensive and expensive operating business. Not to mention the asset i.e. reserves of the company are always being depleted.

In a sense we are spending hundreds of millions only to hope commodity prices are high enough to justify a profit during the life of the mine. The conclusion can be made that the mining business is a cyclical and expensive and risky venture.

Thus being an intelligent investor, and when a sector is in the bottoming phase of a bear market i.e. consolidation timeline, this author can't resist seeing what high quality assets have been forgotten and neglected and undervalued.

During the search through the trenches of lifeless mining companies, one was discovered which intrigued this writer. It is more of innovation than a simple mining story - a word long forgotten in the sector. Remember that fracking in the oil business had been around since the '80s but did not become widely used until the 2000s, making formerly unprofitable oil deposits suddenly profitable and manageable.

The company of discussion today is Nippon Dragon Resources (RCCMF).

1. Company Overview

Nippon Dragon Resources, formerly known as Rocmec Mining Inc, is a Canadian company that is a hybrid company, combining mining and intellectual property.

The company has patents (10 countries) for a mining extraction method known as Thermal Fragmentation (some call this the Fracking of the mining sector).

It also has an advanced stage, high potential mine that is permitted - the Rocmec mine. The company wants to be a dual-growth business with leasing its Dragon technology for mines worldwide while retaining a royalty for use, while simultaneously developing and extracting its own Rocmec mine.

The company has an impressive management, including the Vice President Donald Brisebois - the former CEO of Rocmec Mining (2005-2012) and the inventor of the Dragon Thermal Fragmentation process. He held positions for large mining companies such as Falconbridge, Teck, and most importantly was the general manager of Placer Dome Inc before it was purchased by Barrick (ABX) in 2006.

On top of the high quality management that understands mining, they fund their own projects. They participate in the financing alongside the shareholders.

Two insiders of the Corporation subscribed for a total of 950,000 units as part of the Common Share Private Placement (the “Insider Participation”), says a Nippon Dragon Press Release.

The company is also in talks with Australia and New Zealand, Japan, South Africa, and Quebec to get working contracts for cash-flow and organic growth.

2. Thermal Fragmentation

When one is mining, then dynamite is commonly used. For years this has been the most effective way but it has come at a price - dilution. The costly process destroys some of the ore veins itself.

(Source: Nippon Dragon)

As one may notice; the innovation in the mining sector hasn't strayed too far from the days of the Mayans. Of course one cannot be ignorant about the great strides that the mining industry has made, it's simply amazing how far mining has come. But could it go further? With high grade gold becoming a thing of the past, mining will now have to venture deeper and through more tonnage, all while drilling lower grade gold - thus increasing costs tremendously.

The method uses heat in order to shatter/spall/flake the high grade veins (investors can watch a video of the demonstration of the heating and flaking process). This process reduces the need for dynamite which also reduces the dilution that would follow the explosion. This will not be a stand alone method for most mines, but the Dragon technology would compliment the operation for thinner veins (less than 2 meters in width).

(Source: Nippon Dragon Resources - Dragon Extractor(left) vs. Mini Dragon(right) )

Here are the key benefits of using the Dragon Drill:

- A boasted reduction in dilution of a 4:1 ratio. Less dilution increases grades realized and less tonnage for the mill.

- Increased safety of the underground mine. No wall damage or destruction of surrounding ore would be suffered from the lack of explosions. Potentially reducing cave-ins.

- Impressive cost savings (company estimates are 30%-60% respectively).

- There needs to only be a 2 person team per Dragon, adding to productivity and lower labor costs.

- A “green” technology which is not harsh on the environment and lower energy costs.

- Precision mining which is faster and more accurate for increased efficiency.

Investors would be wise to follow this link and examine the Dragon's pilot operation of the thermal fragmentation demo.

2.1. The Rocmec Mine Asset

The Rocmec asset is located in the mining safe jurisdiction of Quebec. The property was acquired in 2005 and to date has invested over $40 million in the property.

The property includes a 100m deep two compartment shaft, an 844 metre decline allowing access to five levels (50, 70, 90,110 and 130 metres). On these levels a total of 1700 metres (drifts and cross-cut drift) were driven. The Rocmec 1 ore body is well defined by diamond drill holes.

The company boasts that there are over 2,000 hectares that is virtually unexplored still. The NI43-101 from May 2010 confirmed roughly 500,000 oz with a cut off grade of 3 grams-per-ton. This author believes after speaking with management that the deposit is undervalued and with further drilling the resource estimate should grow.

The Rocmec mine has potential and exploration upside. If the company can get proper funding it plans to continue developing the mine and use its Dragon technology to extract the resources at low cost, delivering a hopeful high ROI and thick margins.

The company also has an interesting mining property, Denain, that is also in Quebec. It has yielded high grades (averaging about 18 gpt gold) using assay samples collected during the thermal fragmentation operations. This is very early stage exploration but it is worth noting for the investor.

3. The Bull Case for Innovation

Margins scale vertically with mining companies; and before the meltdown of 2012 in the sector, most miners neglected costs due to the decade rise in gold prices. But alas, every boom halts and a correction ensues - now mining companies cannot depend on a higher gold price to save them, but require innovation. Margins now have to be made from cutting costs - which in this author's opinion should be the number one method to increasing earnings (building multimillion/billion dollar mines cannot be controlled by the paper/futures market of the commodity it drills). For example, if gold does not go up in price, then the company has a responsibility to its shareholders to spend on research and development so that margins will grow from lowering the cost curves.

Simply stated: to grow profits, either the underlying commodity price has to rise or the costs must be lowered. Mining companies aren't generally in control of the price of the commodity (unless they form a cartel) so they must spend on innovation for what they can control - costs.

The extraction process allows thermal fragmentation with an accuracy of 2 cm to quickly extract any type of hard rock up to 110 cm wide. With such precision, high grade precious and base metal veins can now be extracted without dilution. The thermal unit can be set up to extract a specific corridor.

(Source: Nippon Dragon Demonstration Slideshow)

The picture above shows how the company's process is able to precisely drill and extract what is intended, avoiding the rest of the ore body and debris from explosions.

This will also save costs significantly with regards to the transportation of the useless ore and the increased milling of the debris. Examine the photo below:

(Source: Nippon Dragon Demonstration Slideshow)

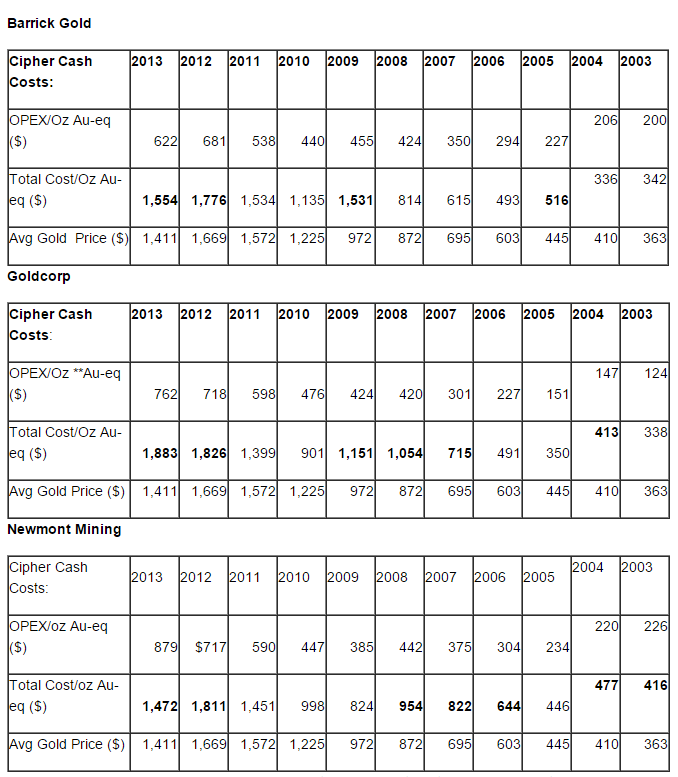

The mining sector is in a miserable position: lowering average grades and increasing costs. Kitco released very detailed and informative article on what the true cost of mining gold is; the results were staggering.

(Source: Kitco)

Barrick Gold (ABX), Gold Corp (GG) and Newmont Mining (NEM) each have higher all-in sustaining costs per ounce than what that ounce of gold is even worth. This is unsustainable and could prove to be fatal if commodity prices do not rise. These companies have debts and if a payment is missed that would declare a default (such a scenario just happened recently for one of the larger gold producers defaulting in Nevada, Allied Nevada Gold (ANV).

All-in sustaining cost was devised by the World Gold Council and senior gold companies to standardize a measure that adequately addresses all-in costs. It includes sustaining capital and G&A expenses but does not include initial project capital or dividends. This non-GAAP standard was intended to provide further transparency into the costs associated with producing gold.

In all honesty, even if a company is spewing out slight profits in this market, that is not enough. Mining is itself a capital intensive business thus requires innovation for lowering costs at all times, whether bear or bull market for the commodity it extracts. The lower the costs the higher the margins which returns more cash to shareholders and ultimate value.

In higher gold price markets, companies can just issue new shares (diluting current shareholders) to raise cash to pay its bills. Investors seemed to have only cared about large, multi-million-ounce producing companies and the leverage they brought. No one seemed to notice that even though most of these companies pulled out millions of ounces annually, they were not generating cash to organically grow. At the end of the day cash is king. Why do these companies not invest slightly in innovative technologies? That question has this author scratching his head.

Peter Bryant and Clareo Partners conjured up a phenomenal article calling for innovation in the mining industry and the lack of past efficiency. Please read this article for more information on the topic at hand.

But those wanting to capture the full value of this super cycle will need to realize important transformations in their business system: rapid and accurate characterization of ore bodies, faster development of mines and speed of extraction, improved recovery rates and mine planning as well as increased use of automation and remote operations. So despite mining companies producing record profits there remains substantial value, from current operations, that is not being captured, says Peter Bryant.

With lower operating expenses offered from thermal fragmentation from the Dragon, could this be the lifeline that unprofitable mines need? Would the Dragon be the solution for closed old mines to become renewed?

4. Conclusion? Speculative Buy and Hedge

Mining isn't the most exciting business. In an era of advancing new technologies for communications, social media, and the "App" revolution, mine investments may seem like a thing of the past. Yet, one critical premise must be acknowledged: One cannot have these technological gadgets without the resources extracted from the earth. The copper, silver, iron, titanium, and all the other multiple commodities that go into the very technology consumers use daily are needed for the populace's growing standard of living.

So the question is: With the mining business seeming dated, dirty, expensive and boring - how can the future generations be swayed into investing in business that cannibalizes itself (constantly depletes assets), instead of investing in a flashy E-commerce business or advancing the new "smart" phone? No one dollar can be in two separate assets at once, there is always an opportunity cost.

Not to mention the world is depleting these assets to maintain everyday life - thus mining needs innovation to dig deeper with higher extractions i.e. grade recovery and minimizing fatal incidents for employees.

Nippon Dragon Resource is not a complete solution for the innovation required in mining but a very effective, cost efficient procedure.

As a shareholder, one can have two immediate takeaways: future growth from business operation and as a hedge on the price of gold.

Nippon Dragon's hedge: It is simple economics to understand that if supply increases while demand stays stagnant, prices will fall usually. Thus with the innovation needed and required in the gold and mining business, many unprofitable mines and old mines could come online to operate at lower costs, making them profitable. This will obviously grow the supply - further pushing prices down. An example of this is the oil price from 2014. Due to the shale fracking boom in US - pushing America into the top 3 oil producers globally - the added supply of oil wells that came online helped push the price of oil into one of its most brutal annual declines (oil fell roughly 60% year-to-date).

Thus if innovation occurs and prices fall, traditional mining companies will suffer decreased margins (unless their costs reduce appropriately to meet the lower prices). But imagine owning the business that is renting out its technology for companies to use in making these unprofitable mines and closed mines come online. This would benefit the shareholders of Nippon Dragon significantly.

Will this be prophetic? One can only speculate. But it is definitely a logical thesis. It also wouldn't be unlikely for a company to outright try and purchase the Dragon technology.

Downside? Of course as with any investment there are risks. But the most prominent issue the company faces is that it needs to be in a mine to show off its technology. The company can build the Dragon Technology and export it into foreign mines cheaper than getting their Rocmec mine ready for extraction. But if they have the proper financing and once the market for gold mining recovers, this will be the future of their development and they will be able to use their own mine as a demonstration for investors while generating revenue.

Honest and intelligent management, interesting potential asset (Rocmec), innovative and efficient patents for a sector that desperately needs a lifeline - Nippon Dragon Resources is an interesting and creative speculation.

Disclosure: I own Shares of Nippon Dragon Resources (NPI.V)