Morning Call For Monday, August 7

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 +0.07%) this morning are up +0.10% on possible increased M&A activity after Bloomberg news reported that people with knowledge of the matter said United Technologies is weighing the possible acquisition of Rockwell Collins. European stocks are down -0.19% after German Jun industrial production unexpectedly fell at the fastest pace in 6-months. Another negative for stocks is the -1.09% decline in Sep WT crude oil (CLU17 -1.01%) , which is undercutting energy stocks, after compliance on OPEC and non-OPEC crude production cuts fell to 86% in July, the lowest since Jan. Representatives of some OPEC and non-OPEC oil producers are meeting in Abu Dhabi today and tomorrow to discuss why some members are falling behind in meeting their pledges to reduce output. Asian stocks settled mostly higher: Japan +0.52%, Hong Kong +0.46%, China +0.53%, Taiwan +0.69%, Australia +0.93%, Singapore -0.18%, South Korea +0.16%, India -0.16%. Asian markets found carry-over support from Friday's stronger-than-expected U.S. Jul payrolls report, which is positive for global economic growth.

The dollar index (DXY00 -0.14%) is down -0.16%. EUR/USD (^EURUSD) is up +0.23%. USD/JPY (^USDJPY) is up +0.13%.

Sep 10-year T-note prices (ZNU17 -0.01%) are down -2.5 ticks.

The Eurozone Aug Sentix investor confidence fell -0.6 to 27.7, stronger than expectations of -0.7 to 27.6.

German Jun industrial production unexpectedly fell -1.1% m/m, weaker than expectations of +0.2% m/m and the biggest decline in 6 months.

U.S. STOCK PREVIEW

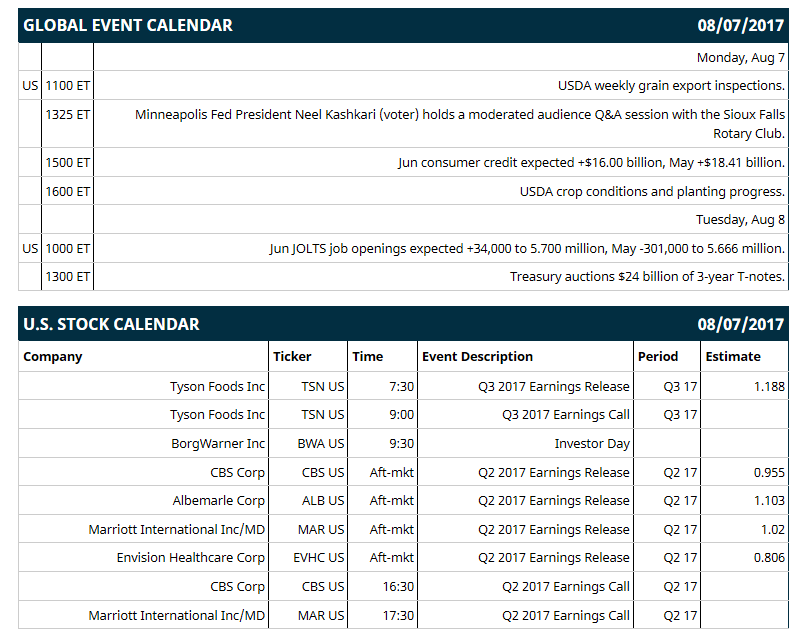

Key U.S. news today includes: (1) Minneapolis Fed President Neel Kashkari (voter) holds a moderated audience Q&A session with the Sioux Falls Rotary Club, (2) Jun consumer credit (expected +$15.25 billion, May +$18.41 billion), (3) USDA weekly grain export inspections, (4) USDA crop conditions and planting progress.

Notable S&P 500 earnings reports today include: Tyson Foods (consensus $1.19), CBS (0.96), Albemarle (1.10), Marriott (1.02), Envision Healthcare (0.81).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: KeyBanc / Pacific Crest Global Technology Leadership Forum on Mon, Pacific Crest Securities Conference on Mon-Tue, Jefferies Global Industrials Conference on Mon-Wed, MUFG Securities Seattle Investor Conference on Tue, Cowen and Company Communications Infrastructure Summit on Tue, Cowen & Co. Communications Infrastructure Summit on Tue, Oppenheimer Technology, Internet and Communications Conference on Tue-Wed, J.P. Morgan Auto Conference on Wed, Canaccord Genuity Growth Conference on Wed-Thu, Goldman Sachs Power, Utilities MLP and Pipeline Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

GrubHub (GRUB +9.06%) was upgraded to 'Overweight' from 'Equalweight' at Morgan Stanley with a price target of $59.

Illumina (ILMN -2.01%) was upgraded to 'Buy' from 'Hold' at Canaccord Gentry with a price target of $215.

Kaiser Aluminum (KALU +0.04%) was downgraded to 'Market Perform' from 'Outperform' at Cowen.

B&G Foods (BGS -8.68%) was upgraded to 'Outperform' from 'Market Perform' at BMO Capital Markets with a 12-month target price of $39.

Time Warner (TWX +0.17%) was downgraded to 'Inline' from 'Outperform' at Evercore ISI.

KLA-Tencor (KLAC -0.15%) was upgraded to 'Buy' from 'Hold' at Stifel with a price target of $106.

Re/Max (RMAX +9.49%) was downgraded to 'Equal-Weight' from 'overweight' at Stephens

Lift Storage (LSI +0.30%) was downgraded to 'Underperform' from 'Inline' at Evercore ISI.

General Motors (GM +1.44%) said it was recalling 800,000 Chevrolet Silverado 1500 and GMC Sierra 1500 pickup trucks worldwide from the 2014 model year to fix a steering defect that could cause drivers to lose electric power steering assist.

Fluor (FLR -8.66%) was downgraded to 'Accumulate' from 'Buy' at Johnson Rice.

BP PLC (BP +0.53%) was upgraded to 'Overweight' from 'Neutral' at Piper Jaffray with a price target of $42.

Rockwell Collins (COL +0.47%) jumped over 6% in after-hours trading after United Technologies was said to be weighing a potential acquisition of the company.

Berkshire Hathaway ({=BRK/A=}) slipped 2% in after-hours trading after it reported Q2 operating EPS of $2,505, below consensus of $2,791.

MARKET COMMENTS

Sep S&P 500 E-mini stock futures (ESU17 +0.07%) this morning are up +2.50 points (+0.10%). Friday's closes: S&P 500 +0.19%, Dow Jones +0.30%, Nasdaq +0.15%. The S&P 500 on Friday settled higher on the +209,000 increase in U.S. Jul non-farm payrolls, stronger than expectations of +180,000, and the as-expected -0.1 point decline in the U.S. Jul unemployment rate to a 16-1/3 year low of 4.3%. In addition, the U.S. Jul average hourly earnings report rose by +2.5% y/y, stronger than expectations of +2.4% y/y.

Sep 10-year T-note prices (ZNU17 -0.01%) this morning are down -2.15 ticks. Friday's closes: TYU7 -9.0, FVU7 -4.75. Sep 10-year T-notes on Friday closed lower on the larger-than-expected +209,000 increase in U.S. Jul non-farm payrolls and the +2.5% increase in U.S. Jul average hourly earnings, which were hawkish for Fed policy.

The dollar index (DXY00 -0.14%) this morning is down -0.146 (-0.16%). EUR/USD (^EURUSD) is up +0.0027 (+0.23%) and USD/JPY (^USDJPY) is up +0.14 (+0.13%). Friday's closes: Dollar Index +0.703 (+0.76%), EUR/USD -0.0097 (-0.82%), USD/JPY +0.64 (+0.58%). The dollar index on Friday closed higher on the stronger-than-expected U.S. Jul non-farm payroll report of +209,000, which bolstered the case for the Fed to keep raising interest rates. The dollar was also boosted by Friday's increase in the 10-year T-note yield, which boosts the dollar's interest rate differentials.

Sep crude oil (CLU17 -1.01%)this morning is down -54 cents (-1.09%). Sep gasoline (RBU17 -1.35%) is down -0.0231 (-1.40%) at a 1-week low. Friday's closes: Sep WTI crude +0.55 (+1.12%), Sep gasoline +0.0144 (+0.88%). Sep crude oil and gasoline on Friday closed higher on the stronger-than-expected U.S. Jul non-farm payroll report, which signaled economic strength that may lead to increased energy demand. Crude oil prices were also supported by the stronger-than-expected German Jun factory orders report, which was positive for European economic growth and energy demand.

(Click on image to enlarge)

Disclosure: None.