Markets: Not Contained

The horror of wildfires in the US and globally continues. There is no containment when climate change drives droughts and the tinder of dry forests finds the frailty of human judgment. So too for the markets today. The crisis in emerging markets is not contained even as the TRY gained back to 5.8830 early at the open following headlines that Turkey is doubling US tariffs.

The currency is up 3% to 6.15 now after a court in Turkey rejected US pleas to end Pastor Brunson’s house arrest. So TRY is not enough to spread cheer across emerging markets. Start with Indonesia where the central bank hikes 25bps to 5.5% - the fourth hike since May – as the IDR fell 1% at the open bringing another round of intervention. The BI Governor Warjiyo noted, "The reason for the rate hike is to maintain the attractiveness of our domestic financial market, in that we want yields... to remain attractive despite rising risk premiums and that could trigger inflows." Continue onto China where the CNY fixed lower and the housing prices rose but the stock market fell. CNY wobbles after weaker data yesterday. Move then to South Africa where the ZAR is off over 3% and focus is on its politics hitting stocks and bonds, weaker metals prices hitting its current account. There is little room for EM to hide today and the pain trade outside of Turkey belies the containment arguments from yesterday. So we are in a risk-off mood and that puts the USD back into the spotlight with the data today looking more important than usual as it will drive FOMC reactions. The risk for 98 US dollar index returns.

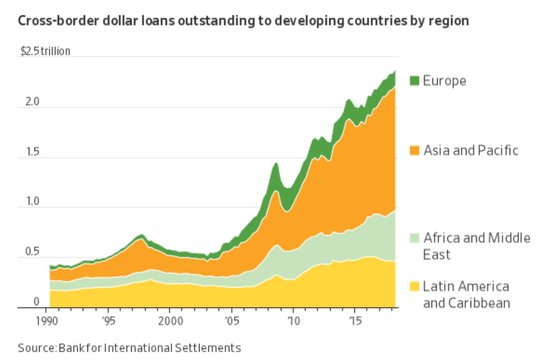

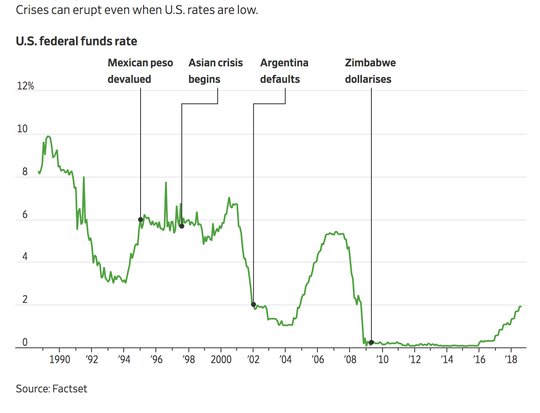

Question for the Day: What can stop the EM pain trade? There are 3 things blamed for the current crisis in EM – 1) FOMC rate hikes, 2) US trade tariffs and sanctions, 3) Position overhangs. The positions have been washed out but the last month of July brought some bargain buyers than are now getting burned. The FOMC rate hikes are likely to continue and that is the first driver that needs some reversal to help EM – so data ahead matters. The USD borrowing abroad is mostly in Asia and that puts China as key.

As for the race to the bottom – the fact that ARS and TRY are the leaders isn’t a surprise – but that ZAR and INR are next maybe worth considering. The ZAR pain trade is linked to more than C/A and real rates. This is about global demand, links back to China and the trade stories about cars and Platinum/Palladium. Markets are not going to stop looking for more pain until we see good news about trade, Fed hikes and we get that final capitulation moment – one that is more than 7.3 in TRY.

What Happened?

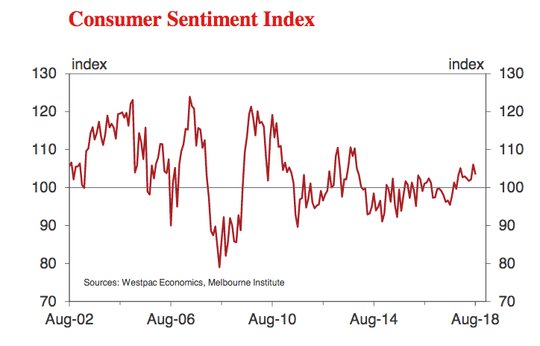

- Australia August Westpac consumer confidence 103.6 from 106.1 – as expected. The index has been above 100 for 9 months. The August drop gave back half of the June-July gains. Current conditions drop to 105.4 from 106.6. Expectations drop to 102.5 from 105.7. Economic outlook 12M forward fell to 100.3 from 105.5 while next 5Y is 101.1 from 104.3. Views on the housing market were mixed. The "time to buy a dwelling" index rose 5.5% to be 15.1% higher y/y and could be attributed to recent declines in

housing prices and easing rate rise fears. - Australia 2Q wage price index up 0.6% q/q, 2.1% y/y after 0.5% q/q, 2.1% y/y – as expected. Private sector wages rose 2% y/y – best since 2Q 2016 - while public sector rose 2.4% y/y same as last quarter. Retail wages rose just 0.1% q/q, 1.5% y/y after 0.2% q/q, 1.8% y/y – lowest among all industries. Construction rose to 0.5% q/q from 0.2% q/q. The biggest rise was in wholesale trade up 1.1% q/q, 2.1% y/y from 0.2% q/q, 1.7% y/y. Healthcare rose 0.3% q/q, 2.7% y/y after 0.6% q./q. Education slowed to 0.5% q/q, 2.8% y/y from 0.9% q/q.

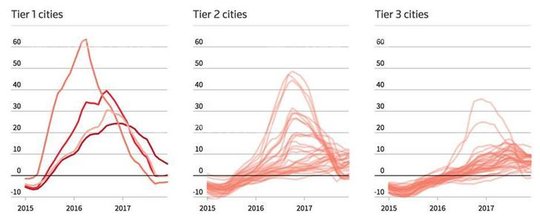

- China July house price index up 1.1% m/m, 5.8% y/y after 1% m/m, 5% y/y – much more than 5% y/y expected – fastest yearly pace since Sep 2017, best monthly since Oct 2016. 65 of the 70 cities in the NBS survey reported monthly gains up from 63 in June. Declining house inventories and some easing of credit drove gains. The Tier-3 cities led the rose 1.5% m/m from 0.7% m/m in June.

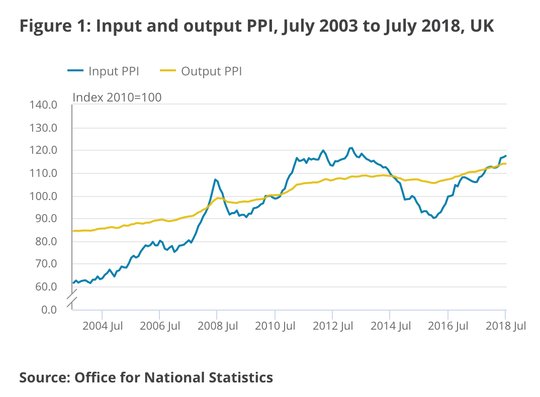

- UK July PPI output 0% m/m, 3.1% y/y after 0.1% m/m, 3.1% y/y – less than 0.1% m/m, 3.2% y/y expected. The core output prices rose 2.2% y/y after 2.1% y/y – also less than the 2.3% y/y expected. Crude oil prices are up 51.9% y/y lifting PPI input prices rose 0.5% m/m, 10.9% y/y after 10.2% y/y – near expectations – but still the most since May 2017. Imported materials, which account for roughly two thirds of input PPI, rose by 10.0% y/y in June, the highest rate in 13 months.

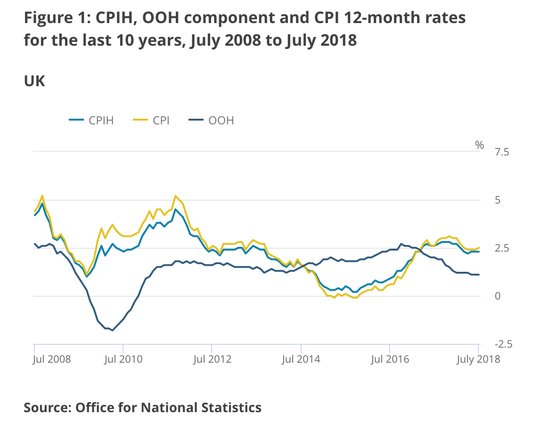

- UK July CPI 0% m/m, 2.5% y/y after 0% m/m, 2.4% y/y – as expected – highest since February. Gains in PC games and transport costs led the rise. The core CPI -0.1% m/m, 1.9% y/y after 1.9% y/y - less than 2.0% y/y expected.The CPIH 0% m/m, 2.3% y/y from 2.3% y/y. The RPI rose 0.1% m/m, 3.2% y/y after 3.4% y/y.

Market Recap:

Equities: The US S&P futures are off 0.25% after a 0.64% gain yesterday. The Stoxx Europe 600 is off 0.15% from early 0.1% gains while the MSCI Asia Pacific fell 0.9% led by pain in China financials.

- Japan Nikkei off 0.68% to 22,204.22

- Korea Kospi closed for holiday

- Hong Kong Hang Seng off 1.55% to 27,323.59

- China Shanghai Composite off 2.06% to 2,723.64

- Australia ASX up 0.46% to 6,415.70

- India NSE50 closed for holiday

- UK FTSE so far off 0.6% to 7,567

- German DAX so far off 0.1% to 12,349

- French CAC40 so far off 0.3% to 5,387

- Italian FTSE so far off 0.3% to 20,906

Fixed Income: US bonds rallied in Asia on weaker China shares, reverse a bit on TRY gains and return with equity pain. EU bonds opened softer, trade bid with Italy still a concern. 10Y German Bund yields off 1.5bps to 0.31%, French OATs off 1.2bps to 0.665%, UK Gilt yields off 2.5bps to 1.235% after as expected CPI/PPI. Periphery hit with Italy up 2.5bps to 3.045%, Spain off 0.5bps to 1.405%, Portugal flat at 1.80%, Greece up 0.5bps to 4.195%.

- Germany DFA sold E0.839bn of 30Y 2.5% Aug 2046 Buxl at 0.94% with 1.34 cover – previously 1.12% with 0.7 cover – after the Bundesbank holding cover 1.59% from 1.0.

- Portugal IGCP sold 3M and 12M bils at lower rates and mixed demand. E250mn of Nov 2018 3M bills at -0.432% with 2.72 cover – previously -0.399% with 2.93 cover – and E750mn of July 2019 12M bills at -0.291% with 2.51 cover – previously -0.28% with 2 cover.

- US Bonds are bull flattening with moderate risk-off globally – 2Y off 1.9bps to 2.618%, 3Y off 2.2bps to 2.69%, 5Y off 2.4bps to 2.748%, 10Y off 2.4bps to 2.875%, 30Y off 2.3bps to 3.044%.

- Japan JGB rally with equity risk-off swing – 10Y off 1.5bps to 0.085%. Bid from the open, BOJ buying unchanged today.

- Australian bonds rally with tame wages, China weakness – 3Y off 0.5bps to 2.005%, 10Y off 1bpsot 2.575%. AOFM sold A$1bn of 12Y 2.5% May 2030 TB155 bonds at 2.6348% with 3.17 cover – previously 2.8934% with 3.41 cover.

- China PBOC injects CNY383bn via MLF loans – net adds CNY46.5bn on the day.Money market rates mixed with O/N up 2bps to 2.332% and 7-day off 2bps to 2.568%. The 10-year bond yields fell 1bps to 3.55%.

Foreign Exchange: The US dollar index holds steady at 96.82 near yearly highs with 97 next key level. In EM, USD mostly bid – EMEA: ZAR off 3.1% to 14.685, RUB off 1% to 66.97, TRY up 2.75% to 6.17; ASIA: INR flat at 69.89 –touched 70.08, TWD off 0.2% to 30.854, KRW off 0.35% to 1132.

- EUR: 1.1320 off 0.25%. Range 1.1316-1.1350 with renewed focus on EM and Italy driving and focus on 1.1250 as pivotal support.

- JPY: 111.15 flat. Range 111.13-111.43 with EUR/JPY 125.80 off 0.2%.Focus is on 110.70 and 111.80 with crosses driving and risk-off equities a fear.

- GBP: 1.2715 off 0.1%. Range 1.2692-1.2736 with EUR/GBP .8905 off 0.1%. Focus is on Brexit politics and moderate CPI with little fear for BOE again.

- AUD: .7215 off 0.35%. Range .7203-.7244 with .7250 now resistance opening .7050 next – metals, China, moderated wages mean no RBA fears. NZD .6550 off 0.35% with .6545 lows.

- CAD: 1.3095 up 0.35%. Range 1.3051-1.3100 with focus on oil, NAFTA, rates and data ahead.

- CHF: .9980 up 0.35%. Range .9934-.9983 with EUR/CHF 11295 up 0.15% - holding better thanks to TRY and JPY with 1.00 key for $.

- CNY: 6.8856 fixed 0.25% weaker from 6.8695 yesterday, trades weaker to 6.8900 into London from 6.8830 close, now off 0.4% to 6.91.

Commodities: Oil off, Gold off, Copper off 1.6% to $2.6870.

- Oil: $66.20 off 1.25%. Range $66.02-$66.90. Brent $71.78 off 0.95%. WTI watching $66 and uptrend support.USD gains, inventories driving.

- Gold: $1185 off 0.8%. Range $1184-$1189. Silver $14.83 off 1.5%. Platinum off 2.4% to $782.30 and Palladium off 2.4% to $879.35.

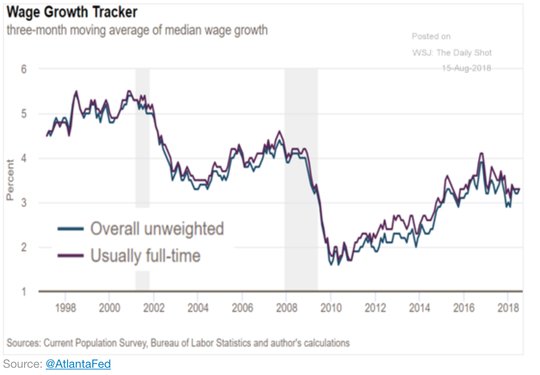

Conclusions: Does productivity matter? The US markets are watching for some signal that the FOMC can slow its hikes. There is plenty of data today that can change the view – from IP to retail sales, the productivity number maybe the underappreciated one – with wages in the US the key focus for inflation mattering.

Economic Calendar:

- 0830 am US Aug NY Empire Manufacturing 22.6p 20e

- 0830 am US July retail sales (m/m) 0.5%p 0.2%e / ex autos 0.4%p 0.3%e / core 0%p 0.4%e

- 0830 am US 2Q productivity 0.4%p 2.5%e / ULC 2.9%p 2.9%e

- 0915 am US July industrial production (m/m) 0.6%p 0.3%e / cap utils 78%p 78.1%e

- 1000 am US Jun business inventories 0.4%p 0.1%e

- 1000 am US Aug NAHB housing market 68p 67e

- 1030 am US weekly EIA crude oil inventory -1.35mb p +1.21mb e / gas 2.9mb p -0.8mb e

- 0400 pm US June TIC flows $69.9bn p -$80bn e / long term $45.6bn p $59bn e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.