GBP/USD Revisits 1.2490 Hurdle; BoE Sticks To Cautious Script

GBP/USD Daily

Chart - Created Using Trading View

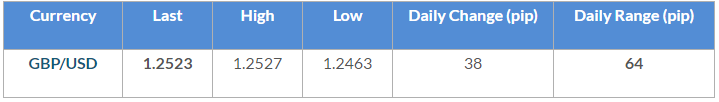

- The British Pound outperforms its major counterparts, with GBP/USD climbing to a fresh monthly high of 1.2527 as the key data prints coming out of the U.K. economy beat market forecast; will continue to watch the topside hurdles going into the final week of March as the pair extends the recent series of higher highs & lows, while the Relative Strength Index (RSI) appears to be making a more meaningful attempt to break the bearish formation carried over from December.

Source: Monthly Business Survey – Retail Sales Inquiry, Office for National Statistics

- Indeed, the 1.3% rebound in U.K. Retail Sales undermines the cautious outlook held by the Bank of England (BoE), and the fresh developments may spur a growing dissent within the central bank as inflation exceeds the 2% target for the first time since 2013; however, a deeper look at the report showed the 3-month average for retail sales contracting 1.1%, with BoE board member Ben Broadbent arguing ‘we may already be seeing the impact of that squeeze on retail spending, which in real terms fell quite sharply around the turn of the year’ while delivering a speech in London.

- The Monetary Policy Committee (MPC) official went onto say ‘the currency has remained weak even in the face of robust consumption growth since that date. And if the foreign exchange market had anticipated a higher cost of finance for sterling borrowers after Brexit you’d probably have seen the same expectation in other financial markets – a steeper yield curve, perhaps, or higher premia in UK banks’ funding markets. That hasn’t really happened;’ the recent comments suggests the majority remains in no rush to raise the benchmark interest rate off of the record-low, and Governor Mark Carney may continue to tame market expectations in 2017 as the U.K.’s departure from the European Union (EU) clouds the long-term outlook for growth and inflation.

- Despite the bullish reaction to U.K. Retail Sales, another failed attempt to close above the Fibonacci overlap around 1.2460 (61.8% expansion) to 1.2490 (38.2% retracement) may undermine the near-term rebound in the exchange rate, with the first downside region of interest coming in around 1.2370 (50% retracement); may see a similar behavior in RSI should the oscillator struggle to break trendline resistance.

|

Currency |

Last |

High |

Low |

Daily Change (pip) |

Daily Range (pip) |

|

AUD/USD |

0.7649 |

0.7679 |

0.7625 |

29 |

54 |

AUD/USD Daily

Chart - Created Using Trading View

- AUD/USD continues to pullback from a fresh 2017 high (0.7749), with the recent series of lower highs & lows raising the risk for further losses especially as the RSI appears to be carving a bearish formation; the failed attempt to test the December high (0.7778) may open up the downside targets, but the broader outlook for the Aussie-Dollar exchange rate remains relatively flat as it continues to operate within the 2016 range.

- Despite the limited market reaction to the Reserve Bank of Australia (RBA) Minutes, the fresh batch of central bank rhetoric suggests Governor Philip Lowe and Co. will be undeterred by the Federal Open Market Committee’s (FOMC) normalization cycle as officials warn ‘domestic wage pressures remained subdued and household income growth had been low, which, if it were to persist, would have implications for consumption growth and the risks posed by the level of household debt;’ indeed, the bar appears to be high for the RBA to introduce another rate-cut amid ‘a build-up of risks associated with the housing market,’ and it seems as though the central bank will continue to endorse a wait-and-see approach for the foreseeable future

- With limited data prints coming out ahead of the RBA’s April 4 policy meeting, the central bank is likely to keep the official cash rate at the record-low of 1.50%, and more of the same may continue to limit the appeal of the Australian dollar as Governor Lowe appears to be in no rush to implement higher borrowing-costs.

- With that said, AUD/USD may continue to give back the advance from earlier this month following the failed attempt to break/close above the Fibonacci overlap around 0.7730 (61.8% retracement) to 0.7770 (61.8% expansion), with a closing price below 0.7650 (38.2% retracement) opening up the next downside region of interest around 0.7590 (100% expansion) to 0.7600 (23.6% retracement) followed by 0.7530 (38.2% expansion).

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!