GBP: Lack Of Data Leaves Sterling Adrift

Talking Points:

- Weak UK Services PMI pinned on bad weather.

- Next week’s data calendar is thin.

- Sterling crosses to be steered by other currencies with USD to the fore.

Fundamental Forecast for GBP: Neutral

We have changed our outlook for GBP to neutral from bullish on a lack of any positive hard data this week while a fairly light economic calendar next week will not help traders in their decision making process. While GBP has fallen from our last bullish call, we did advise two weeks ago not to chase prices and to buy on dips.

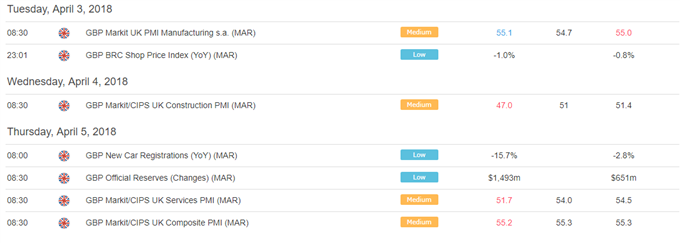

This week’s data prints disappointed overall with construction and services PMIs both sharply lower, due to the recent spell of bad weather in the UK. Overall the composite PMI edged just 0.1% lower on the month with a decent beat in UK manufacturing providing support. Car buyers also kept their hands in their pockets with new car sales dumping 15.7% YoY.

Going forward, the worry is that the sharp fall in the dominant services sector will drag Q1 GDP down to 0.3%, a touch lower than market expectations of 0.4%. The PMI surveys also showed that March UK GDP was just 0.15% due to the ‘Beast from the East’. While the bad weather has been factored in – next month’s PMIs are expected to jump back – any additional weakness in UK hard data may weigh on GBP ahead of the Bank of England’s expected 0.25% rate hike in May. This week’s UK data releases are minimal, leaving Sterling at the whim of other currencies, especially the USD which is starting to gain strength despite the ongoing US-China trade war and NAFTA negotiations.

GBPUSD Price Chart Four Hour Timeframe (February 26 – April 6, 2018)

IG Client Sentiment data show 46.8% of traders are net-long GBP/USD with the ratio of traders short to long at 1.14 to 1. In fact, traders have remained net-short since Mar 21 when GBP/USD traded near 1.40037; price has moved 0.1% higher since then. The number of traders net-long is 3.1% higher than yesterday and 9.1% higher from last week, while the number of traders net-short is 5.3% lower than yesterday and 8.8% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse lower despite the fact traders remain net-short.

The DailyFX Q2 Trading Forecast for GBP is now ...

more