FX Traders To Focus On Chinese Yuan Now

As long as Trump did not further escalate the trade tensions, long AUD/USD?

Risk assets gained with yuan as trade woe is set aside

Near-term dollar weakness is being confirmed by USD/CNH returning to a lower trading range. This dynamic is being supported by China equities which started the week on a positive note, partly on relief that Donald Trump didn't further escalate the tit-for-tat with China.

In the short-term, traders can focus on technical indicators to help set the direction for USD/CNH. Last week's low at 6.6135 is the first line of support. Below that, the next technical area is the 6.5578/6.5684 October/November double-low.

Smaller companies on the ChiNext Board are likely to lead the charge in a rebound that's long overdue for Chinese stocks. The 3-month Shibor (Shanghai Interbank Offered Rate) has fallen drastically since late June and extra liquidity has been released after a reduction in banks' RRR on July 5 which quenched the thirst for cash in the financial system. The big slide for interbank lending rates could help small stocks, which are more sensitive to borrowing costs than larger peers. BOC has acted to slightly loosen its tight monetary policy and to take a slower deleveraging pace. Stability was the key message as policy advisors indicated that authorities will take on a slower pace of deleveraging.

In our opinion, it should not be "one size fits all" when it comes to curbing debt growth, which sounds as if the government wants to downplay this campaign until confidence recovers. Policymakers are likely to attempt a more 'targeted' deleveraging campaign, helping some parts of the economy to add leverage while cutting in other areas, similar to its targeted monetary policy.

From the Fed minutes, it shows that they already have concerns that the trade war could hurt business sentiments and investments, noting that industry contacts said that it was already having an impact.

It's a data-lite session ahead in Asia but there are plenty of weekend news stories to react to. Risk assets are likely to start off positively given the strong gains on Wall Street, but there will be some regional headwinds from the negative reports on US Secretary of State Pompeo's visit to North Korea.

Our Picks

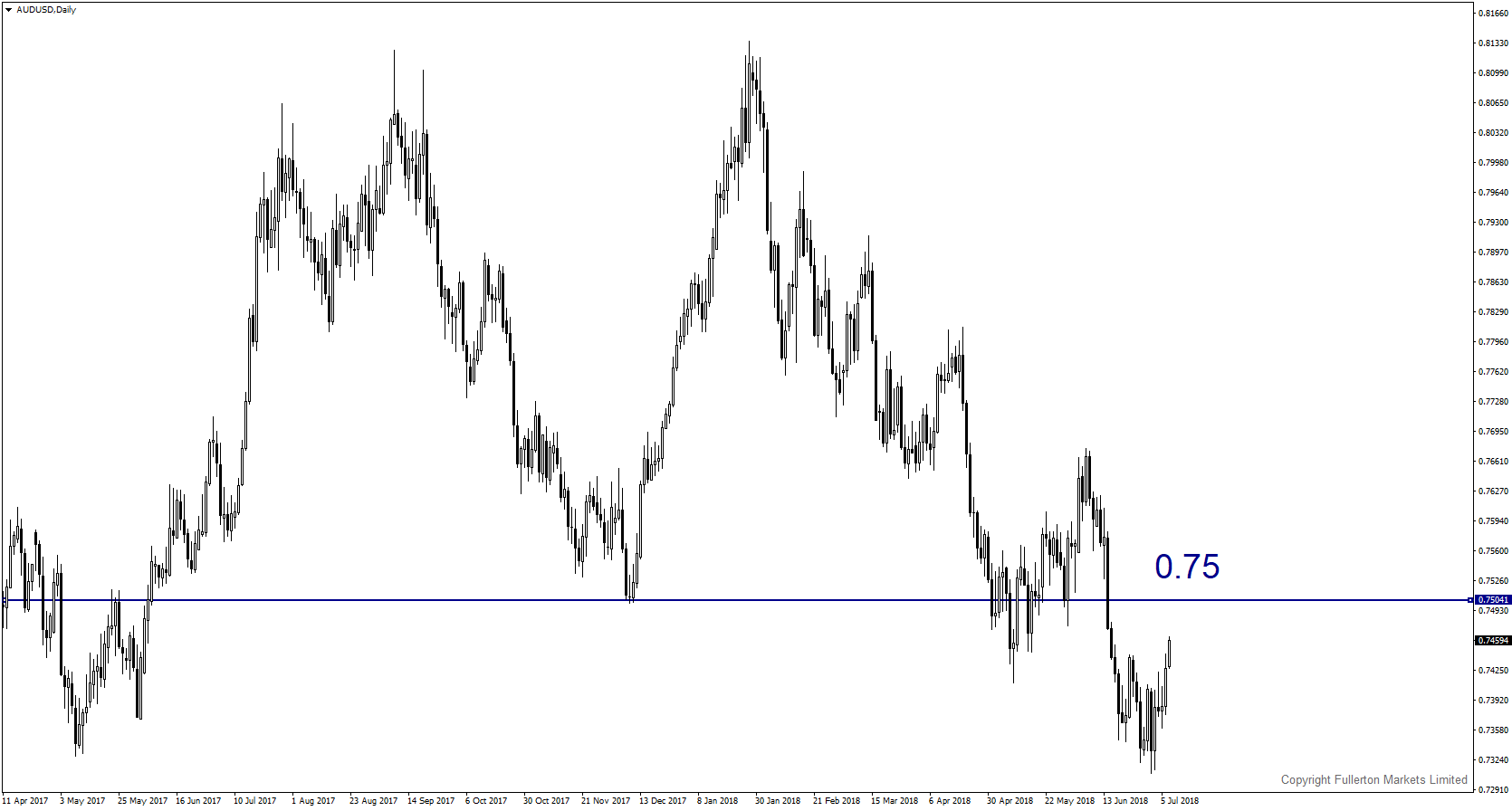

AUD/USD – Slightly bullish.

Improving yuan and China stocks’ sentiment may help to push this pair towards 0.75 this week.

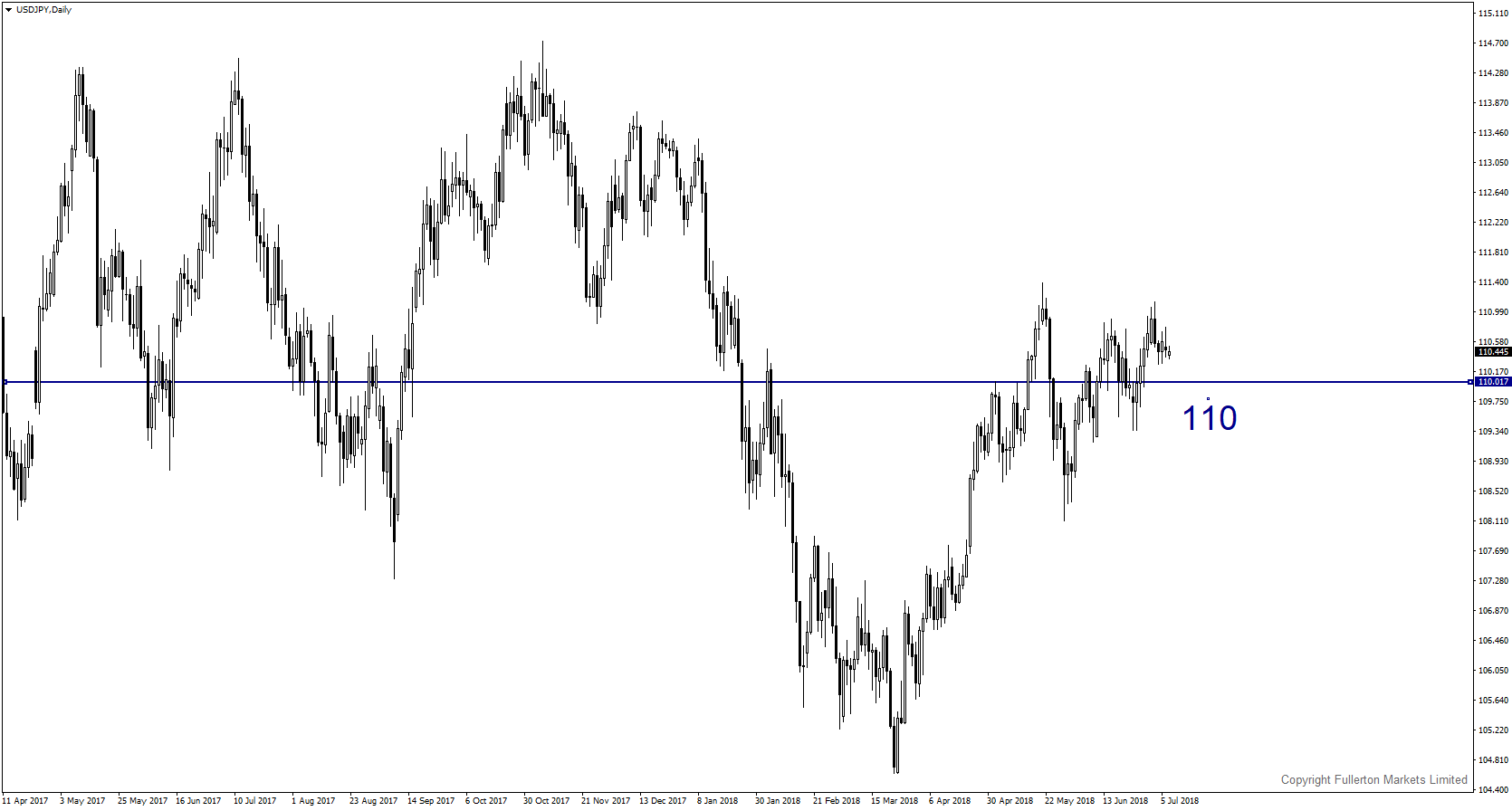

USD/JPY – Slightly bearish.

A softer dollar outlook this week may pressure this pair towards 110.

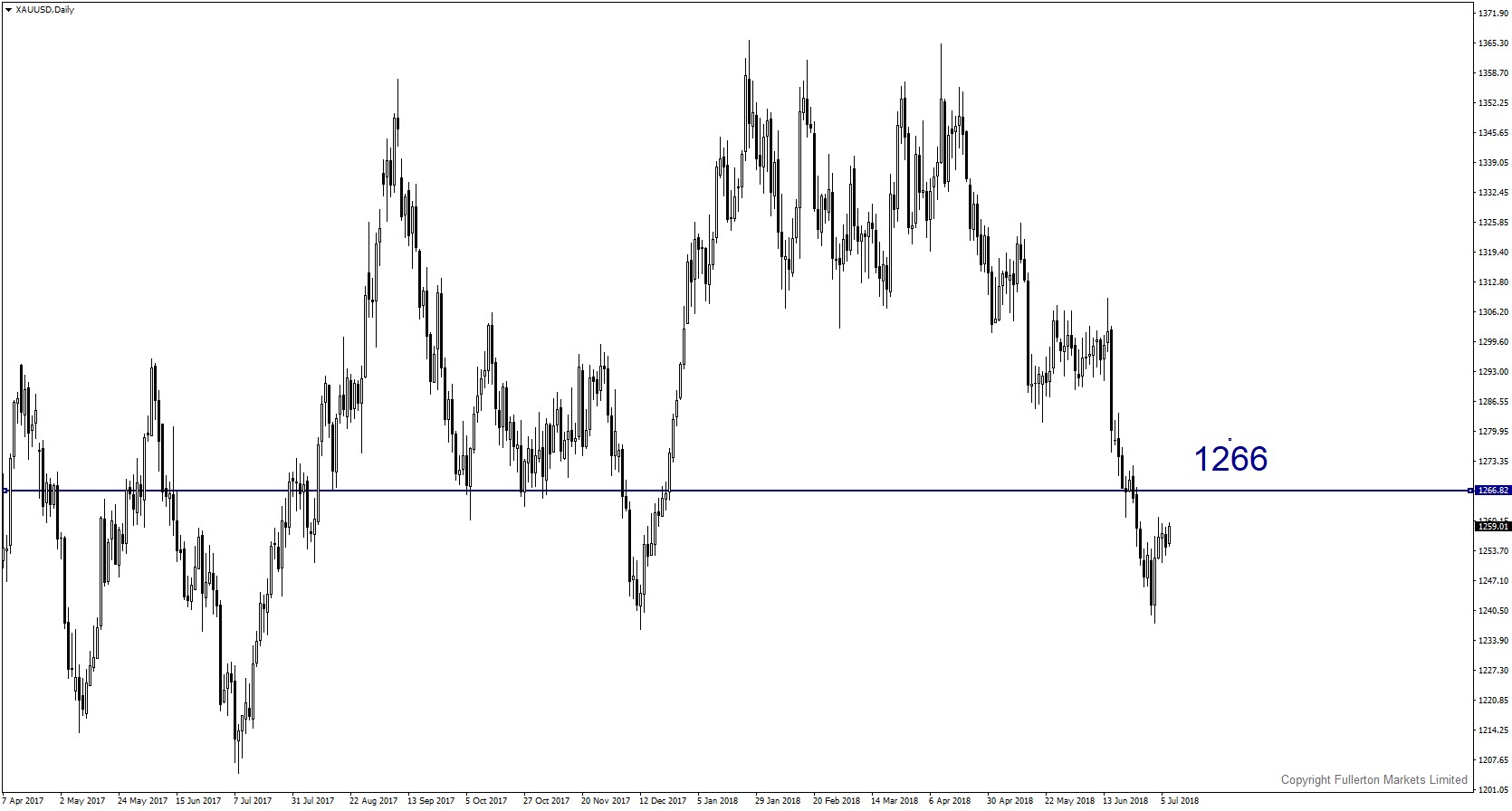

XAU/USD (Gold) – Slightly bullish.

We expect price to rise towards 1266 this week.

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more