Forget About China… I’m Investing In India!

Due to great demographics, we believe that India has potential for stellar growth. Roughly 1.2 billion people live in the country. Over 50% are younger than 25 and over 65% are below the age of 35.

This is the opposite of Japan, where an aging population continues to contribute to deflationary pressures. In the U.S., we have our own concerns with the aging baby boomers, entitlement programs and deflation.

Indians are by nature an enterprising people. Indian voters, about 550 million strong, voted to elect Narendra Modi as their prime minister. This is an individual that campaigned on a modern platform of enterprise. So the Indians in record numbers tossed out the Congress party, which had been in charge since 1947. That party had long been criticized of hindering growth for most of the years since 1947. With the changing of the guard, Indians have voted for a new path!

Other positives:

From the Indian perspective, the decline in commodity prices is good news. India imports almost 80% of its oil! It stands to benefit from lower prices as its import bill falls and, with it, its trade deficit.

Fiscal deficit, current account deficit and inflation are all showing clear down trends.

Consequently, India will be among the very few countries in the world, and perhaps the only one in the large emerging markets, to have shown improvement in growth and earnings in 2014.

India currently trades for 15x earnings. That’s not expensive when considering its growth potential. India is projected to show earnings growth near +19% in 2015.

India has one of the lowest valuations relative to its growth in the emerging markets. In fact, it is the third smallest among 13 emerging markets. With both its price-earnings multiple and growth in 2014 in the mid-teens, its PEG (price-earnings to growth) ratio of 1 is higher than only Taiwan (0.9) and Korea (0.7).

The risk to this investment thesis:

After India’s Parliament closed its winter session without passing key reform bills, Prime Minister Narendra Modi issued rarely used executive decrees to push through parts of his legislative package. While the mass media cheered, investors must realize that Indian shares could offer a bumpy ride if Modi’s agenda gets stretched out or substantially altered, especially in light of global markets’ recent risk aversion.

If politics don’t get in the way, then India should be one of the world's great growth stories over the next 5-10 years.

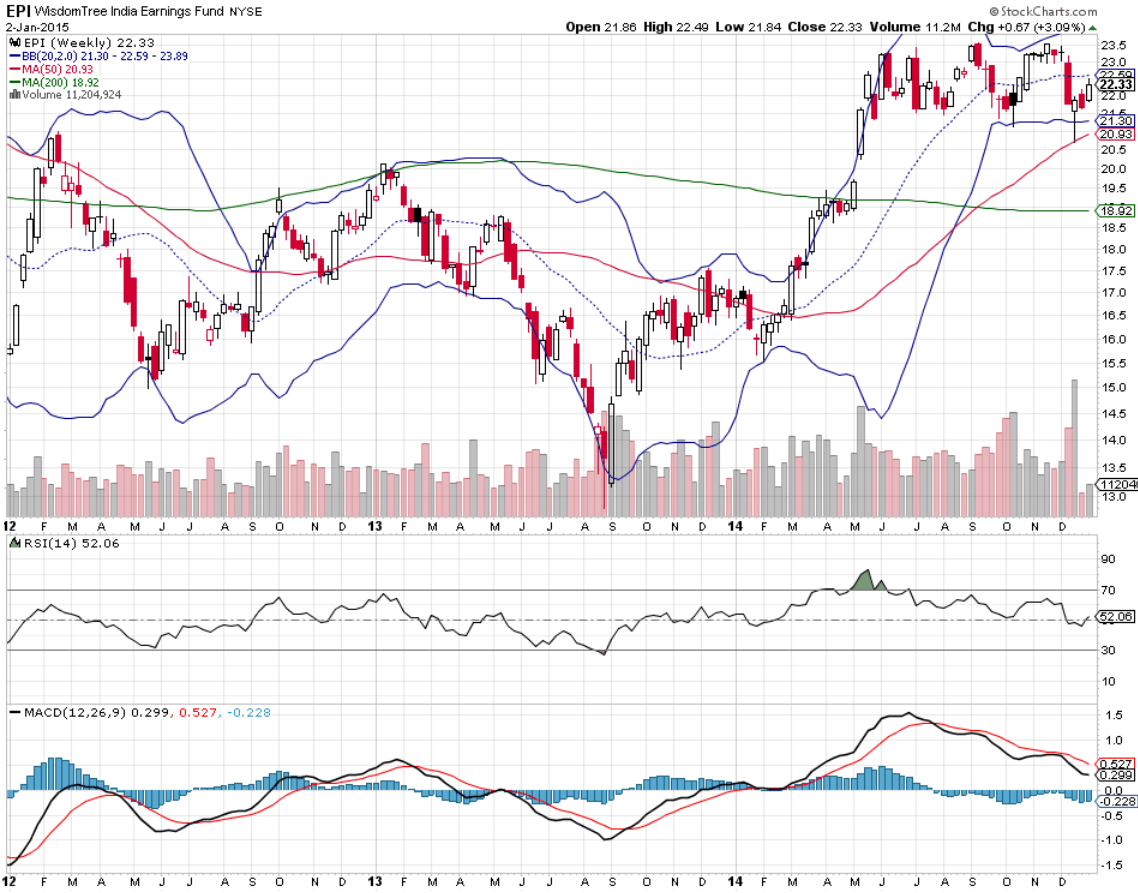

WisdomTree India ETF (EPI) on a 3-year, weekly chart time frame:

Disclosure: None

Good read, thanks.

Thanks George!

Corey, I think you are right on. When I visited I saw the momentum building. I am long TTM...IBN looks great too.

Same here!

Thanks, Jordan! Tata Motors (TTM) is one of the individual stock (ADR) picks that we have highlighted for our members here at Investview. So far, so good…in fact, we have already locked in profits on half of the trade. [Full Disclosure: Jordan works at Investview as well, but in a separate group.]

go to Investview.com for more details

Where would I find more info on these recommendations? Do you have a link? Thanks.

Nicely done Mr. Halliday, what other countries might you recommend investing in? I'd rather diversify than risk having all my eggs in one basket. Thank you.

Thank you, Frank! As for your question, while we would be overweight India, the others mentioned in our article that have better growth expectations and reasonable valuations are Taiwan and South Korea.

India is definitely an excellent venue for serious investors to take a closer look at. It's often overlooked, or at least overshadowed by China so I appreciate you sharing this.

Thank you, Farah! Hopefully, the article has prompted investors to take their own closer look at India and what it offers compared to China. In fact, there are many countries superior to China in our view.

Deaar Sirs, The choice is obvious. The RBI Governor with his erudite scholorship and correct assessment of situation, hold back reduction of interest rates with all the pressures from the Govt and many quarters. He has practised what he has believed. Fortunately for him the inflation, crude prices have come down and Government is talking investment friendly decisions as early as possible. As it is a democratic country, the opinions from various quarters will be different unlike in China. You have to bear the opposition in India. But the Govt. in China can act as it deems fit without any fear of opposition. You may know there is good legal system though burdened legal personnel. Hence the preference of Investment may be considered positively. T V Sreenivasa Murthy, Hyderabad

The “command economy” that China runs makes us nervous. We believe that this could lead to disaster for investors in the years to come.

Awaiting the reality of these prospects in India.

Gregory, it is already happening with a mid-teens earnings growth rate. My team and I believe that it will get even better in the years to come.

Enjoyed this, thanks.

Thanks, Vincent!

Excellent article Corey, and I agree completely. You may want to check out Steven Hansen's piece on India. He has much to say on the topic as well, I think you'll enjoy it:

www.talkmarkets.com/.../betting-on-india

Thank you, Mike! I will definitely check out Steven’s article.

You've convinced me that India is worth a closer look in regards to investing. But why does that make it BETTER than China? Might India not be a good investment choice in addition to China? Or do you think investors should be wary?

It is widely acknowledged (and accepted) that China does not always report accurate numbers. So, investing in China can be like investing in a company that manipulates numbers and details. If your timing is right, then it is possible that you could make money. However, we would argue that avoiding this type of country/company is the safest and best decision in the long run.

This is a good point that most people don't realize at first glance.

obviously indian economy having strenth for sustain as like as growth

Are you showing a candle light to the sunshine by your investment in preference to India over China? China is sitting with world's largest reserve of 4 Trillion dollars that is being eyed greedily Europe and American States as well as Africa and Latin America. And China is least involved in military conflicts.

China’s total bank debt grew from $14 trillion in 2008 to more than $26 trillion today. China’s central bank has more than doubled its money supply to support this giant growth in credit. This “shadow banking” is a potential bubble ready to burst. We loved China in the 2000-2010 period. Now, though, we are not very optimistic about China for years to come.

China is more corrupt, hence more risk