Five Charts That Tell You Exactly What’s Going On In Agtech

What’s more important than the industry responsible for feeding the world?

It may not be the most exciting sector, but like almost every other sector, agriculture is under pressure to increase efficiency and cut costs.

And it may have the toughest job of all. If it can’t begin producing more food with less land and other recourses, then we’re all screwed.

There are 80-plus startups offering innovative approaches and products – from robotics to predictive data analytics – that are determined to prevent such an eventuality.

Which ones are getting funded? Which ones are getting left behind?

AgFunder, an online investment platform for agri-food technologies, recently published a report on the biggest investing trends to emerge in 2016.

Below are five of its most revealing charts…

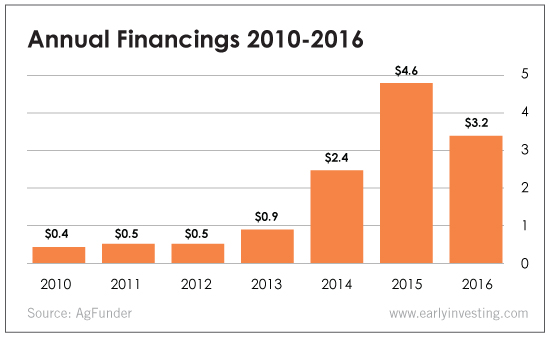

Agtech startups had a good year in 2016, totaling $3.2 billion worth of investments. It just wasn’t quite as good as the record-breaking year of 2015. The main reason? Exits have slowed down. And exits whose values exceed $1 billion are especially rare in agtech, which is something that venture capitalists care a lot about.

The under-the-radar reason is the jump in seed rounds. There are more rounds overall, but because seed round raises aren’t large, the total funds raised declined.

Two categories dominated investments: food marketplace/e-commerce (with a 40% share) and agricultural biotechnology (22% share). Food e-commerce is a $60 billion-a-year business. That’s huge. And it’s populated by supermarket chains that are making excruciatingly slow progress in providing local food delivery services (of either local produce or artisanal food offerings).

CB Insights tears down the agtech sector a little differently. It uses different categories and breaks it down by number of startups per category (as opposed to deals per category). Its biggest category? Sensors, with 18 agtech startups. The second-biggest? Precision agriculture and predictive analytics, with 16.

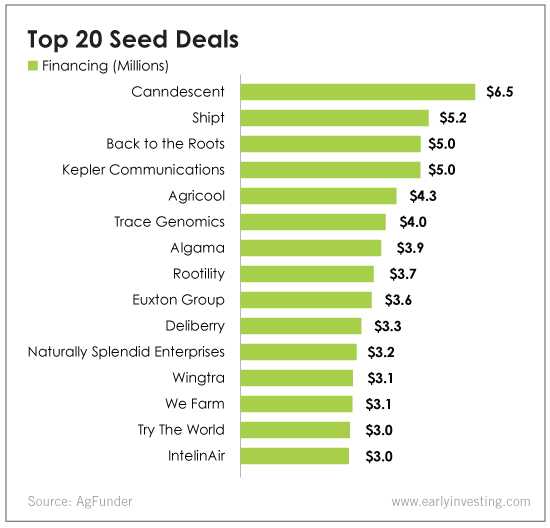

The largest seed round raise belongs to cannabis cultivator Canndescent. It got $6.5 million. But cannabis did not drive the surge of agtech seed fundraising activities. That honor goes to food delivery: 98 delivery startups completed their seed funding last year. Farm management software was next with 67 startups. And supply chain technology was third with 41.

The food e-commerce and ag biotechnology categories attracted the most money. But the biggest investments in individual companies targeted microbe farming, microbial crop inputs, alternative proteins and gene-editing tools.

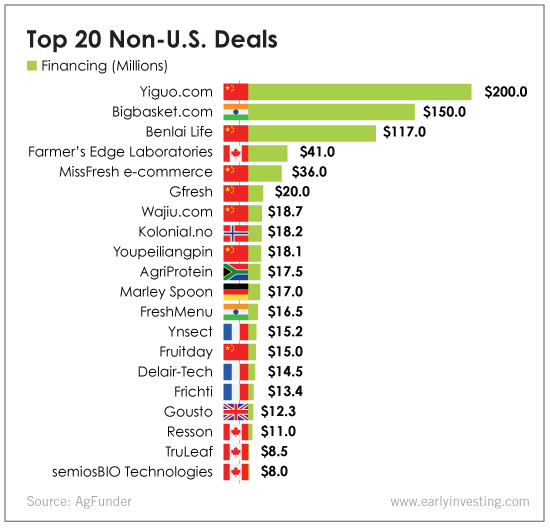

Outside the U.S., China dominated. Its 10 fundraising deals last year totaled $427 million, easily beating second-place India’s $313 million. China accounted for six of the top 10 deals and two of the top three.

At the moment, agriculture remains one of the least disrupted industries. That’s about to change.

Which makes agtech one of my priority sectors.

When I find a startup I really like, I’ll let you know.

Disclosure: None.