EUR/USD Forecast: Quietly Waiting For Draghi

The new week started with stocks and commodities down, as risk aversion sentiment kicked in. The dollar is marginally higher against most of its rivals, although the yen and the euro are outpacing the US greenback, with the JPY up on its safe-haven condition and the EUR finding some support in better-than-expected German IFO data.

The confidence index showed that business climate surged to 109.5 in September, beating expectations of 106.4. Expectations also rose, up to 104.5 from previous 100.1 and the 100.2 expected.

Nevertheless, the EUR/USD pair remains confined to a tight intraday range of less than 30 pips, as investors are waiting for some additional clues. Later on today, ECB's Draghi will testify before the Committee on Economic and Monetary Affairs of European Parliament, in Brussels, and he will probably give some hints on economic policies and/or the situation of the region. Also, there are several FOMC speakers scheduled for this week, starting today with Tarullo. The US will also release its New Home Sales figures for August, expected sharply down compared with July.

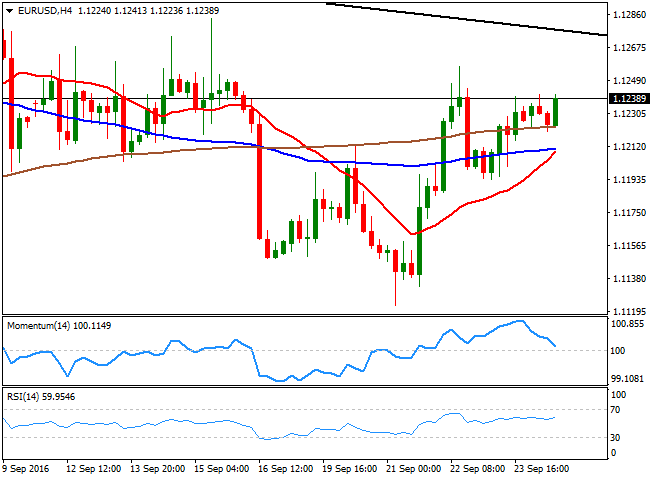

The EUR/USD pair 4 hours chart shows that the price is holding so far above its moving averages, with the shortest maintaining a strong upward slope but still below the longest, while the RSI indicator turned higher around 59 with no actual strength and the Momentum extends its decline towards its 100 line. The downside seems limited, but there's no upward potential at this point.

The immediate short term resistance comes at 1.1245, with a break above it exposing 1.1280 a daily descendant trend line coming from 1.1615, with further gains beyond the line supporting an advance up to 1.1335.

Below the 1.1200 level on the other hand, the pair can decline down to the 1.1150/60 region. Further slides are unlikely, but if the price continues falling, the next support comes at 1.1120.