Dewan Housing Finance Corporation: Value Pick In Housing Finance Sector

DHFL – Value pick in housing finance sector

Dewan Housing Finance Corporation (NSE:DHFL) primarily provides housing finance to individuals, especially in the lower and lower-middle-income groups in Tier II, III and IV cities. The company also offers non-housing loans such as loan against properties (LAP), SME and developer loans

Investment rationale

1) New Entrant in low-cost housing

Dewan Housing Finance Corp Ltd, with a portfolio of around Rs62,000 crore, disburses Rs1,700 crore every month , Rs300 crore of this goes for relatively low-cost housing(which is 18% of the total portfolio) hence the company is slowly building exposure to this priority sector which is given investment status by the government as well as interest subsidy on loans taken for affordable housing

2) Life insurance stake sale to be value accretive

The management intends to restructure the company to be a core mortgage player in the affordable housing finance market.

The recent proposed stake sale in the life insurance business would not only improve capital adequacy ratio significantly but would also be book value accretive without any shareholder dilution

DEWH has entered into an agreement to divest its 50% stake in DHFL Pramerica Life Insurance to its wholly-owned subsidiary, DHFL Investments Limited (DIL) for a value of INR16.9b-20.2b. As the current book value of DEWH’s investments in the insurance JV is just INR310m, virtually the entire proceeds from the stake sale would be capital gains. This transaction would increase FY18 book value by 25-30% without any shareholder dilution. Additionally, this transaction would shore up tier-I ratio by 350-400bp to more than 15%, the highest in the past five years.

3) Large white space in builder financing; AUM to grow 16-17% in FY18

The management is upbeat on the prospects of builder financing in the affordable housing space. Most builders do not have sufficient access to formal financing. DEWH, with its strong local on-the-ground knowledge, has an edge over other banks/HFCs. The company also uses this opportunity to finance the end buyers in these projects. The share of builder loans has grown from 6% to 12.5% in the past two years and is expected to further increase to 14-15% over the next few quarters. The management expects overall loan book growth of 16-17% in FY18 and beyond.

4) Relentless focus on costs and margins

Over the past few quarters, DEWH has not only reduced its share of bank borrowings but has also focused on reducing the cost of bank borrowings. The cost of bank borrowings declined from 10.1% in 1QFY17 to 9.4% in 3QFY17. We believe DEWH would be able to reduce this by another 60-70bp over the next year. While there is pressure on yields in the home loan segment, the benefit from reduction in cost of funds coupled with increasing share of high-yielding builder loans should support margins at ~3% over the medium term. At the same time, DEWH is focused on cutting legal and advertising expenses to reduce cost-to-income ratio to 21-22%.

5) Valuation and view

DEWH continues to capitalize on its mortgage lending expertize in an underpenetrated market. Its focus on the core mortgage market is demonstrated by the fact that it is divesting non-core assets such as the life insurance business. Moreover, the management’s continued commitment towards lowering operating cost should improve return ratios as well as investor sentiment. Currently, the company is operating at a P/B of 1.53x(FY18earnings) and 1.38x(FY19earnings). We value the company at 1.7xFY19book valueand arrive at a target price of Rs539 over medium to long term horizon

Technical Aspect

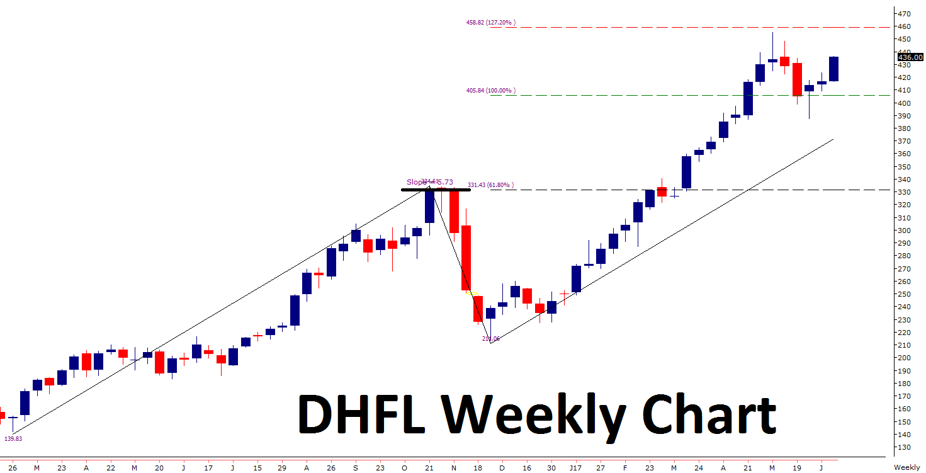

The weekly chart of DHFL shows that price has been rising strongly for many weeks. The chart shows that price had previously had resistance around 330 where it has previous swing top. Post breakout we saw same consistent move which clearly suggests strong bullishness in this stock. And also suggests that buying is happening even at higher levels. As now as per Fibonacci we seen stock is reversing from 405 after making a new high of 455.

As we know that prices do experience ups and downs so if price dips then any dips should be used as buying opportunity, as the fundamental and technical aspects are strong and provide for higher targets across multi months.

For technical levels post 539 we will provide an additional update.

(Click on image to enlarge)

Disclosure: My comments above reflect my view of the market. The analysis is not a recommendation to buy, sell, hold or sell short any security. I don't have any commercial relationship with ...

more