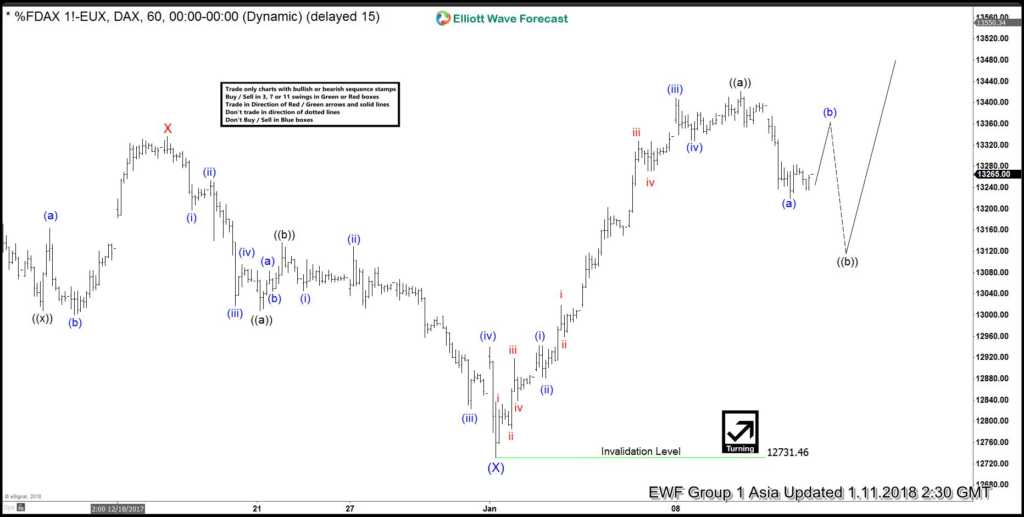

DAX Elliott Wave Analysis: Correction In Progress

DAX short-term Elliott Wave view suggests that Intermediate wave (X) ended at 12731.46. The rally from there is unfolding as a 5 waves impulsive Elliott Wave structure where Minutte wave (i) ended at 12943, Minutte wave (ii) ended at 12881.5, Minutte wave (iii) ended at 13408.5, Minutte wave (iv) ended at 13328.5, and Minutte wave (v) of ((a)) is supposed to complete at 13421.5. The Index is correcting cycle from 1/2/2018 low within Minute wave ((b)) in 3, 7, or 11 swing before the rally resumes.

Internal of Minute wave ((b)) is unfolding as a zigzag Elliott Wave Structure where Minute wave (a) is proposed complete at 13219. While Minute wave (b) bounce fails below 13421.5, the Index has scope to extend lower in Minute wave (c) of ((b)) to finish the zigzag correction. Afterwards, expect the Index to resume higher as far as the pivot at 1/2 low (12731.46) stays intact. We don’t like selling the Index and expect buyers to appear for more upside in 3, 7, or 11 swing, provided pivot at 1/2 low stays intact.

DAX 1 Hour Elliott Wave Chart

(Click on image to enlarge)

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for you. ...

more