Tuesday, August 8, 2017 5:29 AM EDT

A lull in top-tier economic news flow left FX markets in consolidation mode in Asian trade. The US Dollar continued to edge lower as prices digested Friday’s surge in the wake of July’s upbeat labor-market data. The New Zealand Dollar continued to inch lower in what appears to be continued pre-positioning for the upcoming RBNZ monetary policy announcement.

The data docket remains lackluster through the remainder of the trading day, with only a small helping of second-tier US releases left to round out the day. A strong lead from sentiment trends is likewise absent. Share prices are treading water across most European bourses and S&P 500 futures point to more of the same once Wall Street comes online.

On balance, this seems likely allow for a bit more follow-through on current market dynamics. This may translate into some further weakness for the greenback and its Kiwi cousin. With that said, it ought to be kept in mind that vacuum on the scheduled event risk front leaves ample room for stray headlines that might have otherwise passed with little fanfare to drive seesaw volatility. A cautious approach seems prudent.

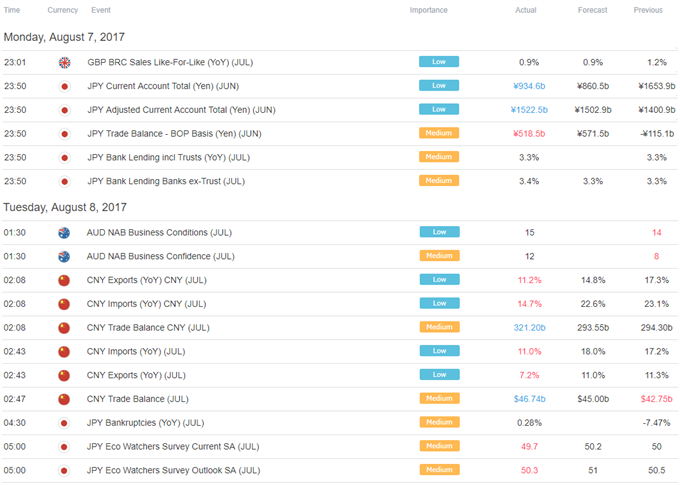

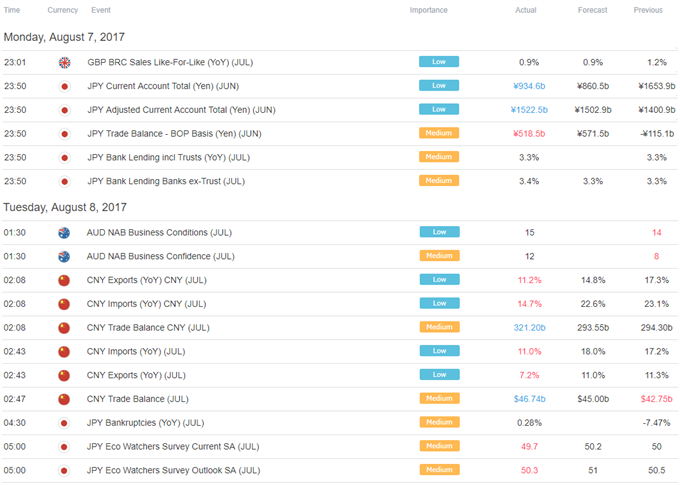

Asia Session

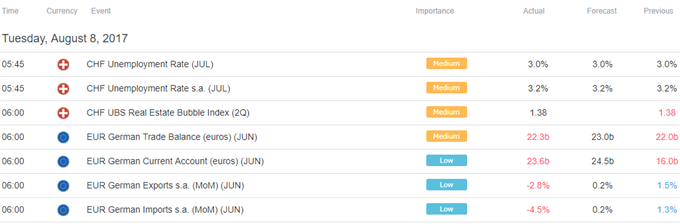

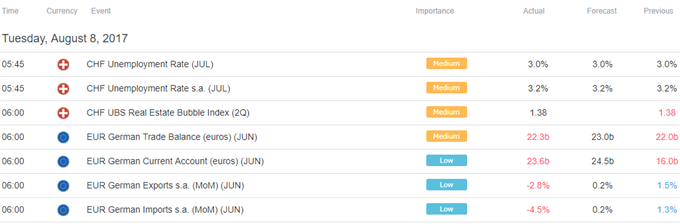

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

Disclaimer: DailyFX, the free news and research website of leading forex and CFD broker FXCM, delivers up-to-date analysis of the ...

more

Disclaimer: DailyFX, the free news and research website of leading forex and CFD broker FXCM, delivers up-to-date analysis of the fundamental and technical influences driving the currency and commodity markets. With nine internationally-based analysts publishing over 30 articles and producing 5 video news updates daily, DailyFX offers in-depth coverage of price action, predictions of likely market moves, and exhaustive interpretations of salient economic and political developments. DailyFX is also home to one of the most powerful economic calendars available on the web, complete with advanced sorting capabilities, detailed descriptions of upcoming events on the economic docket, and projections of how economic report data will impact the markets. Combined with the free charts and live rate updates featured on DailyFX, the DailyFX economic calendar is an invaluable resource for traders who heavily rely on the news for their trading strategies. Additionally, DailyFX serves as a portal to one the most vibrant online discussion forums in the forex trading community. Avoiding market noise and the irrelevant personal commentary that plague many forex blogs and forums, the DailyFX Forum has established a reputation as being a place where real traders go to talk about serious trading.

Any opinions, news, research, analyses, prices, or other information contained on dailyfx.com are provided as general market commentary, and does not constitute investment advice. Dailyfx will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

less

How did you like this article? Let us know so we can better customize your reading experience.